Have you ever wondered why some stocks are in the S&P 500 and others not? Good, it turns out there is a very specific set criteria That which must be met for a share to be included in the index. These conditions are disclosed below.

Now, three Fool.com contributors will name their favorite stocks to add to the index by 2025. Let’s dive right in.

Palantir meets all criteria for inclusion in the S&P 500

Jake Lerch (Palantir Technologies): My pick for a stock that could join the S&P 500 next year is Palantir Technologies (NYSE: PLTR)Palantir is the maker of an AI-powered platform that helps organizations make sense of complex data sets, and the company’s stock is all the rage.

So far this year, Palantir stock has risen a remarkable 80%. Its market cap is now $68 billion, making the AI stock America’s 279th-largest public company by market cap. However, as of this writing, Palantir is still not a member of the S&P 500.

So what’s going on?

It’s a good one ask because Palantir meets all the requirements for inclusion in the S&P 500:

-

An American company

-

Market capitalization of at least $18 billion

-

Stocks are very liquid

-

Public float is at least 50% of the total number of shares outstanding

-

Positive profit in the most recent quarter and total positive profit in the four most recent quarters

First outPalantir is based in the US and has a market cap of nearly $70 billion — check.

Second, Palantir shares are highly liquid, with the number of public shares accounting for well over 50% of the outstanding shares.

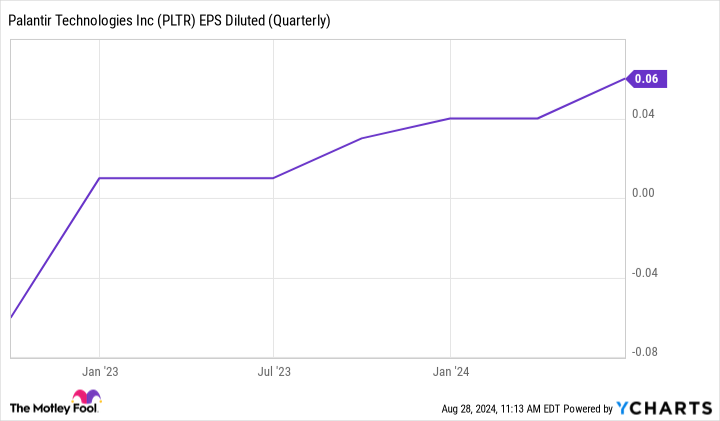

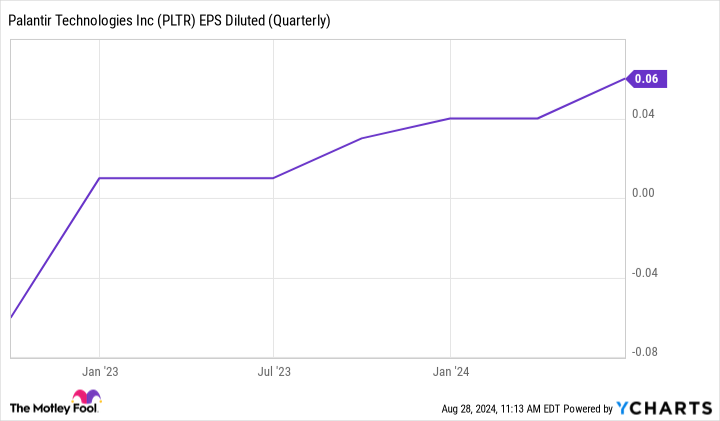

Finally, we come to profitability. Profitability, is likely the reason Palantir is not in the S&P 500. Although the company has reported positive profits in each of the last six quarters, she have been small gain.

As you can see above, Palantir was still losing money in the last quarter of 2022. As a result, the committee has likely delayed Palantir’s inclusion in the S&P 500. They are waiting for more quarters of positive profits before Palantir gets the green light.

However, one additional quarter of positive profits could be enough to prompt the committee to add Palantir to the index in 2025. And that is precisely What i think will happen.

Inclusion in the S&P 500 could help this company become the next big advertising stock

Will Healy (The trade editor): Mega-cap tech stocks like Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) And Meta platforms (NASDAQ: META) have built their fortunes on digital advertising. These companies generate tens of billions in revenue each quarter by helping companies of all sizes reach the audiences they want, and that market power makes them mainstays of the S&P 500.

Under the influence of this industry, the next advertising stock to enter the S&P 500 could be The trading desk (NASDAQ: TTD). The demand-side platform enables agencies and businesses to manage digital advertising campaigns, placing ads at the times and places they believe will generate the highest returns. Additionally, users can further refine the timing and placement of ads using AI tool Kokai to capture more value.

His capabilities have helped it become a stock with a market cap of $50 billion, well above the minimum market cap required to enter the S&P 500. From there, his finances will likely help propel this stock further.

Revenue for the first half of 2024 came in at just under $1.1 billion, up 27% from the same period last year. The company has also recovered from a profit slump it faced in 2022, with net income coming in at $117 million for the first six months of 2024, up 176% from year-ago levels.

Amid these rapidly rising profits, the stock’s price-to-earnings (P/E) ratio of 205 probably isn’t representative of its valuation, but its price-to-sales (P/S) ratio of 24 does make it expensive. Still, analysts are forecasting revenue growth of 26% this year and 20% in 2025, meaning revenue will continue to put downward pressure on the sales multiple.

Finally, investors should remember what inclusion in the index means: a place in the portfolio of every investor who invests in the S&P 500 through index funds. That growing influence should further strengthen the stock as more advertisers turn to the platform.

Coinbase would expose the S&P 500 to the potential upside of cryptocurrency.

Justin Paus (Coinbase): As the S&P 500 looks to innovation and AI technology companies like CrowdStrike And Supermicrocomputer in the index it makes perfect sense to add Coinbase (NASDAQ: COIN)also. Cryptocurrencies are still hotly debated among investors, but the asset class is forcing its way into the conversation. According to research from The Motley Fool, it is “very likely” that about a quarter of investors will buy at least some form of cryptocurrency.

The case for Coinbase is simple. It’s a publicly traded U.S. company, which arguably makes it the safest exchange and crypto finance company after fraud and controversy tainted or destroyed private and foreign competitors like Binance and FTX.

Next, it easily meets the criteria for inclusion in the S&P 500; its current market cap of $42 billion meets the minimum threshold. Moreover, it is comfortably GAAP profitable, with nearly $1.4 billion in net income over the past four quarters.

Most importantly, it’s a fantastic company. Coinbase’s exchange is its core business, but its ambitions extend into the crypto economy, including financial products like bank and debit cards that let users spend their crypto like dollars. Cryptocurrency can be cyclical, but Coinbase has proven it can weather the downturns. The company is also in a great financial position, with over $8 billion in cash on its balance sheet, nearly a fifth of its share value.

Cryptocurrencies will need to continue to gain traction among society and investors for Coinbase’s business to grow long-term. But there’s no better stock to get exposure to crypto’s potential upside. Adding Coinbase to the S&P 500 would represent a forward-thinking investment strategy and help propel the index higher in the years to come as cryptocurrency continues to gain traction.

Should You Invest $1,000 in Palantir Technologies Now?

Before you buy shares in Palantir Technologies, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $731,449!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 3, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former chief marketer and spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet and CrowdStrike. Justin Pope has no position in any of the stocks mentioned. Will Healy has positions in CrowdStrike, Palantir Technologies, Super Micro Computer and The Trade Desk. The Motley Fool has positions in and recommends Alphabet, Coinbase Global, CrowdStrike, Meta Platforms, Palantir Technologies and The Trade Desk. The Motley Fool has a disclosure policy.

3 Fantastic Stocks That Could Join the S&P 500 by 2025 was originally published by The Motley Fool