Do you hope to become a self-made millionaire? It’s certainly possible even if you’re not a professional artist or athlete. The key for most regular people is to just invest what you can, when you can, pick the right stocks, and then leave them alone long enough to let them do the hard work.

Here’s a look at three great stocks that have not only helped groups of investors become millionaires, but will likely continue to do so well into the future.

1. Coca Cola

There’s nothing particularly exciting about it The Coca-Cola Company (NYSE:KO). Sure, it’s the name behind the world’s most popular soft drink. It also owns several other well-known brands such as Gold Peak tea, Minute Maid juices, Powerade sports drinks and Dasani water, to name a few. But the beverage industry is busy, competitive and limited in terms of growth potential.

But this market saturation doesn’t really matter if you’ve perfected the art (and science) of convincing people to buy your product again and again, and that’s exactly what this company has done. From a brilliant combination of steady lifestyle branding efforts (most Gen-Xers and older folks still remember the “I’d like to teach the world to sing” jingle from 50 years ago!) to leveraging the enormous scope in negotiating pricing, production, and product placement with its retail and bottling partners, Coca-Cola has become parent to some of the world’s most recognized beverage brand names.

Investors have also joined in. A $10,000 investment in Coke stock 50 years ago would be worth about half a million dollars today. And that’s just the share price increase. In the meantime, if you reinvest dividends paid into more shares of Coca-Cola, your initial investment would now be worth well over $2 million. Slow-and-steady clearly wins the race.

Of course, the hardest part of owning a stake in this slow-moving dividend payer is staying patient enough to let your reinvested dividends create enough critical mass to matter. Not everyone is willing or able to simply wait and watch, confident that big returns lie ahead.

This might help: The Coca-Cola Company has increased its dividend every year for the past 62 years. The split-adjusted quarterly dividend of $0.195 paid in 1994 has now grown to $0.485 per share. It is also worth remembering that there will never be a time when people do not get thirsty.

2. Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) does not pay a meaningful dividend. The current yield is just under 0.5%. Instead, Google’s parent company has taken a more direct approach to turning its investors into millionaires. Since the company’s initial public offering in 2004, its shares have risen as much as 7,000%.

Admittedly, the company’s very best days are probably in the past. Search engines aren’t exactly a fast-growing business anymore, now that much of the developed world is already regularly online. It’s also a busy market, with alternative search engines such as Microsoft“Bing is gaining traction.

However, this way of thinking ignores some important realities about Alphabet.

One of these realities is the fact that while the search engine market is no longer a huge growth engine, this business is not the only meaningful sector that Alphabet is in. YouTube now accounts for roughly a tenth of the company’s revenue, and just over a tenth of the company’s total revenue comes from its fledgling cloud computing business. Alphabet’s cloud business only recently turned an operating profit, and its bottom line continues to grow much faster than any of its other businesses. The market may be underestimating the short-term earnings growth that is in store here.

The other detail worth mentioning is that although Alphabet’s bread-winning Google already has an impressive 90% of the global search engine market (according to figures from GlobalStats), there is actually still plenty of opportunity for above-average growth on this front. Market researcher Mordor Intelligence believes that the so-called next-generation search engine market (enhanced, for example, by the addition of artificial intelligence) will grow at an annual rate of almost 15% until 2029. Alphabet’s first-quarter search ad revenue was also up 14.3% year over year.

Connect the dots. Every time it seems like the company is running out of opportunities, it finds a few new levers to pull.

3. Amazon

Last but not least, add Amazon (NASDAQ: AMZN) added to your list of great stocks that have already made many millionaires, but could make even more.

The company doesn’t need much introduction. It arguably launched the entire e-commerce industry when internet access became commonplace in the late 1990s and early 2000s. Market research firm eMarketer estimates that Amazon has about 40% of the U.S. e-commerce market. But despite Amazon’s dominance of the North American online shopping landscape, eMarketer believes that Amazon’s share of this market will continue to grow, rather than stagnate or even shrink, at least until 2025.

However, that dominance is only part of the bullish argument for owning Amazon stock. Amazon is also the largest provider of cloud computing services in the world, and this company is a beast. It accounts for more than 60% of the company’s operating revenue, boosted again by first-quarter revenue growth of 17%. Although already well developed, Mordor Intelligence says the global cloud computing services market is on track to grow at an average annual rate of more than 16% at least until 2029.

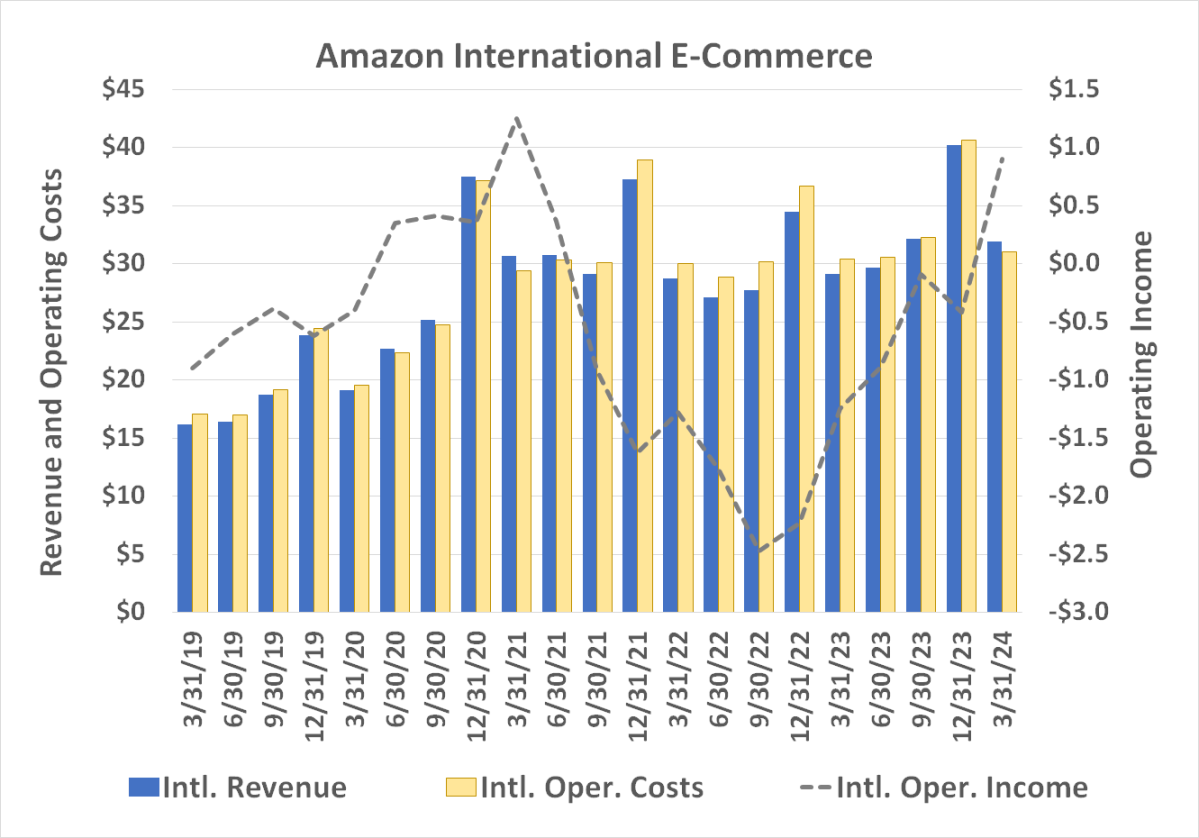

Amazon is finally doing everything it can on another front. That is international e-commerce. Although this business regularly operates in the red (with the exception of the height of the coronavirus pandemic), it has been reducing operating costs from its international operations and growing revenue for a few years. Last quarter’s international operating profit of $903 million is the most profitable since the record-breaking profit of $1.25 billion in the first quarter of 2021. Only this time, there is room and reason for the trajectory to increase both sales and earnings keep pushing.

In the meantime, Amazon remains North America’s online shopping powerhouse.

It’s unlikely that Amazon stock will be able to repeat the 244,000% gain since its 1997 IPO over the next 27 years. However, that certainly doesn’t mean it can’t continue to outperform the overall market.

Should You Invest $1,000 in Amazon Now?

Before you buy stock in Amazon, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $830,777!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has positions at Alphabet. The Motley Fool holds positions in and recommends Alphabet, Amazon and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

3 Great Stocks That Have Created Many Millionaires and Will Continue to Generate Even More Originally published by The Motley Fool