Stock splits are back in fashion. In recent months, both have been fast-casual chains Chipotle and chip giant Nvidia announced plans to split their shares. It’s unclear whether more such announcements are in the offing, but shares of some top companies have certainly reached price levels that could justify such moves. Being among them MercadoLibre (NASDAQ: MELI), Bookings of holding companies (NASDAQ: BKNG)And Regeneron (NASDAQ: REGN).

1. MercadoLibre

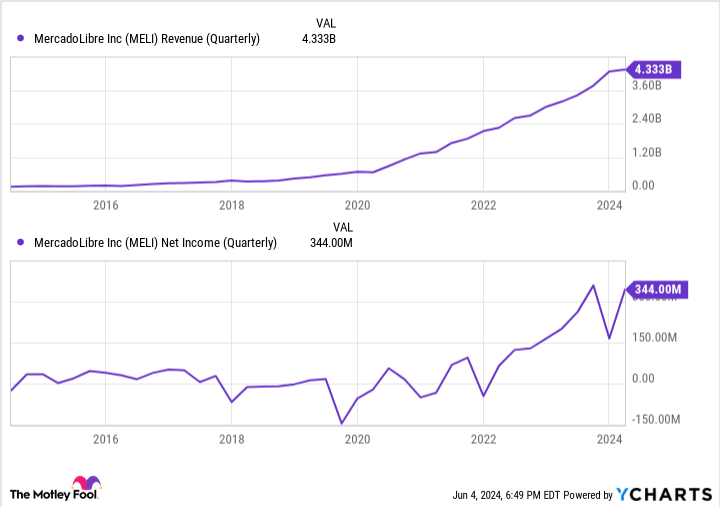

MercadoLibre is riding the wave of the bull market. Although the Latin American e-commerce specialist has faced some headwinds in recent years, its stock has generally outperformed the broader market. At the time of writing, MercadoLibre shares are changing hands at an eye-watering $1,631, so a stock split would be appropriate, especially since there are good reasons to think the company will continue to perform relatively well. Consider MercadoLibre’s full range of services.

Although sometimes the Amazon of Latin America, its activities go far beyond just the e-commerce platform. MercadoLibre has a fintech division, a logistics company and an online storefront builder. Its operation offers several strong competitive advantages, including a powerful network effect and significant switching costs. It’s hard to imagine a competitor taking much market share away from MercadoLibre in Latin America.

The company has historically delivered strong financial results and superior stock price returns. That should continue for a while.

2. Booking positions

Booking Holdings runs platforms that help people with their travel arrangements, from flights and accommodations to car rentals and activities. Despite disruptions to the travel sector due to the pandemic, the stock has performed well over the past five years, easily outperforming the broader market. At the time of writing, it’s trading at $3,801 per share, hardly an amount the average investor could afford to spend on just one share.

Booking Holdings doesn’t appear to be in much danger of losing significant momentum, although its shares have been volatile this year. However, the financial results are still quite solid. In the first quarter, revenue rose 17% year over year to $4.4 billion. Admittedly, revenue growth has slowed significantly in recent quarters. Once the period of lockdowns and social distancing ended, people’s pent-up desire for travel fueled a boom in the industry, but that couldn’t last forever.

For Booking Holdings, the 17% year-over-year revenue growth is roughly in line with pre-pandemic performance. Ultimately, the company’s adjusted net earnings per share rose nearly 76% to $20.39. It also saw healthy growth on other measures, including nights booked and gross travel bookings. Booking Holdings benefits from the network effect: the more people use the platform, the more attractive it becomes to companies like hotels and car rental companies – and the more those companies make their offerings available through the platform, the more incentives travelers will have to use it.

Given its strong position in the industry, its competitive advantages and the fact that travel won’t go out of style anytime soon, Booking Holdings should continue to deliver extraordinary returns. If it doesn’t split its shares, the shares could reach $5,000 in a few years.

3. Regeneron

Regeneron is one of the leading biotech stocks, and one of the most expensive, at around $994 per share. It has become expensive thanks to excellent financial performance, and it seems well positioned to continue delivering results. The company’s key growth driver, the eczema treatment Dupixent, is on the verge of a major new approval as a treatment for chronic obstructive pulmonary disease (COPD).

Regeneron’s other key product, eye drug Eylea, should also perform well thanks to recent regulatory developments. In the first quarter, Regeneron’s revenue fell 1% year over year to $3.15 billion due to a decline in sales from its coronavirus franchise. Excluding the COVID-19 antibody, Regeneron’s revenue rose a decent 7% year over year. Investors can expect stronger year-over-year sales growth if the Food and Drug Administration (FDA) approves the COPD label expansion for Dupixent later this year.

The biotech has also developed brand new products, especially in the field of oncology. The FDA’s approval decision for linvoseltamab, a potential treatment for heavily pretreated multiple myeloma, is awaited. That candidate could get the green light at the end of August. Regeneron still has a number of promising candidates in the pipeline, both within and outside of oncology. That, combined with the strong current lineup, should allow the company to maintain the momentum it has had in recent years.

The fractional option

None of these companies have ever done a stock split. (Booking Holdings did a reverse stock split about 21 years ago.) So while either of them could choose to do so relatively soon, it’s also possible that investors will have to wait a while. Fortunately, there is another option. Most stockbrokers now offer their clients the opportunity to purchase partial shares for a corresponding portion of the price of a whole share. So even with €50, investors can invest in MercadoLibre, Booking Holdings and Regeneron. You don’t have to wait for a stock split to qualify for these market winners.

Should you invest $1,000 in MercadoLibre now?

Consider the following before purchasing shares in MercadoLibre:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The ten stocks that made the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $741,362!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Amazon. The Motley Fool holds positions in and recommends Amazon, Booking Holdings, Chipotle Mexican Grill, MercadoLibre, and Nvidia. The Motley Fool has a disclosure policy.

Stock Split Watch: 3 Growth Stocks That Could Be Next was originally published by The Motley Fool