If you’re looking for high dividend yield stocks, there’s certainly no shortage of them right now. Interest rates have gone up. Dividend yields have followed.

Finding a dividend stock you can confidently hold for a decade or more, however, is a different story. Too many of them seem to have a risky downside, including the prospect of interrupted payouts or dividend cuts. You’ll need to be above-average cautious when looking for new income-producing names.

You can also start your search with one or more of the following three low-risk, high-yield dividend stocks.

WP Carey

WP Carey (NYSE: WPC) is not exactly a household name, but chances are you benefit from it regularly without even knowing it.

That’s because it owns a wide range of industrial properties that it leases to companies that prefer to rent rather than own their own land and buildings. Tenants range from pharmaceutical companies and schools to supermarkets and auto parts manufacturers — and more — in the U.S. and abroad.

WP Carey is legally structured as a real estate investment trust (REIT), making it even more cost-effective to pass on rental income to shareholders.

Commercial rental real estate can be a risky business for a number of reasons. The most important is cyclical economic weakness that limits the ability of tenants to make their monthly rent payments, or the demand for commercial real estate in general. Still, WP Carey is expected to continue to repay the loans it took out to acquire land and buildings. To achieve this, Carey recently cut its dividend by about 20%.

Additionally, most of the REIT’s tenants are larger companies that can handle economic challenges. WP Carey is also a net-lease REIT. That means the tenant is fully responsible for the ever-changing and unpredictable costs such as taxes, insurance and maintenance. This REIT’s leases also inherently include ongoing rent increases, so it collects payments that more or less reflect the prevailing rents at a given time.

That doesn’t mean WP Carey is a risk-free investment. But overall, it’s a reliable dividend payer and dividend grower. You’re getting in with a healthy forward-looking dividend yield of almost 5.7%.

Enbridge

WP Carey’s yield of just under 5.7% is good, but Enbridge‘S (NYSE: ENB) is even better at 6.7%. It is also more reliable in terms of dividend growth, having increased its annual payments for 29 years in a row.

That may come as a surprise, given that Canada’s Enbridge is in the oil and gas business. Crude oil and natural gas prices are all over the place and have been particularly volatile over the past decade. These wild swings can make it difficult to be in the energy sector.

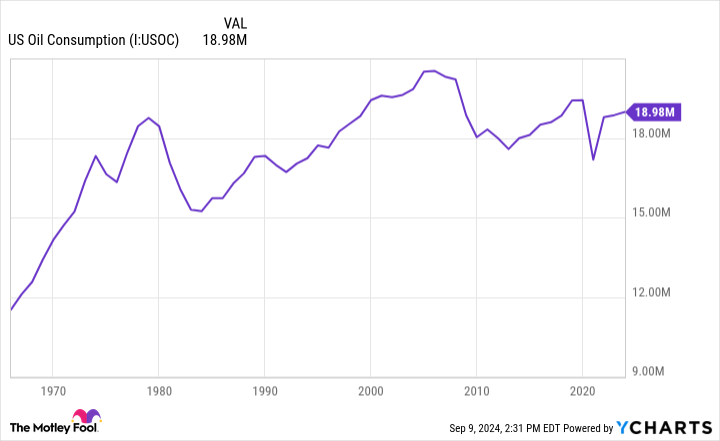

Enbridge’s top and bottom lines aren’t really tied to gas and oil prices. That’s because it’s primarily a pipeline and storage facility operator, with more than 18,000 miles of pipeline spanning Canada and the United States. The company simply collects tolls for the oil and gas it delivers, regardless of the price of that oil and gas. The company is only concerned with natural gas and crude oil consumption, which is about as strong in the U.S. now as it has been since the late 1990s.

That’s one of the main reasons Enbridge’s revenues and profits have been much more consistent and reliable than crude oil and natural gas prices.

This does not mean that there will not come a time when the world will no longer need gas or oil. However, that time is still far away. Goldman Sachs predicts that oil consumption will continue to grow through 2035, and even after that peak, we’ll still be using a lot of it after 2040. We’ll also still need a way to get it from point A to point B.

That’s what Enbridge does: it processes nearly a third of the crude oil produced in North America and facilitates 40 percent of oil imports to the U.S.

Verizon

Finally, add the American telecom giant Verizon Communications (NYSE: VZ) to your list of high yielding dividend stocks to buy and hold for 10 years.

It’s clearly not a growth stock. Everyone who needs or wants wireless phone service already has it. Landline phones are also a shrinking business. Any growth Verizon achieves will be largely driven by population growth and by stealing customers from competing service providers who are also trying to steal Verizon’s customers for themselves. The only real high-growth engine in Verizon’s toolbox is its enterprise networking offering, and even that capability is somewhat limited.

However, a lack of huge growth potential doesn’t mean Verizon won’t continue to pay and grow its dividend. The company still has plenty of ways to grow its business and the dividend-driving profits that flow from it.

Think about it. People are effectively addicted to their phones, to the point where they feel uncomfortable without them. Data from Reviews.org indicates that the average American checks their phone 144 times a day, spending an average of four hours and 25 minutes staring at the screen each day. People aren’t just going to stop using them.

Meanwhile, Verizon is expanding its business by acquiring similar companies, including competitors. Just last week, it announced that it Border communicationand added 2.2 million customers to its fiber optic broadband branch.

It won’t be cheap. Verizon is shelling out $20 billion in cash to buy the company. But it’ll be worth it. Verizon believes there are at least half a billion in annual savings to be had by combining the two companies’ fiber connectivity businesses, so the Frontier purchase should pay for itself eventually. The deal also gives Verizon more control over this slice of the telecom market, which is another way to make it more competitive.

These are just anecdotal examples of what Verizon is willing and able to do to stay in position to continue paying and growing its dividend. The point is that it does it, and it does it well.

Again, Verizon is never going to be a high-growth stock. But it is a dividend machine, currently yielding 6.6% thanks to 18 consecutive years of annual payout growth — a streak that’s unlikely to be broken any time soon.

Should You Invest $1,000 in WP Carey Now?

Before you buy shares in WP Carey, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and WP Carey wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $716,375!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 9, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Enbridge and Goldman Sachs Group. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

3 High Yielding Dividend Stocks You Can Buy and Hold for 10 Years was originally published by The Motley Fool