It’s been a while since the term “FAANG stocks” caught the attention of investors, mainly because these stocks are no longer the popular names they once were. The so-called “Magnificent Seven” tickers have taken their place as the market’s hot-button group.

The point is that all five FAANG stocks are still great investments, and three of them are excellent prospects that you’ll want to add to your portfolio as soon as possible.

1. Amazon

Most investors know Amazon (NASDAQ: AMZN) has been (literally) the most rewarding stock on the market in the past three decades, with shares up more than 260,000% since their IPO in 1997. But most investors also understand that the e-commerce giant’s days of peak growth are over. It’s simply too big now to continue growing at its historic pace.

That doesn’t mean the future isn’t bright, though. It’s just different in some compelling ways.

One of those ways is a relatively new, intense focus on profitability. While the company has historically been more interested in expanding its footprint than making a profit, in recent years it has been closing and eliminating warehouses that weren’t operating as cost-effectively as they needed to. It’s streamlining all of its operations to cut costs.

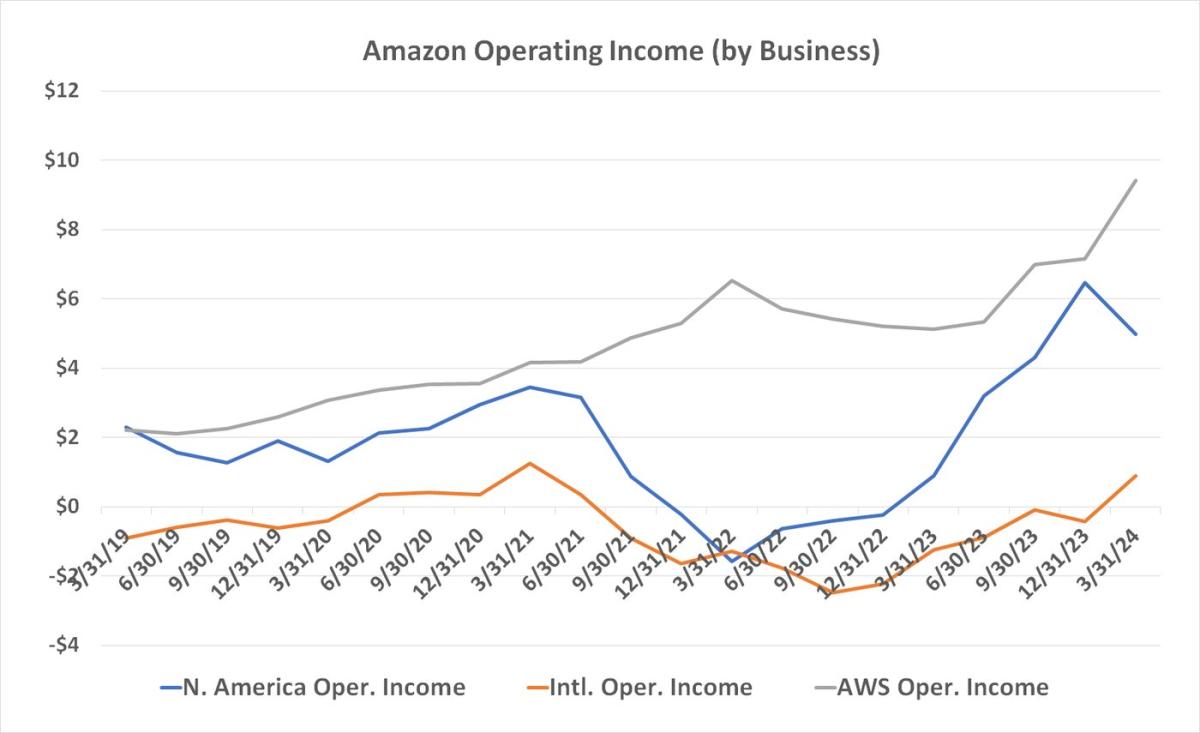

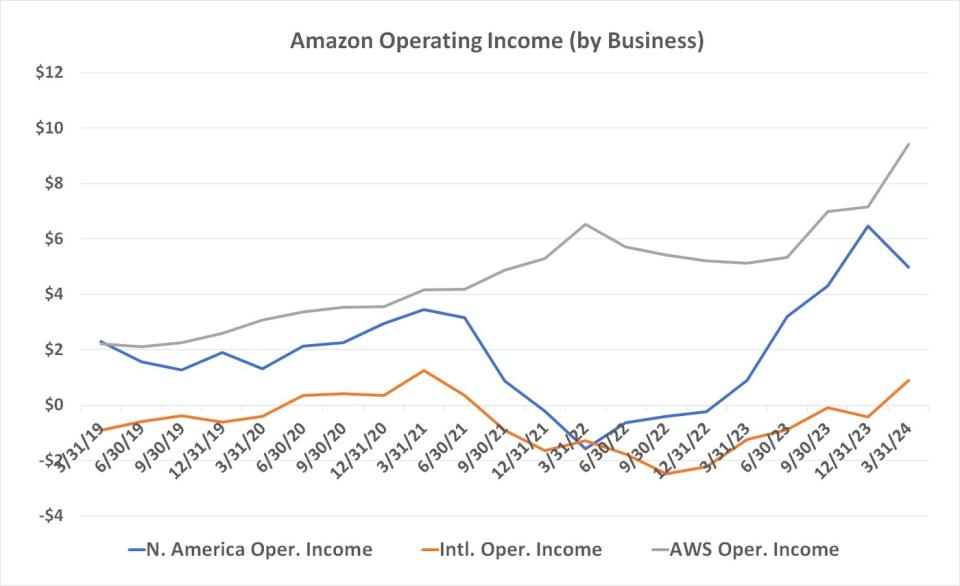

And it works! While revenue improved 13% year-over-year in the first quarter, operating profit more than tripled. Notably, the international e-commerce business went from a regular loss to an operating profit of $900 million. That’s the best this division has done since early 2021, when the COVID-19 pandemic was in full swing.

Amazon’s cloud computing arm, Amazon Web Services, is also firing on all cylinders, recovering from the skyrocketing operating costs seen in late 2022 and 2023. Q1 operating revenues of $9.4 billion were record-breaking and continue to improve. Expect more of the same, too. Mordor Intelligence believes the cloud market is expected to grow at an average annual rate of over 16% through 2029.

Amazon’s newest business is also booming. It’s advertising. Amazon.com’s third-party sellers paid more than $11.8 billion to feature their products more prominently on the site, a 24 percent increase year over year.

Amazon shares are up more than 130% since the beginning of last year, hitting new records last week. But given its short- and long-term earnings growth, there’s still more upside for this FAANG stock.

2. Netflix

It would be easy to expect the worst for the streaming giant Netflix (NASDAQ: NFLX). Suspiciously, after a marked slowdown in customer growth, the company will no longer disclose its subscriber numbers starting next year. The streaming market itself is also facing a saturation headwind, forcing its leading companies to collaborate with peers and competitors to create more marketable bundles. Cable giant Comcast recently unveiled a cable TV package that included Netflix and Apple TV, for example, while Walt Disney And Discovery of Warner Bros. are bundling Disney+, Max, and Hulu into a discounted bundle set to launch sometime this summer.

But just because the crowded industry is maturing doesn’t mean Netflix is doomed. There are a few key things working in its favor that could, and should, keep the stock’s current rally going. One of them is the company’s position within the streaming market.

See, it’s not just the original name in the industry that spawned all the others. It’s also still the most popular and “stickiest” streaming platform. Nearly 270 million households pay for access to its content… far more than any of its rivals. Meanwhile, streaming market research firm Antenna reports that Netflix has a churn rate of just 2%, compared to over 4% for Disney+ and over 6% for Max, to put it in perspective. For most American households that pay for multiple streaming services, there’s still a “Netflix first, others second” mentality. Habits are powerful.

The other issue working in Netflix’s favor is the rise of ad-supported streaming services. While only about 40 million of its 270 million subscribers (around 15%) are paying a lower monthly price in exchange for watching the occasional TV commercial, it’s an option that will keep the service marketable for much longer than it otherwise would have been. Market research firm Global Market Insight believes the ad-supported streaming market is expected to grow at an annual rate of more than 8% through 2032.

3. Apple

Last but certainly not least, add Apple (NASDAQ: AAPL) to your list of FAANG stocks to consider buying before the end of July.

It’s not necessarily a name to get excited about right now. While the stock was a must-have for years after the introduction of the iPhone in 2007, slowing iPhone sales, which account for about half of Apple’s revenue, have raised concerns about future growth.

But there is already a huge new growth catalyst at work. It is artificial intelligence.

While there’s no denying the company was late to the party, it’s quickly catching up. Last month, Apple unveiled several AI features for its smartphones, tablets and computers that will make its wares even more powerful (particularly when it comes to generative artificial intelligence). As Oppenheimer analyst Martin Yang writes, “Apple’s introduction of Apple Intelligence will position the company as a leader in the consumer AI experience.”

But it’s not just Apple’s consumer-facing AI apps that show so much promise. The company is also working on technology that most consumers will never see in action. For example, the company is developing its own chips for use in AI data centers. While NvidiaThe dominance of this market is not immediately in danger, The Wall Street Journal reports that these chips could be based on a completely different kind of artificial intelligence, namely inference, rather than the training-focused architecture that is common today.

It remains to be seen what the future holds for Apple’s AI. But Apple has a long history of success. With Precedence Research predicting that the global AI market will grow 19 percent on average through 2032, there’s little doubt that the company will win at least its fair share of market expansion.

Should You Invest $1,000 in Apple Now?

Before you buy Apple stock, here’s what to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $751,670!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 2, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has positions in Warner Bros. Discovery. The Motley Fool has positions in and recommends Amazon, Apple, Netflix, Nvidia, Walt Disney and Warner Bros. Discovery. The Motley Fool recommends Comcast. The Motley Fool has a disclosure policy.

3 Incredible FAANG Stocks You’ll Want to Add to Your Portfolio in July was originally published by The Motley Fool