Finding stocks that are a bit ignored by the market but are fantastic companies is a great investment strategy. These stocks could potentially have serious upside if the masses discover them. While no stock is truly “unknown” today, given all the research available to individual and institutional investors, there is a certain degree of popularity in the stock market.

If you want to buy obscure stocks, consider these three. They have great businesses and a strong advantage.

1. UiPath

UiPath (NYSE: PAD) is a leader in robotic process automation (RPA). RPA is software that automates repetitive tasks, giving employees the freedom to do work that requires original thinking. The work that can be automated is limited by the available input. That’s why UiPath also has artificial intelligence (AI) tools that increase the amount of information that can be extracted from it. Combined, these two technologies create a powerful option for customers.

The company also has an excellent financial profile, with annual recurring revenue (ARR) growth of 22% to $1.46 billion in the fourth quarter of fiscal 2024 (ending January 31). It also posted its first quarter with a positive operating margin on generally accepted accounting principles (GAAP), a sign to investors that management is serious about profitability. With management forecasting ARR growth of around 19% for fiscal 2025, there is still plenty of room to expand.

UiPath also doesn’t have a premium price tag. At 8.5x revenue, it’s much cheaper than many of its software peers, despite growing at about the same pace.

UiPath is a great investment because it is in a growing field, has strong financials, and can be purchased for a fairly cheap price. As a result, investors can dive into this stock and reap the rewards as its value steadily increases through growth.

2. dLocal

dLocal (NASDAQ: DLO) is another obscure company that is a vital partner for many of the largest companies in the world. With customers like Shopify, Spotify, AmazonAnd NikedLocal gives the company some credibility.

All these customers want to expand globally. Yet the financial systems of some emerging market economies (such as India, Egypt and Thailand, for example) are not the same as those of more developed countries. As a result, every company should build a payment processing infrastructure that is suitable for every country. This is expensive and time-consuming, and the work may not provide a positive return on investment.

dLocal’s product takes care of all that for them. The software connects to the customer’s existing payment processing network, allowing them to process transactions at these locations. By doing the legwork for its customers, dLocal brings business to countries that would otherwise be ignored.

This service has become incredibly popular and is growing rapidly. In the first quarter, revenue grew 34% thanks to payment volume growth of 49%. It’s also profitable, with a 9% profit margin in the first quarter.

dLocal is a relatively unknown company, but investors should take notice and get into the stock before the rest of the market does.

3. Procore

Procore (NYSE:PCOR) is used by many companies in the construction sector. The products provide customers with one reliable database that allows contractors, subcontractors and project owners to accurately assess project status. Additionally, working from one reliable database reduces expensive rework that can cause projects to run late and over budget.

Procore is also a great way to take advantage of the software transformation that took place in business a decade ago. Because job sites did not have access to the Internet, software solutions in the field were relatively worthless. However, 5G has changed that idea and Procore is a way to turn back the clock and invest in a growing software company.

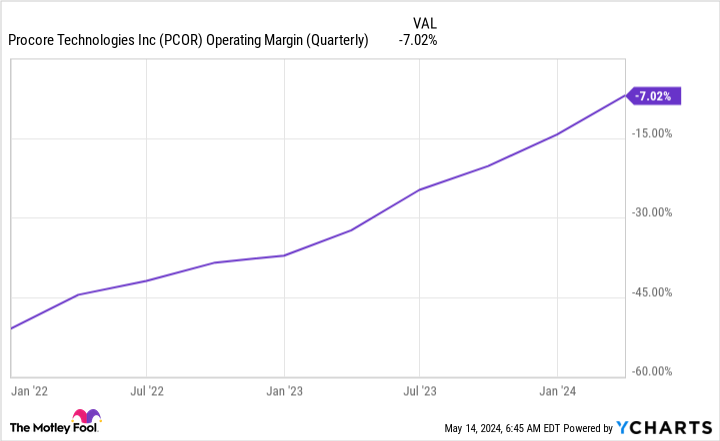

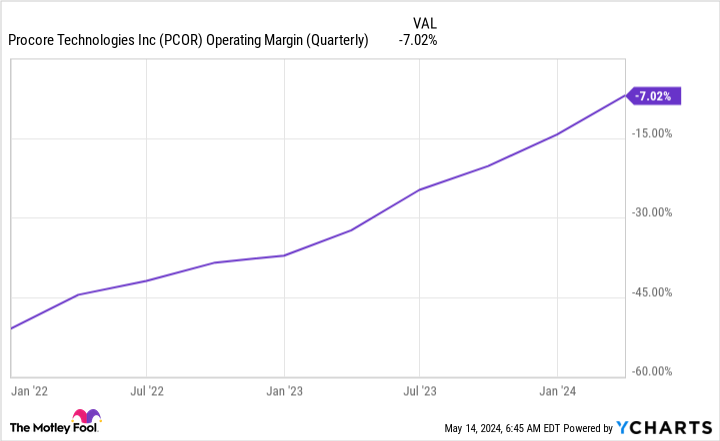

In the first quarter, Procore’s revenue rose 26% year over year to $269 million. Management also raised its 2024 revenue guidance in the quarter. As far as profitability goes, Procore is on track to reach that goal, even if it isn’t even broken yet.

Recently, at 9.7x revenue, Procore is a great company to invest in without fear of paying too much for the stock. I think Procore will be a market-beating stock over the next five to ten years, and investors can pick up the stock now to take advantage of this potential.

Should You Invest $1,000 in UiPath Now?

Before you buy shares in UiPath, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and UiPath wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $579,803!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Keithen Drury holds positions in DLocal, Procore Technologies and UiPath. The Motley Fool holds positions in and recommends Procore Technologies and UiPath. The Motley Fool has a disclosure policy.

3 Little-Known Stocks That Could Deliver Monster Returns was originally published by The Motley Fool