Passive income investors dream of finding companies that can pay reliable and growing dividends while beating the market. A company needs to grow its profits in order to return more money to shareholders over time. To grow earnings, the company must be in good financial shape and be able to navigate economic cycles to increase dividends even as earnings growth fades.

W.M (NYSE: WM), ExxonMobil (NYSE:XOM)And Owens Corning (NYSE:OC) are three companies generating near-record high profits and using the dividend as a key way to reward patient shareholders.

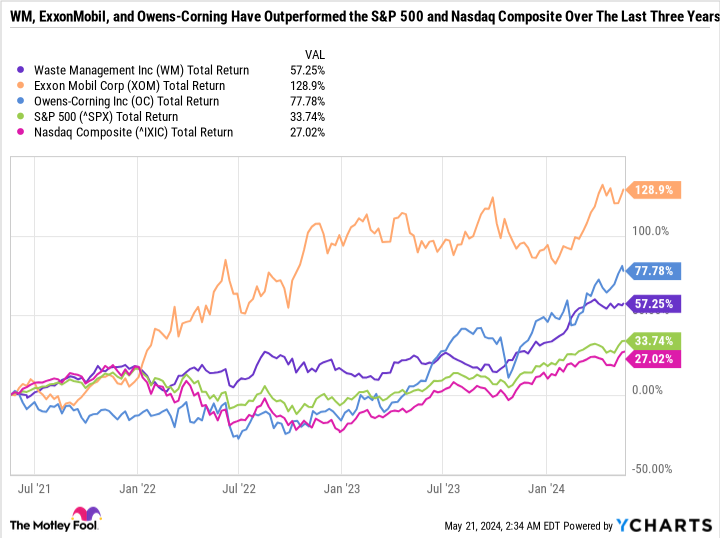

Three Motley Fool contributors were asked to highlight dividend stocks that have outperformed the major indexes (on a total return basis) over the past three years and are now worth buying. This is what they came up with.

WM’s growth is accelerating

Daniel Foelber (WM): Formerly known as Waste Management, WM has delivered impressive returns for a company that makes money collecting, transporting and processing commercial, industrial and household waste and recycling. The stock is hovering around an all-time high and has delivered a total return of 57.3% over the past three years, handily outperforming S&P500 and the Nasdaq Composite.

WM is a great example of why a leading company with an effective business model can command a premium valuation even though it is not in a popular high-growth sector like technology.

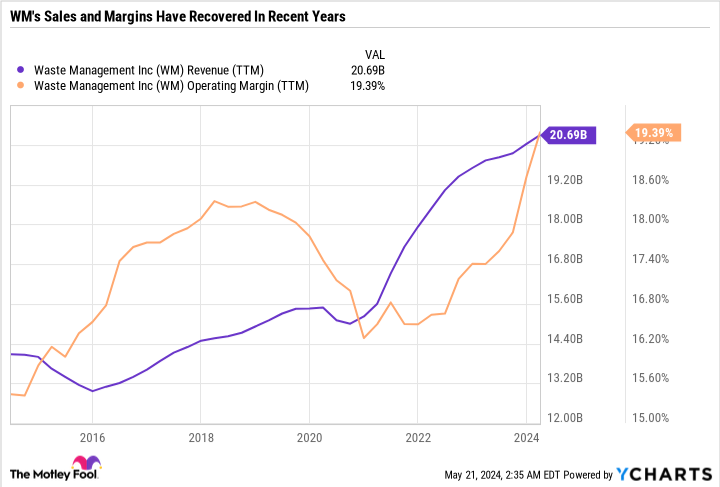

WM’s revenue growth stagnated and margins fell noticeably in 2020 and 2021. But in recent years, WM has seen a massive recovery in margins and accelerated revenue growth. Turnover has increased by more than 25% over the past three years.

WM benefits from an integrated business model that spans the entire integrated waste management value chain. By collecting, transporting, treating and disposing of waste materials, WM has better control over where waste goes and where it comes from. A comparison would be an integrated oil and gas giant like ExxonMobil versus a company that only drills oil and doesn’t deal with the other aspects of the industry.

Because waste is a necessary part of life, WM benefits from consistent cash flow from a reliable customer base. In the long term, the country benefits from a growing population and a growing economy. More people and higher economic output contribute to greater production, consumption and waste.

Over the past ten years, WM’s dividend has doubled and its share count has fallen by 13.9%. The company’s high free cash flow generation supports further dividend increases.

The yield is only 1.4%, but that’s more a result of the share price doing so well, rather than a lack of dividend increases. Unfortunately, the stock’s strong performance has made it expensive. It has a price-to-earnings ratio of 28.5.

WM is at the top, so despite its high price tag, it could be a stock worth paying for. The company has a clear runway for growing profits and dividends. With a payout ratio of just 46.7%, WM can afford to grow dividends faster than earnings, although the company prefers a hybrid capital return approach that includes buybacks and dividends.

All in all, WM has everything it takes to continue to outperform the market in the coming years.

Energy prices may rise and fall, but ExxonMobil remains ahead

Scott Levine (ExxonMobil): While the S&P 500 and Nasdaq have both moved higher year to date, ExxonMobil stock has left the two in the dust. The S&P 500 and Nasdaq are up about 12% since the start of the year, and ExxonMobil shares are up nearly 20%. The outperformance has been even better over the past three years, with ExxonMobil posting a total return nearly four times that of the S&P 500 or Nasdaq.

Despite the recent rise, ExxonMobil shares, with a 3.2% forward dividend, remain a great opportunity for investors looking to strengthen their passive income streams.

After reporting a strong end to 2023, ExxonMobil also pleased shareholders with its first quarter 2024 financial results. ExxonMobil exceeded analyst expectations for first quarter 2024 revenue of $73.2 billion and reported a revenue of $83.1 billion. And the promising view of what lies ahead also fueled the bulls’ enthusiasm. With plans to expand its assets in Guyana, Brazil and the Permian Basin, ExxonMobil expects to grow earnings at a compound annual growth rate of more than 10%, from $8.89 per share in 2023 through 2027 .

Operating across the value chain, ExxonMobil is an energy company that represents one of the best options for investors looking for high-quality oil dividend stocks. The company has demonstrated a firm commitment to rewarding shareholders. With the 2023 dividend increase, the company has increased its distribution for 41 years in a row, and in 2023, ExxonMobil repurchased $17.5 billion worth of shares. In light of last year’s strong performance and the outlook for 2024, it is very likely that the company will increase the price again in 2024.

A share for bulls in the housing market

Lee Samaha (Owens Corning): The S&P 500 is up 26.5% over the past year Nasdaq-100 is up 34.4% over the same period, but you don’t need to buy hot stocks or tech stocks to outperform. Owens Corning Building Materials stock is up 59% in comparison and there are reasons to believe it still has significant upside potential.

The roofing, insulation and composites company has strong exposure to the North American housing market, and its stock has climbed a wall of concern since early 2023 on the issue. There is little doubt that the housing market is now going through a difficult period. because relatively high interest rates put pressure on mortgage payers. Owens Corning’s revenue is expected to remain flat at $9.7 billion to $9.8 billion from 2022 to 2024.

Still, interest rates are unlikely to stay high forever, and the company is doing what you’d expect in a down market. In other words, it is taking advantage of its financial strength to buy attractive industrial assets and prepare for a turn in the cycle.

Management takes over a door company Masonite International for an implied value of $3.9 billion. The deal strengthens Owens Corning’s position in the North American housing market. It adds an additional line of products sold to the same group of builders, contractors, distributors, home centers and homeowners it already sells to. As such, management believes it will create a $12.6 billion company with earnings before interest, taxes, depreciation and amortization (EBITDA) of $2.9 billion, of which $125 million will come from generating synergies after the deal (sourcing, supply chain and sales, general and administrative benefits) within two years of the deal.

Hopefully the housing market will be in recovery mode by then, and with a current enterprise value (market cap plus net debt) of $17.3 billion, Owens Corning remains a good value stock for the housing bulls.

Do you now have to invest € 1,000 in waste management?

Before you buy shares in Waste Management, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Waste Management wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool recommends Owens Corning and Waste Management. The Motley Fool has a disclosure policy.

3 no-brainer dividend stocks that have outperformed the S&P 500 and Nasdaq Composite over the past three years, originally published by The Motley Fool