For investors looking for income, there may be no better sector to look at than pipelines. Companies in the sector are in their best financial shape in years, while their valuations are well below pre-pandemic levels.

In fact, the sector generally traded at a ratio of approximately 13.7 times average enterprise value (EV) to EBITDA between 2011 and 2016, while most midstream stocks today trade less than ten times. EV/EBITDA is generally the most commonly used metric to value midstream companies because it takes into account their debt positions and excludes non-cash expenses.

Let’s look at three simple stocks to buy in the sector that will give you both a stream of distribution income and strong price appreciation potential.

Western Midstream

Having just announced a whopping 52% increase in distribution, Western Midstream (NYSE: WES) has one of the highest yields in the midstream industry. The company increased its quarterly distribution to $0.875 per unit from $0.575 a quarter earlier. Based on the new payout, the stock now yields 9.3%.

Better yet, the company recently reported record first-quarter adjusted EBITDA of $608.9 million, up 22% year over year. Western saw record flows of natural gas into its systems. The company has a strong presence in the Delaware Permian, the most productive oil basin in the US. However, the company is also seeing a resurgence in Colorado’s Denver-Julesburg (DJ) Basin, where the number of wells is roughly doubling from a year ago.

The company ended the first quarter with a debt ratio of 3.3 times (net debt/adjusted EBITDA) and is on track to reach a debt ratio of three times by the end of the year. At that point, Western has said it is prepared to pay higher benefits on top of the already robust base benefit. Given the company’s strong balance sheet and distribution coverage ratio, the company should pay out distributions in 2025 that are higher than the already robust quarterly payout of $0.875.

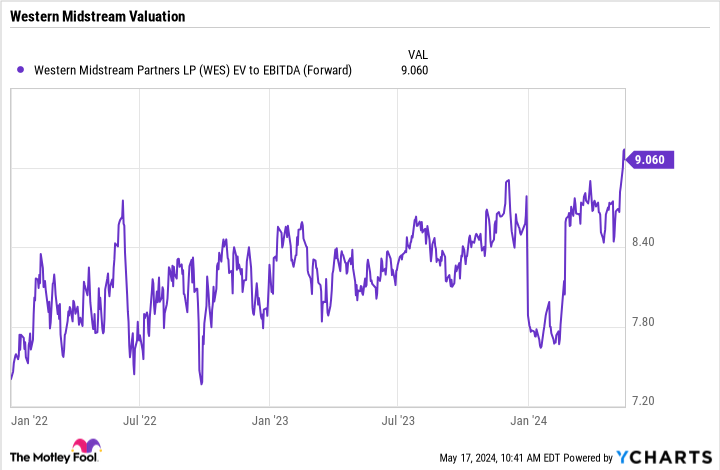

Western stocks, trading at a forward EV/EBITDA multiple of just nine times, are a no-brainer for income-oriented investors.

Partners for business products

One of the best managed midstream operators, Enterprise product partners (NYSE:EPD) has been a model of consistency over the past twenty years. Through various economic and energy cycles, it has increased its distribution for 25 years in a row.

The company is in strong financial shape and has a modest industry impact of just three times. Meanwhile, it currently pays a quarterly distribution of $0.515 per unit, which was up 5.1% from a year ago. That is good for a return of 7.2%.

Even more exciting for investors is that Enterprise is starting to ramp up growth after slowing post-pandemic. After reducing capital expenditure (capex) to just $1.4 billion in 2022, the company has increased it to $3.5 billion in 2023. This year too, it plans to spend about $3.5 billion. Projects take time to build and then ramp up, so the benefits of this spending should start to materialize in the coming years.

Meanwhile, after a five-year wait, Enterprise has just received a key license that will allow the company to move forward with its proposed Sea Port Oil Terminal (SPOT) project. SPOT could be a game-changing project that would make Enterprise a major player in crude oil exports.

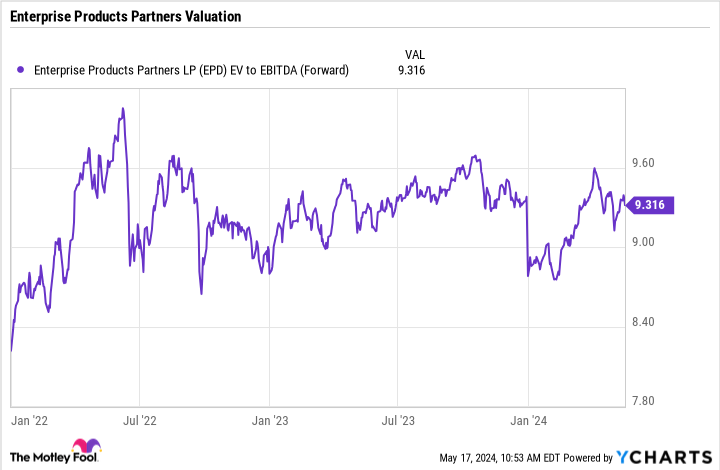

With this Master Limited Partnership (MLP) trading at just 9.3 times on a forward EV/EBITDA basis, now is a good time to invest in the stock.

Energy transfer

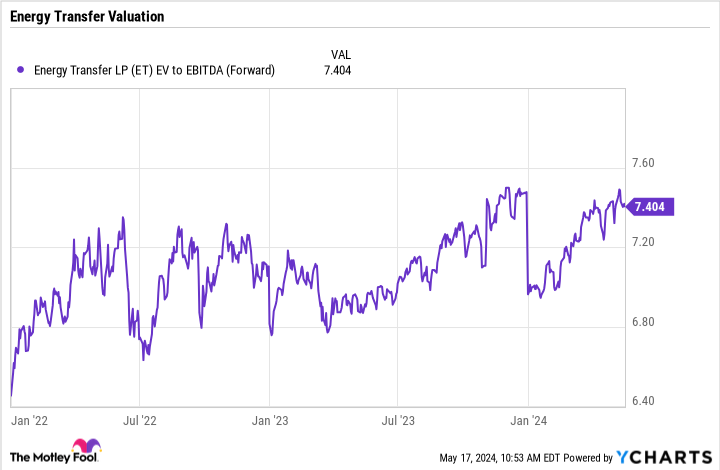

Energy transfer (NYSE:ET) is the cheapest of the three midstream stocks, although it may have some of the best assets. The large integrated system that has been created through growth projects and acquisitions touches almost all aspects of midstream activities. This has given the company enormous scale. Simply put, the company’s large, interconnected system allows it to find the best prices to move products. This can be done by storing hydrocarbons (crude gas, natural gas and natural gas liquids) for use at more attractive times, by upgrading the products to something more valuable, or by shipping them to more attractively priced markets.

Energy Transfer is building a midstream empire and not worried about it. However, that left the company in dire straits in 2020, when it had to cut its distribution in half to help improve its balance sheet.

However, the company has not only returned distribution to previous levels, but it is now higher than before the cut. Meanwhile, its balance sheet, while not as strong as Enterprise’s or Western’s, has recovered, and the company is smartly generating free cash flow that exceeds its distributions. This is a strong sign that it won’t run into the problems it faced in 2020, when it overextended itself in its efforts to grow.

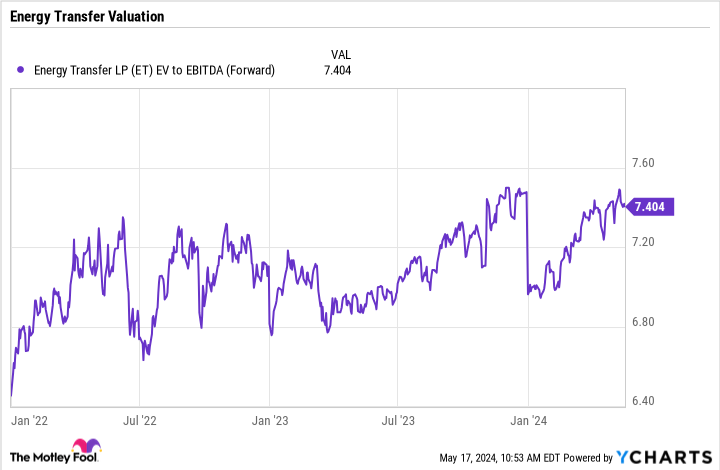

Trading at just 7.4 times forward EV/EBITDA, the new and improved Energy Transfer is one of the biggest bargains in this space right now. The company is growing rapidly and expanding its distribution, but doing so in a more responsible manner while continuing to reduce debt. That makes the share an attractive purchase.

Do you now have to invest € 1,000 in energy transfer?

Consider the following before purchasing shares in Energy Transfer:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Geoffrey Seiler has positions in Energy Transfer, Enterprise Products Partners and Western Midstream Partners. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

3 No-Brainer High-Yield Pipeline Stocks to Buy Now with $1,000 was originally published by The Motley Fool