Artificial intelligence (AI) is a truly revolutionary technology that has captured the imagination of investors like no other. This is a double-edged sword, even if the technology is truly here to stay. If we learned anything from 2000, it’s that too much hype around new technology, without the economics to support sky-high valuations, is dangerous territory to be in.

I don’t want to draw too close a parallel here – there are plenty of reasons to believe this isn’t a second round of the dot-com bubble – but it’s always wise to maintain a healthy skepticism during a boom. All eyes – skeptics and believers alike – are on it Nvidia‘S (NASDAQ: NVDA) upcoming annual shareholders meeting.

On June 26, 2024, the figurehead of the AI revolution will hold the meeting, discussing strategy and voting on action items such as board approvals. Normally, the annual general meetings aren’t as defining as the earnings reports, but it’s still an important event that can shed light on what the future holds for Nvidia and the market as a whole.

With the meeting fast approaching, is it a good time to hop aboard the Nvidia train? Here are three reasons why the stock still looks strong.

1. Nvidia has a lot of money to play with

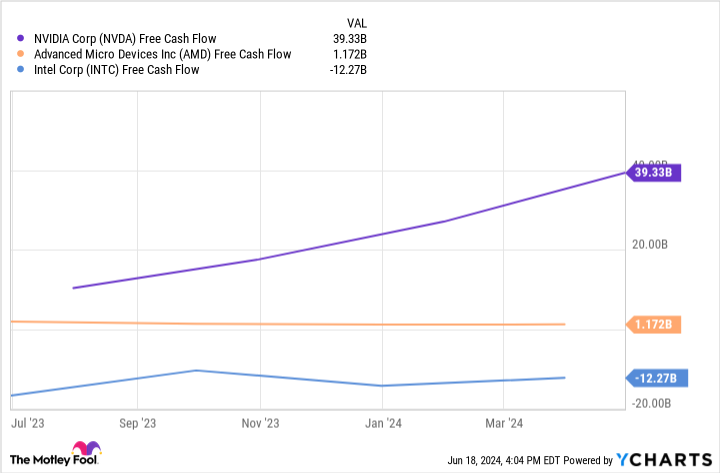

Now that the company has become famous and proven how lucrative the business is, the competition wants a share of those profits. The threat of one AMD or Intel Overtaking and eating into the approximately 80% market share that Nvidia enjoys is real and must be taken seriously. However, Nvidia has great resources to defend itself through continued innovation.

In the technology sector, the best product goes a long way. AMD and Intel need to produce a product comparable to Nvidia’s if they want to take away their market share. This costs money, a lot of money. AMD spent $1.5 billion on research and development (R&D) last quarter, while Nvidia spent $2.7 billion. Remember, Nvidia is already in pole position; it has the best technology on the market, and it still outspends AMD by almost two to one.

Intel, on the other hand, outspends both, at $4.4 billion last quarter. The catch is that these expenses put Intel in the red. How long can it keep this up?

Take a look at this chart showing the free cash flow (FCF) of these companies. FCF is a company’s income after you subtract operating costs and capital expenditures (the money a company spends to grow). It indicates how much room a company has if, for example, it wants to increase R&D expenditure.

2. The market as a whole is growing rapidly

So if we accept that Nvidia has the means to defend itself against its main competitors, we can assume that Nvidia can maintain or increase its market share. There are certainly more factors, but it’s not an unreasonable assumption.

Statista.com predicts a compound annual growth rate (CAGR) for the AI market overall of around 28.5% through 2030. That’s a very fast growth rate, albeit slower than the lightning speed at which the company has been growing recently. Still, this would be an incredible growth rate to maintain.

This is an estimate for the entire market – not just semiconductors, which is Nvidia’s bread and butter – so this is a very rough benchmark. The semiconductor segment could have a lower CAGR rate than this. However, this brings me to my next point.

3. Nvidia isn’t sitting on its laurels: it’s expanding its revenue streams

There’s no doubt that what has led to Nvidia’s massive success of late is sales of its powerful AI chips, but the company sees a future that goes beyond that. Nvidia is trying to build an entire AI ecosystem. It works with companies like Dell to offer complete, on-premise, AI computing solutions. It builds technologies and end-to-end platforms designed for autonomous vehicles, humanoid robotics and drug research. There’s more, but I’ll stop here. The point is that Nvidia wants to position itself at the center of all things AI, as a star around which other companies revolve, rather than just one link in the chain.

Should You Invest $1,000 in Nvidia Now?

Consider the following before buying shares in Nvidia:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls to Intel and short August 2024 $35 calls to Intel. The Motley Fool has a disclosure policy.

3 Reasons to Buy Nvidia Stock Before June 26 was originally published by The Motley Fool