Typically, investors should aim to buy stocks that are in a downturn. Why pay more when with a little patience (and some short-term market fluctuations) you can get more bang for your buck?

However, there are cases where it makes sense to get into a ticker that is not just high, but downright rising. While a pullback may be in store at some point in the near future, the bigger risk awaits and the ticker will continue to post gains. The trick, of course, is to know when those opportunities arise.

With that as background, here’s a look at three stocks that are near rally-driven highs and could still make great long-term investments at their current prices.

1. Home Depot

The real estate picture is probably bleak. New home sales remain roughly in line with pre-pandemic levels, and are only so high because existing home sales remain just above the multi-year low seen late last year. Homeowners aren’t giving up on their low-interest mortgages, while cash-strapped consumers simply aren’t interested in spending a ton of money on a home that might not hold its value. Spending on renovations has also fallen.

So why are the shares of a home improvement retailer? Home Depot (NYSE: HD) at a new 52-week high that is in line with their peak at the end of 2021 (when spending on homes and home improvement projects soared)? Because investors look forward instead of backward.

Reality: Number analysis done by a real estate sales platform Zillow reports that the current housing shortage in the United States is 4.5 million, up from 4.3 million last year. Between the country’s continued population growth and the enormous limit on the number of homes the housing sector can build in a given year – around 1.5 million – this gap could take several years to close. There’s also just a lot of pent-up home buying waiting to be unleashed, with many potential buyers waiting on the sidelines for interest rates and home prices to drop… which they are now.

As the largest name in the industry, Home Depot is perfectly positioned to respond to this demand.

Investors who keep a close eye on Home Depot will point out that the results are inconsistent with this narrative. Last quarter’s sales were flat, while U.S. same-store sales fell 3.6% year over year. The retailer also lowered its full-year earnings guidance with its latest quarterly results.

However, the underlying headwinds appear to be easing, putting Home Depot back in a position to dominate the growing home improvement market. Heck, the analyst community believes Home Depot’s sales will return to growth next fiscal year, with earnings growth resuming the following year due to lower interest rates and more stabilized supply and demand. That’s what the stock’s recent buyers are responding to.

2. Coca Cola

Coca-cola (NYSE:KO) is such a frequently suggested stock pick that it has almost become a cliché. In fact, it’s arguable that the reason the stock is still within sight of last month’s record high is because it’s one of the few tickers that investors know is safe and reliable enough to own in these uncertain times .

The point is that the crowd is right. Coca-Cola is one of the very best, versatile names on the market, regardless of environment.

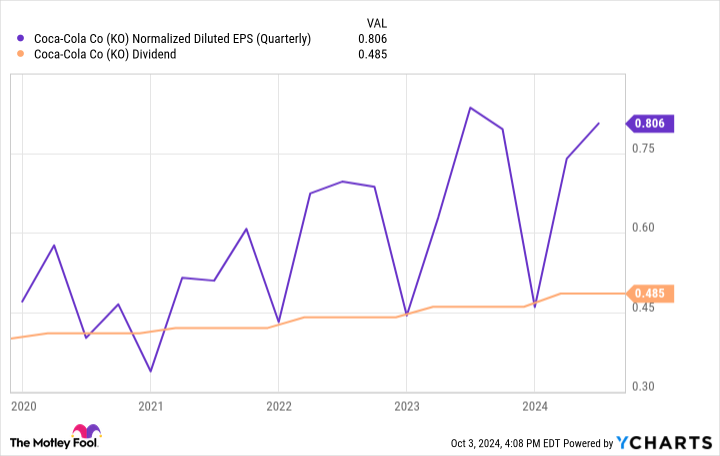

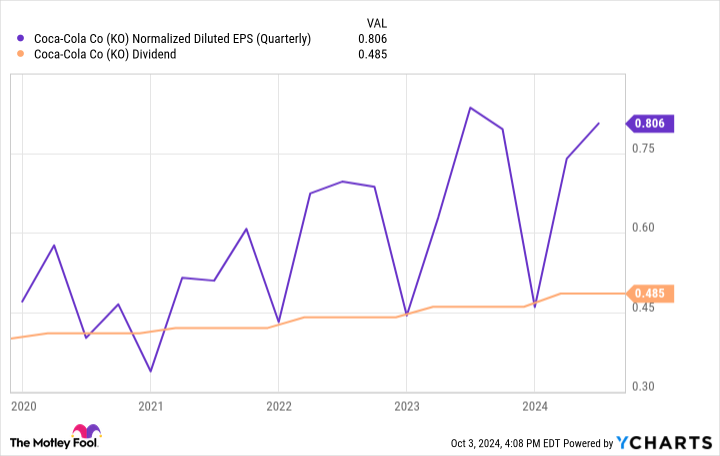

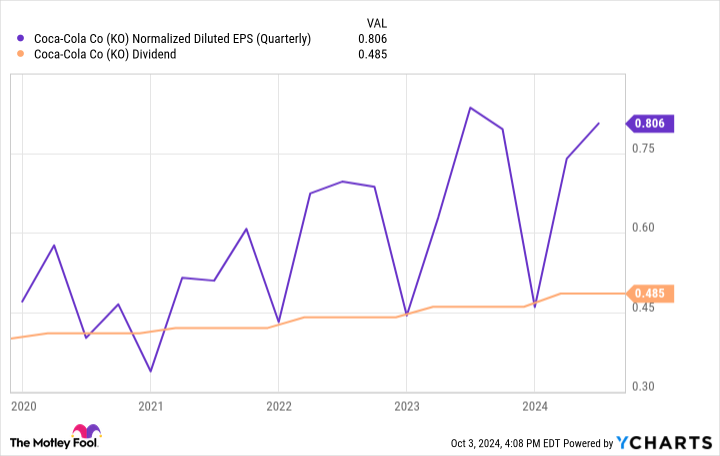

That doesn’t mean the beverage giant has an impressive growth engine. It’s certainly a slowly evolving thing. This year’s expected revenue growth of just over 8% is an outlier, in fact, exaggerated by last year’s anemic comparison. The expected revenue growth for the coming year of just under 5% is in line with the company’s long-term norms. Ditto for profits, which have only grown at a slightly faster pace and should continue to improve at about the same rate.

What Coca-Cola lacks in growth pizza, however, it more than makes up for in consistency. The company has now increased its dividend every year for the past 62 years, with its ability to pay it out never really in doubt.

That’s the result of being the biggest name in the industry and managing a wide range of industry-leading drinks that go far beyond your name Coke. See, this company also owns Gold Peak tea, Minute Maid juice, Powerade sports drink, and Dasani water, just to name a few. Not only does it always have something to meet the world’s ever-evolving tastes, it also wields a great deal of sales and marketing clout.

What it comes down to? As long as consumers get thirsty, The Coca-Cola Company should be able to generate at least some revenue growth.

3.Microsoft

Finally, add a software powerhouse Microsoft (NASDAQ: MSFT) on your list of soaring stocks to buy and hold for the next twenty years.

The usual bullish arguments apply. That is, the world is still heavily dependent on Microsoft software. About a third of the world’s students, businesses and individual consumers still choose Microsoft’s productivity tools such as Word and Excel, while figures from Global Stats’ Statcounter indicate that Microsoft’s Windows is installed on almost three-quarters of the world’s computers .

Then there is cloud computing. Although Amazon Web Services remains the largest provider of cloud computing services in the world, and there’s plenty of business here. In fact, according to data collected by Synergy Research Group and market research firm Canalys, Microsoft is the fastest growing name in cloud computing.

Considering that much of its software and services are rented rather than purchased outright, it’s no surprise that Microsoft’s revenue and revenue has been growing fairly steadily for years.

However, none of this strength is at the heart of why you might want to get into Microsoft stock, even after its 86% rise from its early 2023 low. The overarching reason that this company is an attractive investment for the next twenty years, is the proven willingness and ability to seize new opportunities as they arise.

Think about it. Twenty years ago, cloud computing didn’t even exist. Twenty-five years ago, the Xbox video game console didn’t exist. Just five years ago, Microsoft probably didn’t think an artificial intelligence platform would be ready to generate revenue, but the Copilot Pro is now available to paying subscribers who want to get more out of their computers.

We don’t know what Microsoft’s next big development will be. However, given its track record of innovation and the world’s dependence on much of its existing technology, there is little doubt that the country will be able to continue growing its sales and profits.

Should You Invest $1,000 in Coca-Cola Now?

Before you buy Coca-Cola stock, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has positions in Coca-Cola. The Motley Fool holds positions in and recommends Amazon, Home Depot, Microsoft, and Zillow Group. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

3 Rising Stocks to Hold for the Next 20 Years was originally published by The Motley Fool