Most investors understand the importance of diversifying their portfolios. However, there’s no denying that technology stocks regularly outperform the stocks of most other sectors. Therefore, it wouldn’t be entirely wrong to get some extra exposure from these names and especially from the tickers in charge. Semiconductor stocks are consistently among these leaders.

With that as background, here’s a look at three semiconductor stocks that risk-tolerant growth investors might want to consider sooner rather than later.

1. Axcelis Technologies

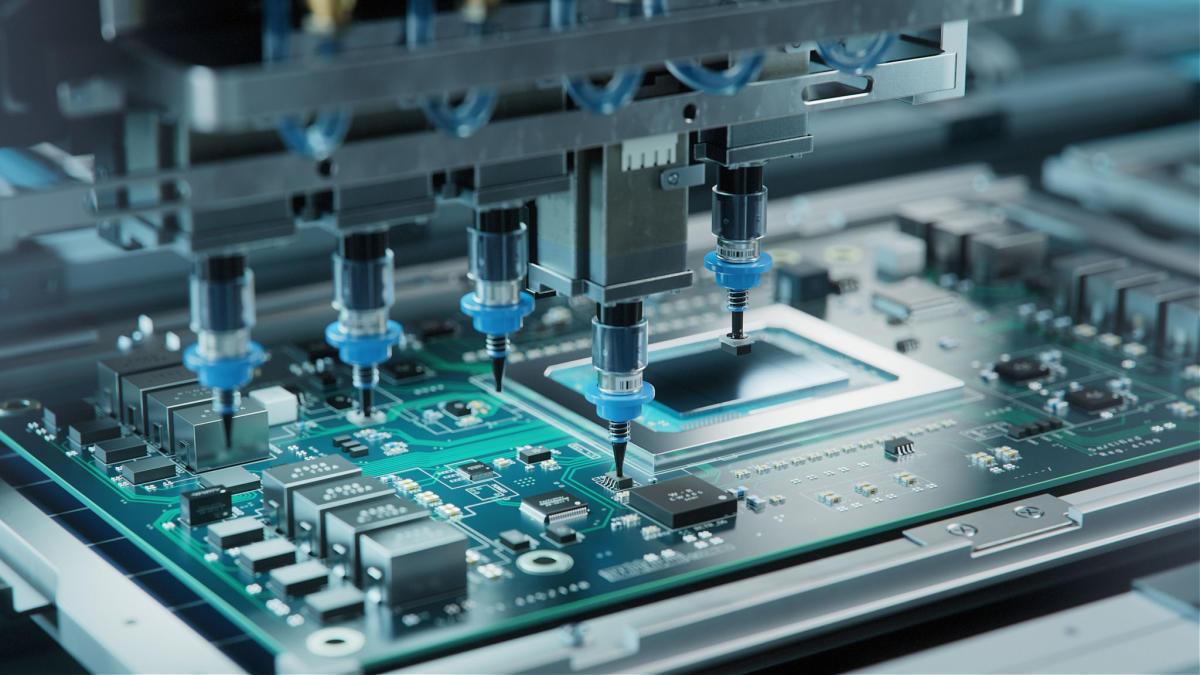

If you think high-performance semiconductors are just the result of clever use of silicon, think again. Modern chip production is so much more scientific and complex. Semiconductor companies are now changing the physical properties of materials to make computing platforms perform even better.

Enter Axcelis Technologies (NASDAQ:ACLS). It produces ion implantation devices used in chip making. Specifically, the Purion ion implantation machines are used to create silicon carbide, which is found in most consumer electronics, as well as electric vehicles. Ion-implanted silicon carbide is quickly becoming the standard in several technology-based industries due to its ability to handle large energy loads and operate at high heat levels without requiring much power.

However, ion implanters are not cheap. Axcelis Technologies implanters start at a few million dollars each, and that price tag can quickly add up depending on the system in question. Chipmakers can’t simply purchase this equipment without a thoughtful return on investment calculation or perhaps without borrowing money to make it possible. That’s why the company’s revenue growth is slowing, in the shadow of the current economic lethargy after the recent surge. Companies are cautious and unsure whether such large investments will yield enough to justify the purchase. This is a key reason why Axcelis sales are expected to shrink by almost 7% this year.

However, take a step back and look at the bigger picture. Between the mainstreaming of electric vehicles and the rise of energy-intensive artificial intelligence platforms, demand for the equipment that enables these technologies will continue to grow. While this market may only grow in single digits, William Blair’s estimate that Axcelis Technologies has about three-quarters of the silicon carbide ion implant market means that the company is poised to account for a large portion of this growth to take.

Axcelis is also exposed to the NAND and DRAM markets and the image sensor market, meaning it will also benefit from the continued technology growth of virtually everything. Therefore, Axcelis Technologies’ sales are expected to start to recover next year with growth of more than 16%.

2. Intel

Semiconductor outfits such as Intel (NASDAQ: INTC) already rely on ion implantation systems to make chips, but don’t be surprised to see the company needing these (and other) technological expansions in the near future.

Well-known investors will probably remember that the past few years have been tough ones for Intel. The company was struggling in R&D, which made rivalry possible Advanced micro devices to commercialize the world’s first 7-nanometer processors. Intel’s design and manufacturing problems are not over in the meantime either. The foundry business lost $7 billion in 2023, with no relief in sight before 2024.

As with Axcelis Technologies, investors may want to look further.

Intel is not leaving the branded hardware market. However, the company is diving headfirst into third-party chip production. That just means it will soon start producing semiconductors designed and marketed under different technology names. To date, the company has committed approximately $30 billion to these plans, with production expected to begin in 2026. Microsoft has already signed up as a customer long before chip production has started.

It’s a big deal simply because the chip foundry industry will soon double in size, from about $100 billion a year now to more than $200 billion by 2032. There seems to be a lot of growth in store for the company.

In the meantime, despite its problems, Intel remains the market leader in computer processors. Data from researcher Canalys indicates that the company still controls a hefty 78% of the computer processor market and a similar three-quarters of the data center market (including AI), according to figures from Mercury Research. Tough stuff or not, there’s still a reason why Intel leads these slow-growing markets that aren’t going to shrink anytime soon.

Shares of Intel are down more than 50% from their 2021 peak, thanks to continually renewed concerns about declining competitiveness and the costs associated with entering the chip foundry sector. However, the setback is ultimately a great entry point into the reinvention story.

3. Broadcom

Last but not least, add Broadcom (NASDAQ:AVGO) on your millionaire semiconductor stock list.

At first glance, it seems too much like Intel to own them both. Just like Intel, Broadcom makes chips, especially processors.

However, the two companies’ product ranges don’t overlap that much. Broadcom’s technological specialty is communications technology. You will find its products in wireless hardware, computer network infrastructure, fiber optic connections and the like. It’s proving especially useful for artificial intelligence data center operators, who increasingly find themselves processing more digital data than they can effectively process. The company also offers software that squeezes the most functionality and performance out of its hardware.

However, the core of the bullish argument for owning a stake in Broadcom at this particular moment is rooted in AI.

It is rarely compared to the titan of industry, Nvidia, rightly so. After all, Nvidia is the undisputed king of AI processing technology. However, high-quality data crunching within a data center is not the only aspect of artificial intelligence. Just as practical (if not more so) is the infrastructure that connects these large banks of individual processors.

That’s where Broadcom comes into the picture. It has developed a lot of technology specifically for the backend of the AI evolution. Take for example the Ethernet switches specifically designed to meet the intense data delivery and power consumption needs of AI data centers. The Trident 5-X12 switch features a proprietary on-chip neural network that can identify data traffic patterns that would otherwise go unnoticed and respond to these patterns by routing that data more efficiently. The end result is a 25% reduction in the amount of power required to perform this task.

Already a leader in optical networking, the company also recently unveiled the industry’s first-ever 200G/lane vertical-cavity surface-emitting laser (VCSEL). In the simplest terms, this product raises the standard for the high-speed connections typically required for large-scale generative AI computing platforms.

So Broadcom isn’t a threat to Nvidia, but it doesn’t have to be to become an excellent investment choice. The technology will largely be used in conjunction with Nvidia’s, and both companies are well positioned to benefit from the 26% annual growth rate that Mordor Intelligence projects for the AI hardware market through 2029. In this vein, analysts expect Broadcom to grow 41% will report. revenue growth this year, followed by another 14% growth next year. However, that’s just a taste of what’s to come.

Should You Invest $1,000 in Intel Right Now?

Before you buy shares in Intel, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool recommends Broadcom and Intel and recommends the following options: long January 2025 $45 calls to Intel, long January 2026 $395 calls to Microsoft, short January 2026 $405 calls to Microsoft, and short May 2024 $47 calls to Intel. The Motley Fool has a disclosure policy.

3 Millionaire-Maker Semiconductor Stocks was originally published by The Motley Fool