After a strong run in the first half of the year, technology stocks have come under pressure recently. Recent trends in stock prices suggest that investors are taking a more cautious stance on the economy, while the mania for artificial intelligence (AI) has also waned. Even high-flying Nvidia has been hit: the share price has fallen by almost 20% over the past six months.

But this recent sell-off also offers opportunities.

Let’s take a look at three tech stocks (that aren’t named Nvidia) that investors should consider buying now that the market is changing so quickly.

1. Taiwanese semiconductor production

Taiwanese semiconductor production (NYSE:TSM)or TSMC for short, is the world’s leading semiconductor manufacturing contractor. Today, many semiconductor companies no longer produce their own chips. Instead, they outsource the process to companies that specialize in chip manufacturing.

While outsourced manufacturing may not sound like an exciting business, don’t be fooled: this is a highly complex process driven by the companies that do it best. In fact, the contract manufacturing unit of Intelwhich was founded in 2021 to compete with TSMC, recently suffered a major setback after chip designer Broadcom said that the tests performed showed that Intel’s latest process was not suitable for large-scale production.

At the same time, TSMC has been leading the way in technological innovation, with the company set to introduce 2-nanometer manufacturing technology next year. The smaller the chip density, the better the performance and consumption. As demand for AI chips becomes insatiable, the company has been expanding its capacity and building new production facilities.

Given the high demand for its services, TSMC will also raise prices for its more advanced technologies. Morgan Stanley Analysts estimate that prices will rise 10% this year for AI semiconductors and chip-on-wafer-on-substrate (CoWoS), 6% for high-performance computing, and 3% for smartphones.

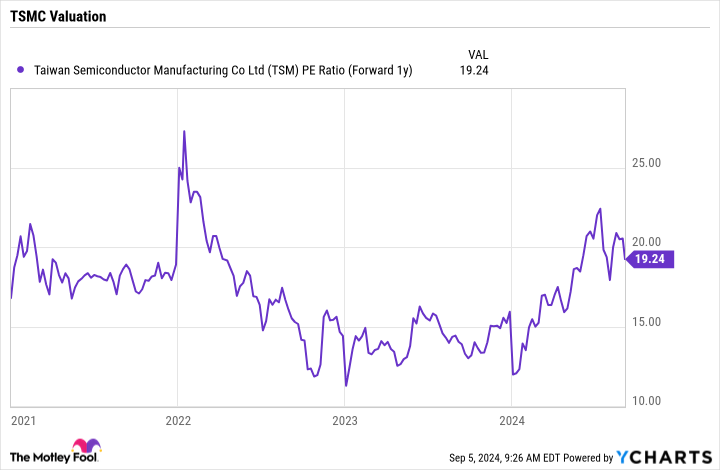

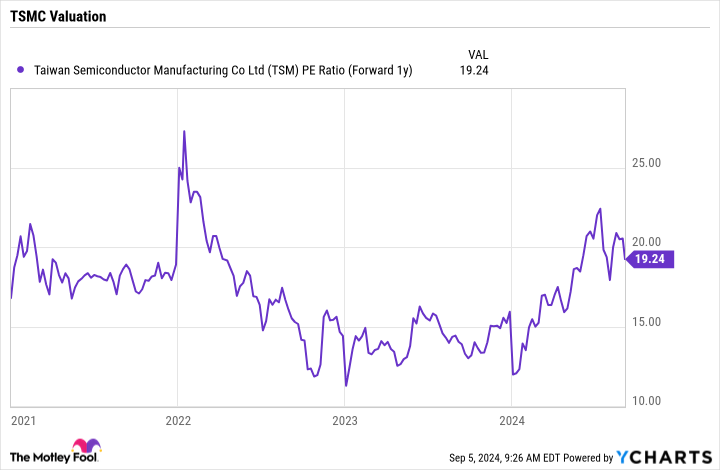

With a forward price-to-earnings (P/E) ratio of around 19 based on analyst estimates for next year, the stock is still attractively valued, especially given its expected growth.

2. ASML

While TSMC makes the chips for semiconductor companies, ASML (NASDAQ: ASML) makes the highly specialized equipment used by companies like TSMC to produce these chips. As TSMC and others expand their production to meet the growing demand for AI chips, they need more equipment to produce those chips.

It is not surprising that semiconductor equipment manufacturing can be a laborious process, as these are very expensive pieces of equipment. These machines have a typical life cycle of about seven years before they need to be replaced or refurbished.

Meanwhile, 2024 is something of a transition year for ASML as it introduces its latest technology: a high numerical aperture extreme ultraviolet lithography system, or high NA EUV. The company says the new machines will increase chip production productivity while reducing production costs and improving chip functionality.

The company has shipped two of its high-NA EUV systems so far, with one working qualification wafer. At $380 million per unit, these new systems are pricey and should boost ASML’s revenue next year and beyond as chipmakers move to cutting-edge technology to help meet demand for AI chips. That, combined with the number of new fabs coming online in the coming years, bodes well for ASML’s long-term prospects.

During an earlier analyst day, ASML management set targets to grow revenue to between 30 and 40 billion euros ($33.3 to 44.4 billion) in 2025 and to 44 to 60 billion euros ($48.8 to 66.6 billion) in 2030. The company generated revenue of 27.6 billion euros ($30.6 billion) last year and expects similar revenue this year.

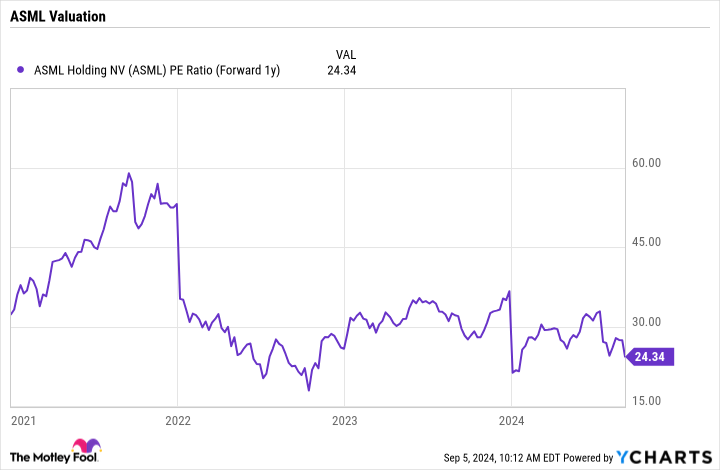

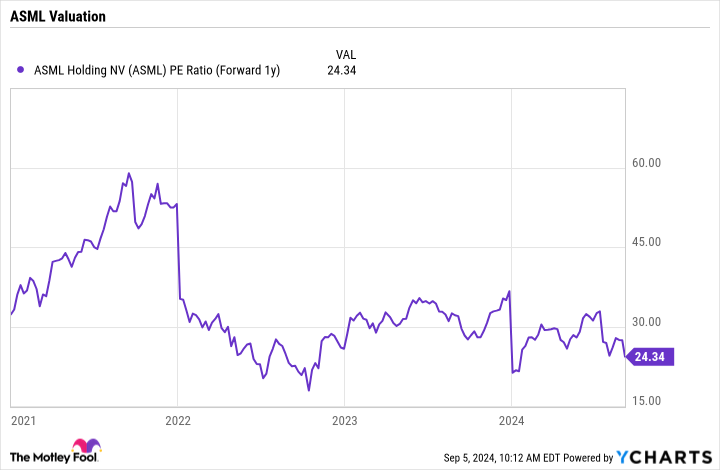

ASML shares are trading at a forward price-earnings ratio of just over 24 times, based on analyst estimates for 2025. Given the growth ahead, ASML stock looks attractive.

3. Arm Holdings

Arm Holdings (NASDAQ: ARM) is the leading semiconductor company for central processing units (CPUs), often described as the brains of devices. The company has a dominant position in the smartphone market, with its technology in virtually all smartphones worldwide.

Meanwhile, Arm is also targeting the personal computer (PC) market. The company’s technology is currently available in all Apple computers and laptops, but the goal now is to be 50% of Windows PCs in the next five years. While it’s not as big a market as smartphones, it’s still a big opportunity for the company. Arm has also made solid progress in the automotive market, reporting 28% year-over-year revenue growth in the sector in Q2.

Arm is also benefiting from AI. Last quarter, Arm noted that it was seeing increased licensing in the AI data center due to the need for customization, while it collaborated on a superchip with Nvidia that combines an Arm-based CPU with an Nvidia graphics processing unit (GPU). The technology is also the basis for CPU data center chips from Amazon And Alphabet.

While semiconductor companies like Nvidia and Broadcom design their own chips, Arm operates under a different model where it licenses its technology to other companies so that they can design their own chips based on its technology. Through its licenses, it collects royalties on the number of chips shipped that incorporate its technology. This revenue stream can last for years or even decades.

More recently, the company has been moving customers to a subscription model, where they can get a wider range of uses for its intellectual property. Whether through royalties or subscriptions, Arm has a very high-margin, largely recurring revenue stream.

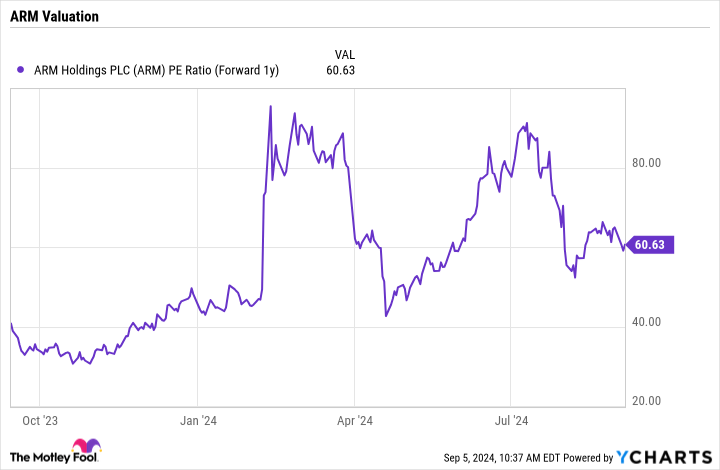

Based on analyst estimates for 2025, Arm shares are trading at a forward price-to-earnings multiple of just over 60.5 times. While that’s not cheap on the face of it, it’s lower than at higher levels and Arm has one of the most attractive and long-tail business models in the semiconductor sector.

Should You Invest $1,000 in Arm Holdings Now?

Before you buy Arm Holdings stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Arm Holdings wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $630,099!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 3, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends ASML, Alphabet, Amazon, Apple, Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

3 Stocks Outside of Nvidia to Buy During Tech Sector Sell-Off was originally published by The Motley Fool