With the attention that artificial intelligence (AI) is getting, it’s easy to focus on Nvidia as a top tech stock. It’s a great pick and has performed incredibly well, but there are other stocks that look more attractive right now.

Three that I have my eye on are: Taiwanese semiconductor production (NYSE:TSM), Meta platforms (NASDAQ: META)And Procore Technologies (NYSE: PCOR)I think they all offer a great compromise between growth and value, and are much better buys than Nvidia today.

Taiwanese semiconductor production

Taiwan Semiconductor, or TSMC for short, is the largest contract chip manufacturer in the world. It takes over designs from giants like Nvidia and Apple and produces them, making it a winner no matter which company is leading the AI race.

TSMC is at the forefront of technology. It has market-leading 3 nanometer (3nm) chips and is already working on the next generation of 2nm chips. These chips can be configured to provide more processing power or to be more efficient.

With the computing power of existing technology already impressive, it’s more likely that TSMC’s customers will opt for more efficient versions, especially since the input costs for AI computing hardware are so high. This could create even more demand for its chips, making the stock a strong buy.

Management is forecasting compound annual revenue growth of 15% to 20%, giving it the potential to be a market-crushing stock. With shares still down about 10% from their July highs, now is a great time to buy.

Meta platforms

Meta Platforms is the parent company of Facebook, Instagram, Threads, WhatsApp, and Messenger. It also has a Reality Labs division, which offers products such as virtual reality headsets.

But all investors really need to focus on is the advertising on social media sites, which accounts for 98% of revenue. Meta-investors simply need to learn to balance the benefits of advertising with Reality Labs’ high unprofitability.

Holistically, Meta is a really impressive company: 38% operating margins with 22% revenue growth. Those are fantastic stats, but the stock trades for 24 times forward earnings. Given that the S&P 500 As a whole, it trades for 23 times forward earnings, which is a bargain considering its business is in much better shape than the average S&P 500 participant.

Meta is expected to continue its dominant position in social media. If any of Reality Labs products are successful, the stock could be a huge winner.

Procore Technologies

Procore may not be a name you’ve heard of, but their construction management software is revolutionizing the industry. Unlike nearly every other industry that has seen a software revolution in the last decade, the construction industry has only recently started to benefit from widespread mobile connectivity.

Now that it’s possible, Procore’s software is incredibly popular because it allows contractors, subcontractors, and project owners to all work from the same source of information, reducing the additional costs of troubleshooting errors. So if an engineer makes a change to the electrical schematic, he or she can upload it to Procore and the electrician can see the changes almost instantly on the job site.

Despite its popularity, Procore still has a long way to go to grow in its target market. In its presentation at the 2023 investor day, it estimated that it has captured less than 2% of the companies, with about 12% of the monetary volume of construction. Globally, it is even less, at about 1% and 2% respectively.

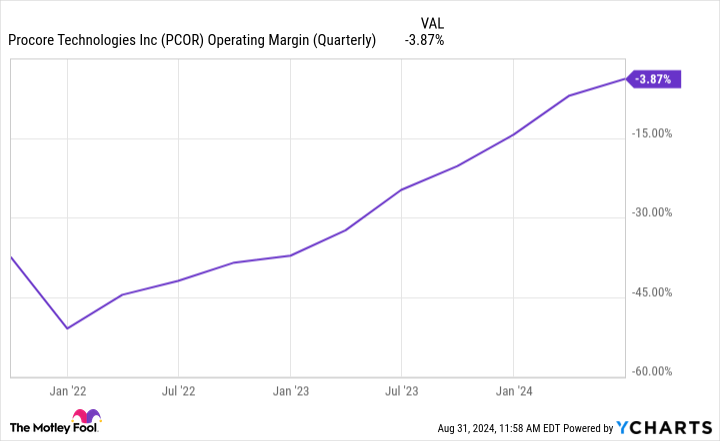

Given the size of the industry, Procore has the potential to become a huge company if it continues its growth trajectory. In the second quarter, revenue grew 24% year-over-year. The company is not profitable, but is getting closer each quarter.

Given its enormous runway, it won’t be long before Procore starts turning a profit and rewarding its shareholders.

Should You Invest $1,000 in Taiwan Semiconductor Manufacturing Now?

Before you buy Taiwan Semiconductor Manufacturing stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $656,938!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 3, 2024

Randi Zuckerberg, former chief market development officer and spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Meta Platforms, Procore Technologies and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Apple, Meta Platforms, Nvidia, Procore Technologies and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

3 Tech Stocks You Should Buy Than Nvidia was originally published by The Motley Fool