Nvidia (NASDAQ: NVDA) has just made a move that many investors have been eagerly awaiting: the tech giant completed a stock split, causing its stock price to drop significantly. Nvidia shares have soared recently, rising nearly 600% in just three years. That’s as the company was once best known for serving gaming customers with its chips that shot to prominence in the world of artificial intelligence (AI).

Nvidia designs and sells the world’s most powerful graphics processing units (GPUs), and customers launching AI programs are rushing to get their hands on them — and other Nvidia products and services tailored to AI projects. As a result, Nvidia’s profits have soared by triple digits in recent quarters and investors have flocked to buy the stock.

The company announced the stock split during its most recent earnings report, launched the operation last week and the shares were trading at their new price in early trading this week. Here are three things to know about the split and what it means for Nvidia and investors.

1. Nvidia shares are not cheaper than before.

Nvidia shares are now trading at the split price for around $120 per share, up from more than $1,200 last week. The company completed a 10-for-1 stock split, offering more shares to current holders to reduce each individual share to one-tenth of its former price.

This is a positive step as it makes the shares more accessible to a wider range of investors. Nvidia even said that this was the motive for the split, to make it easier for employees and shareholders to invest. So you don’t have to spend more than $1,000 today or buy fractional shares to open a position in Nvidia or add a small amount to your existing position.

But this doesn’t make Nvidia cheaper than before the split. The stock still trades for 44x forward earnings estimates, to use a valuation metric as an example. This is because the split affects the individual share price through the issuance of more shares, but it does not fundamentally change the specific company and its shares. The market value of the company and the value of an investor’s holdings remain unchanged.

2. The stock made this surprising move after the past three stock splits.

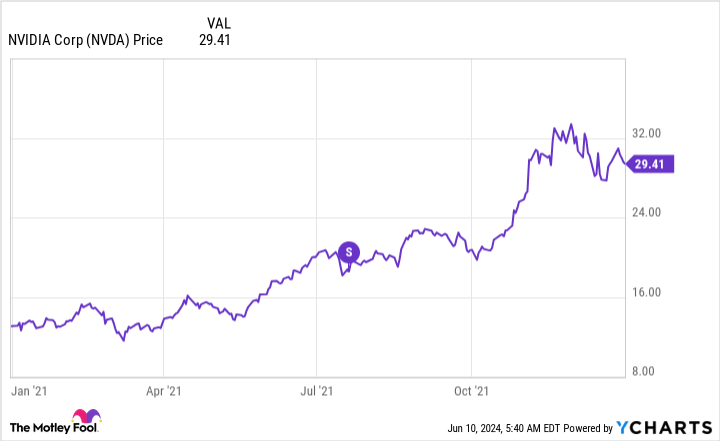

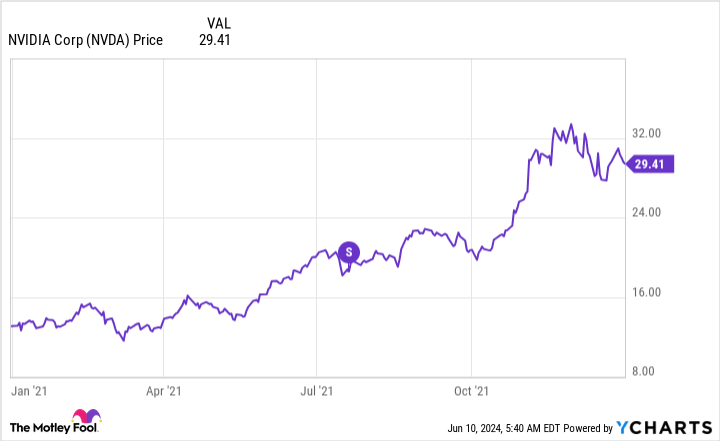

Because stock splits are merely mechanical movements, they do not act as a catalyst for stock movements. So a stock won’t rise or fall just because the company has completed these types of operations. But it’s interesting to look back at how Nvidia stock performed after previous stock splits. The previous three were in 2006, 2007 and 2021.

And in both cases, shares fell or stagnated in the months following the stock split.

NVDA data by YCharts

NVDA data by YCharts

Does this mean the same thing will happen this time? Not necessary. It is important to consider the economic context and other factors that may have contributed to the stock’s performance. For example, the 2006 Nvidia operation took place in the spring – and in the summer there is often less activity in the market, meaning there are fewer catalysts to boost the stock. And in 2007, the overall market was heading into bear territory.

Finally, on all three occasions, Nvidia’s earnings picture was different from its current earnings picture. At the time, the gaming industry was an important customer; today its main customers are in the fast-growing field of AI.

It’s possible that Nvidia shares may trend lower during the slower summer months or in the absence of major news ahead of the company’s Blackwell architecture and chip launch later this year – but this or any other move is not due to the stock split .

3. The stock split shows how Nvidia thinks about the future.

Companies typically launch stock splits after periods of success. Earnings have risen and that has pushed stocks higher as well. In the case of many recent stock splits – especially in the technology sector – the stock in question has reached prices that have put it out of reach for many investors. By this I mean the $1,000 level, which can be a psychological barrier for some investors. For example, Amazon launched a split in 2022 after shares rose above $3,000.

So when a company announces a split, that company usually does quite well when it comes to earnings and stock performance. But the announcement also suggests that the company, in this case Nvidia, could continue to excel. Management is optimistic that, starting at the new price, the stock has what it takes to move significantly higher again.

And a lower price per share provides room to run, as more investors can buy the stock more easily.

What does this mean for Nvidia and for you?

These are positive times for Nvidia, and given the high demand for AI products and services, these good times could continue in the long term. The stock split did not change this, but it did make it easier for certain investors to get into the Nvidia story. And that is positive.

I considered Nvidia stock a buy before the stock split, and my opinion hasn’t changed. Whether the share continues to rise or fall as it did after previous stock splits, that is no problem. Nvidia has the innovation and market leadership to grow profits – and that should drive this stock higher in the long term.

Should You Invest $1,000 in Nvidia Now?

Consider the following before buying shares in Nvidia:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,690!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon. The Motley Fool has and recommends positions in Amazon and Nvidia. The Motley Fool has a disclosure policy.

Nvidia Just Split Its Stock: 3 Things You Need to Know Before You Buy or Sell. was originally published by The Motley Fool