To say that artificial intelligence (AI) has taken the tech world by storm would be an understatement. Although AI technology has been around for decades, the popularity of OpenAI’s ChatGPT and other generative AI tools has catapulted the technology into the mainstream.

With the new popularity of AI, companies are rushing to capitalize and spend billions to ensure they are not left behind in what some believe will be the biggest technological development since the introduction of the internet. For investors interested in exposure to this exploding trend, the following three companies are great options.

1.Microsoft

Microsoft (NASDAQ: MSFT) is one of the few companies that has seen its valuation explode along with the AI hype. With a market capitalization of more than $3.1 trillion, Microsoft is the most valuable publicly traded company in the world.

The tech giant has invested billions in OpenAI and formed a strategic partnership that benefits both parties. Azure, Microsoft’s cloud platform, is OpenAI’s computing platform and infrastructure, giving it the supercomputing capabilities it needs to train and deploy its models.

In return, Microsoft will receive exclusive licenses for OpenAI’s large language models (LLMs). With access to OpenAI’s LLMs (arguably some of the best available), Microsoft can integrate these powerful AI models into its own ecosystem of products and services. From Azure to Office products to Dynamic 365, adding advanced AI capabilities will improve performance, improve the user experience, and strengthen Microsoft’s offering.

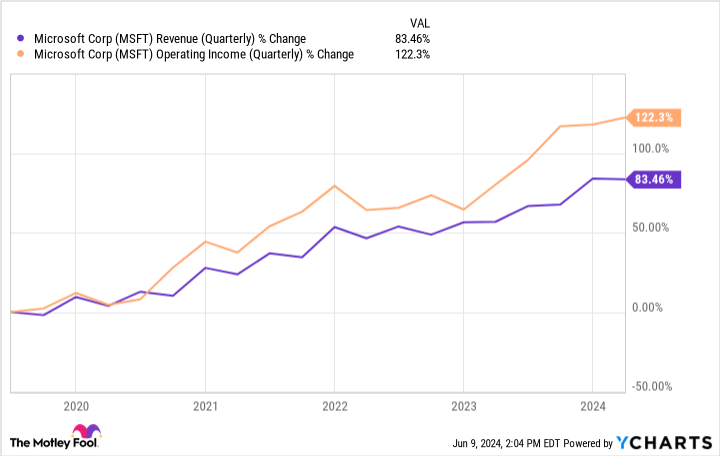

As for Azure, AI could power a growth machine that is already Microsoft’s fastest-growing segment. In the third quarter of fiscal 2024, Microsoft’s revenue grew 17% year over year to $61.9 billion, driven by 31% revenue growth from Azure and other cloud services.

Even without recent AI developments, Microsoft’s products and services have been an important part of the global business world. With this new component, the company is positioned to be a driving force behind the technology.

2. Semiconductor manufacturing in Taiwan

Although AI is generally associated with software, there are essential hardware components that should not be overlooked. That’s true Taiwanese semiconductor manufacturing (NYSE: TSM) (TSMC) comes into the picture. TSMC is the world’s largest semiconductor maker and makes chips that are the cornerstone of the AI pipeline.

TSMC’s chips are used in data centers, graphics processing units (GPUs), AI accelerators and other products that enable faster, more efficient data processing essential for the training, deployment and operation of AI applications. Without TSMC’s chips, you could argue that progress in AI would be significantly slowed, making it indispensable in the AI supply chain.

The high performance of TSMC’s chips has made them the choice of some of the world’s top technology companies. Microsoft and Amazon (NASDAQ: AMZN) they use for their data centers, Nvidia uses them for its GPUs, Apple uses them for smartphones, and dozens of other companies rely on them for their products. It has also done wonders for TSMC’s finances.

In the first quarter, TSMC generated revenue of nearly $18.9 billion, up nearly 13% from the previous year. High-Performance Computing (HPC), which includes AI and data center applications, accounted for 46% of this and is TSMC’s largest revenue segment. Smartphones, which accounted for 38% of revenue, remain a pain point for TSMC with slow sales, but that shouldn’t negate its long-term growth potential.

3. Amazon

Amazon has been using AI for a while, whether it’s for product recommendations, optimizing its supply chain or helping customers with chatbots. Yet the company is still in the early stages of fully integrating AI into its vast ecosystem of products and services.

Amazon is one of the leaders in machine learning and has invested heavily in the technology. Amazon’s cloud platform, Amazon Web Services (AWS), is one of the most comprehensive platforms on the market. It provides SageMaker – which simplifies the process of building, training and deploying machine learning models – with advanced tools for data processing and AI-powered analytics.

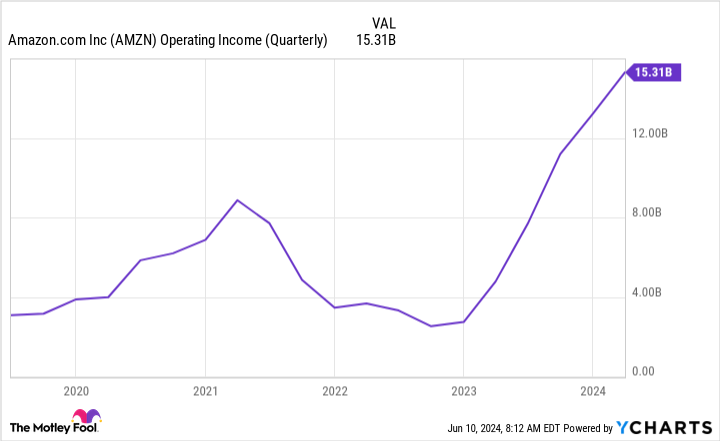

AWS is the world’s leading cloud platform, with a 31% market share as of the first quarter. While Azure has a 25% market share and has been gaining ground in recent years, AWS should remain Amazon’s bread-and-butter profit generator. Although AWS generated only about 17% of Amazon’s revenue in the first quarter, it accounted for more than 61% of its operating revenue (profit from its core businesses).

As an extension of its hugely successful e-commerce business, Amazon’s introduction of Supply Chain by Amazon can benefit greatly from AI developments. Supply Chain by Amazon is a one-stop shop for companies looking to streamline their logistics, and Amazon’s AI developments should enhance these capabilities even further.

With its extensive AI integration and AWS expansion, Amazon is well positioned to continue its market-strengthening growth and generate strong shareholder value.

Should You Invest $1,000 in Microsoft Now?

Before you buy shares in Microsoft, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $746,217!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Stefon Walters has positions at Apple and Microsoft. The Motley Fool holds positions in and recommends Amazon, Apple, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

3 Top Artificial Intelligence Stocks to Buy in June was originally published by The Motley Fool