With the S&P500 And Nasdaq Composite With gains of more than 20% so far this year, investors may feel like the stock market is overvalued. And while certain parts of the market are more expensive than in years past, that doesn’t mean there aren’t opportunities if you know where to look. In fact, now is the perfect time to filter out the noise, zoom out and focus on companies that you could easily hold on to for decades to come.

This is why Visa (NYSE:V), Kinder Morgan (NYSE: KMI)And PPG iindustries (NYSE:PPG) stand out as valuable dividend stocks to buy in October.

The recent sell-off in Visa stock is a buying opportunity

Daniel Foelber (Visa): After reaching an all-time high in mid-September, Visa is under pressure from the US Department of Justice to monopolize the debit markets. The DOJ filed a civil antitrust lawsuit against Visa, alleging that “more than 60% of debit transactions in the United States pass through Visa’s debit network, allowing it to charge more than $7 billion in fees annually for processing of those transactions.”

While civil lawsuits are nothing that can be dismissed completely, it’s worth understanding that they don’t always have a significant impact on a company’s value. In March, the DOJ filed a lawsuit Apple and the stock fell 4.8%, the biggest in seven months at the time. Since then, Apple has risen about 40%, hit a new all-time high, and is now – once again – the most valuable company in the world.

Visa’s fee structure for credit and debit cards is based on transaction volume and amount per transaction. This business model has allowed Visa to steadily grow its business even during difficult times, such as high inflation and pressure on consumer spending.

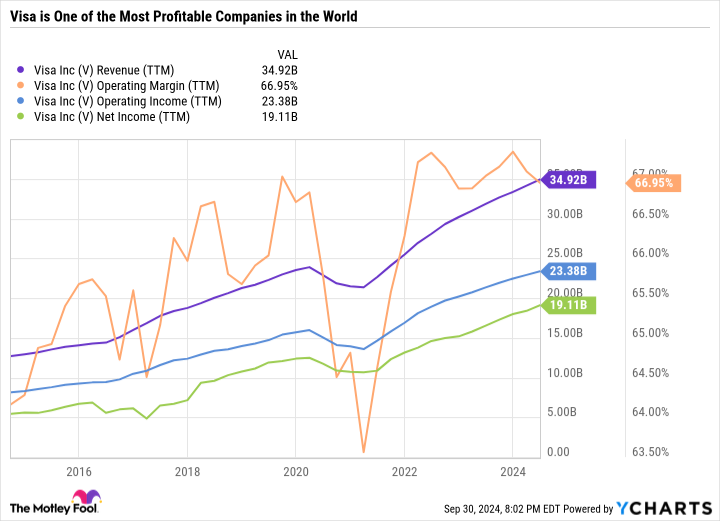

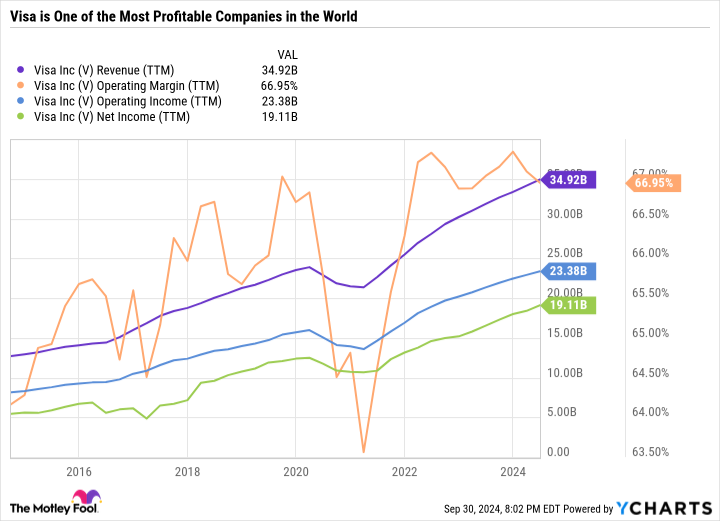

If there’s one metric that explains why Visa has become one of the most valuable financial companies in the world (with a market capitalization of more than $535 billion), it’s the company’s operating margin. Visa has a staggering 67% operating margin, meaning two-thirds of every dollar it earns in sales is converted into operating income. The following graph shows Visa’s incredible profitability: the company converts 55% of every dollar of revenue into net profit.

Visa’s global reach has put pressure on merchants to accept its cards, even if it means pocketing less money per transaction. The company’s network effects make its expansion virtually unstoppable. However, Visa’s profitability is highly dependent on its fee structure.

Visa’s margins are so high that they could fall, and the stock would still be great value. Visa has a price-to-earnings ratio of just 27.7, which is reasonable for a reliable dividend growth stock. Over the past five years, it has increased its dividend by 73.3% and reduced the number of shares outstanding by 11.1% thanks to share buybacks. Even after returning capital to shareholders through dividends and buybacks, Visa still has plenty of dry powder left to reinvest in the company.

Visa may only yield 0.8%, but its low yield is more due to its highly performing share price than a lack of dividend increases. Add it all up and Visa is now a great buy, even if margins are falling.

Kinder Morgan’s robust backlog suggests the company still has plenty of growth ahead

Scott Levine (KinderMorgan): Kinder Morgan, a leading pipeline stock, has demonstrated a genuine commitment to returning capital to its investors, and the company will likely continue to do so for years to come. Add to that the fact that the company has a significant backlog of projects to support future distribution increases, and it’s clear that Kinder Morgan – along with its 5.6% prepaid dividend – represents a great opportunity for investors to take advantage of today. doing.

If you live in the US and use natural gas, chances are you have Kinder Morgan to thank. The company claims that about 40% of natural gas produced in the US flows through its pipelines. It also operates 139 terminals where renewable fuels, petroleum and other products are stored. With these assets, the company often enters into long-term contracts with customers. This gives management excellent insight into future cash flows, giving them clarity on how to plan capital expenditures such as dividends and growth projects. Kinder Morgan, for example, has a backlog of projects worth $5.2 billion.

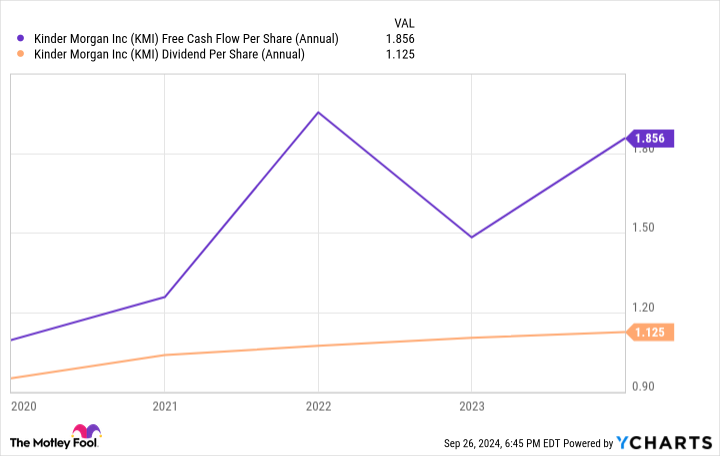

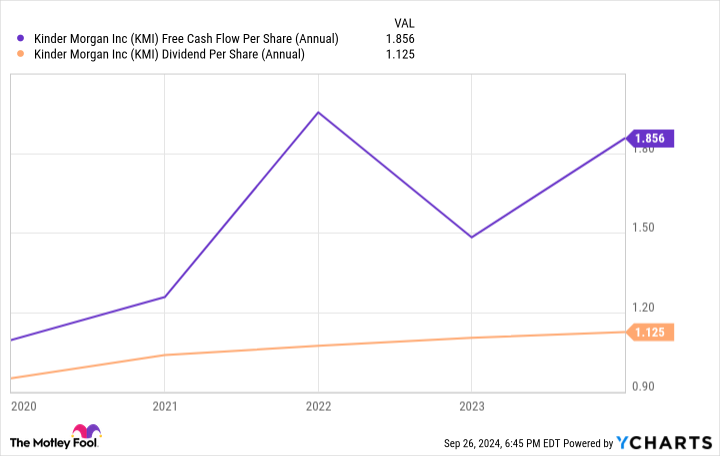

While the company is generous in returning capital to shareholders, management is not jeopardizing its financial health at the same time. For example, over the past five years, Kinder Morgan has generated enough free cash flow to cover its dividend.

Kinder Morgan stock may not seem like a screaming buy. Its value is 8.9 times operating cash flow, which is a premium to the five-year average cash flow multiple of 7.4. But for those who plan to hold the stock for decades to come, the somewhat rich valuation should be less of a concern.

PPG has plenty of potential to improve its dividends in the coming years

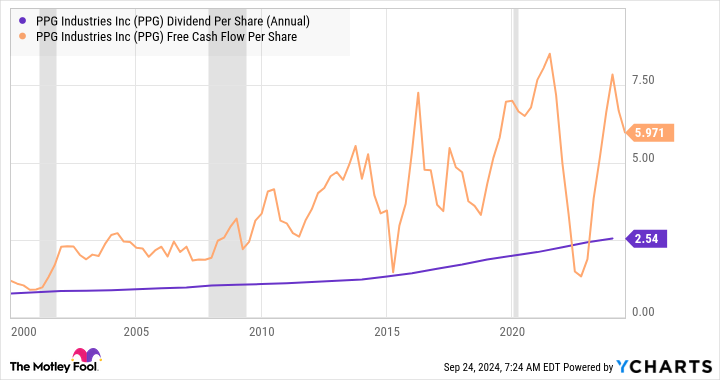

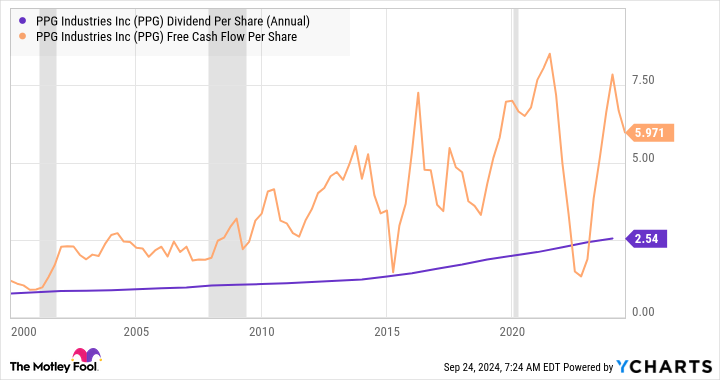

Lee Samaha (PPG industries): Investing in the paint industry may seem as interesting as watching paint dry, but investors shouldn’t dismiss it too quickly. It is a sector characterized by a relatively high return on equity (RoE). PPG’s average RoE over the past ten years was 22.7%. As the chart below shows, PPG has an excellent track record of generating the free cash flow per share needed to easily cover dividend payments.

Moreover, there is reason to believe that PPG can meaningfully improve its earnings, cash flow and dividends in the coming years. For example, it has a large exposure to interest rate sensitive sectors such as architectural paints and automotive (Original Equipment Manufacturing). They should improve in an environment of lower interest rates. In addition, PPG is the leading player in the aerospace coatings market and will benefit from multi-year increases in aircraft production and commercial air traffic growth.

PPG’s market position is solid as the second largest global paints and coatings company operating in a consolidating industry. As long as there is a need for physical products, there will be a need for coatings. As such, PPG is an excellent option for dividend investors.

Should You Invest $1,000 in Visa Now?

Before you buy shares in Visa, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Visa wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 30, 2024

Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no positions in the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Apple, Kinder Morgan, and Visa. The Motley Fool has a disclosure policy.

3 Top Dividend Stocks to Buy in October and Hold for Decades was originally published by The Motley Fool