Stocks that pay regular and growing dividends can grow your money manifold and create solid wealth over time. That’s why you shouldn’t miss an opportunity to double down on promising dividend stocks. Right now, the following three stocks look particularly tempting buys, with all three having impressive dividend track records and targeting steady annual dividend growth.

This stock continues to give larger dividends every year

Brookfield Infrastructure (NYSE: BIP) (NYSE: BIPC) is a globally diversified company that acquires and operates infrastructure assets such as utilities, railroads, toll roads, energy pipelines and data infrastructure. Because nearly 90% of Brookfield Infrastructure’s funds from operations (FFO) come from contracted or regulated sources, it can generate steady cash flows even when the economy is in turmoil. Apart from that, the company also sells assets as they mature and reinvests the proceeds in new projects. This asset recycling strategy has worked well for Brookfield Infrastructure so far, leaving enough cash to not only invest in growth but also increase the dividend every year for the past fifteen years.

Brookfield Infrastructure is a no-brainer dividend stock to buy now. After unit FFO rose 9% in 2023, management predicted 2024 would be “an even better year.” The company recently reported 11% year-over-year growth in FFO for the first quarter, including 7% organic growth. It expects to sell assets worth $2 billion this year and is eyeing several acquisitions, including telecom towers in India.

Brookfield Infrastructure has its eyes on the long term, targeting at least 10% growth in FFO and 5% to 9% growth in annual dividends, while maintaining a payout ratio of 60% to 70%. Whether you buy partnership stock yielding 5.5% or company stock yielding 4.6% now, Brookfield Infrastructure stock can give you solid returns. However, there is an advantage to buying shares of the company: As an investor in the US, you can avoid having to file a K1 tax form and foreign tax withholding.

A first-class Dividend King

American States Water (NYSE: AWR) boasts an unbeatable dividend track record. The Water Supply has paid a dividend to its shareholders every year since 1931, and has increased it every year for the past 69 consecutive years. That’s the longest streak among the Dividend Kings, an elite group of companies that have seen their dividend payments rise for at least 50 consecutive years.

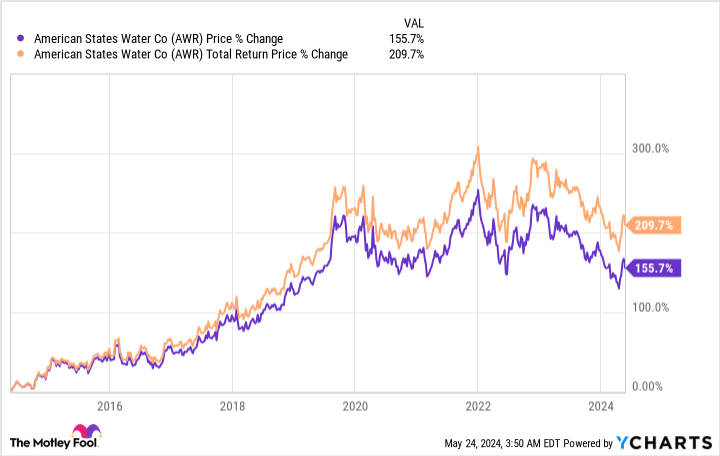

Yet utility stocks tend to be boring, and investors often hesitate to buy them because they believe such stocks have no growth engines and can’t generate big returns. American States Water proves this isn’t true, and that steady dividend growth can go a long way toward boosting stock returns. Including dividends, the water stock has more than tripled investors’ money in the past decade.

It’s never too late to double down on this rock-solid dividend stock. Because it is a regulated utility, American States Water can generate stable and predictable cash flows regardless of how the economy is performing. The company also provides contracted water services to military bases under 50-year contracts and recently began operations at two new military bases. Backed by planned infrastructure investments that should increase its interest base, American States Water is confident of growing its dividend at a compound annual growth rate of more than 7% over the long term.

So don’t ditch the stocks just because they offer a small 2% yield. American States Water Stock’s dividend growth alone could translate into big returns for you over time.

A no-brainer dividend stock to buy

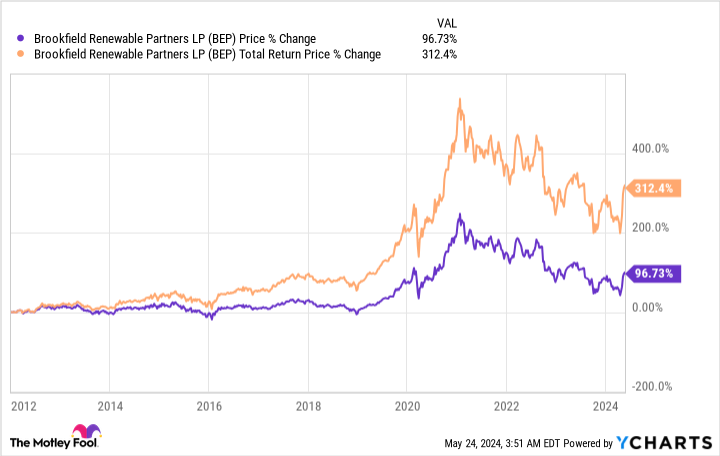

Brookfield Renewable (NYSE: BEPC) (NYSE:BEP) stocks have delivered solid returns for shareholders over time, with dividends hugely driving these returns. The renewable energy stock has been growing its dividend at a compound annual growth rate

of 6% since 2012. The impact of that dividend growth on the share’s return can be seen here:

BEP data by YCharts

One question you might want to ask now before buying the stock is whether it can continue to generate great returns in the future. The answer appears to be a resounding yes if Brookfield Renewable’s operating performance, growth plans and financial targets are anything to go by.

After a record 2023, Brookfield Renewable recently reported record first-quarter FFO and just signed a unique global agreement with tech giant Microsoft to deliver 10.5 gigawatts of new renewable energy capacity in the US and Europe between 2026 and 2030. The growth opportunities are enormous, and the company expects to grow its FFO by at least 10% between 2023 and 2028, driven by its massive development pipeline, margin improvements, inflation escalators and potential mergers and acquisitions.

That FFO should comfortably support Brookfield Renewable’s goal of increasing its dividend payout 5% to 9% annually over the five years. Add in a dividend yield of around 5%, and Brookfield Renewable stock can easily generate double-digit annualized returns for investors who buy the stock now for the long term.

Should You Invest $1,000 in Brookfield Renewable Now?

Before you buy shares in Brookfield Renewable, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Brookfield Renewable wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Brookfield Renewable and Microsoft. The Motley Fool recommends Brookfield Infrastructure Partners and Brookfield Renewable Partners and recommends the following options: long January 2026 rings $395 on Microsoft and short January 2026 rings $405 on Microsoft. The Motley Fool has a disclosure policy.

3 Top Dividend Stocks to Double Now was originally published by The Motley Fool