Warren Buffett and his team Berkshire Hathaway have made the conglomerate one of the most valuable companies in the world, with a market capitalization of more than $880 billion (as of June 23). It didn’t happen overnight; it is the result of decades of strategic investment and patience.

Given Buffett and Berkshire Hathaway’s investment success, it’s no surprise that their stock portfolio has become a favorite for investors looking for stock inspiration.

Keep in mind that your portfolio should reflect your financial situation and not necessarily that of a billionaire and a nine-figure company. There are still stocks from their portfolios worth considering. The following three companies are great buys for long-term investors right now.

1. Amazon

Amazon (NASDAQ: AMZN) is a stock that while Buffett was initially hesitant to sign, it’s always better late than never – especially considering how rewarding it’s been for investors.

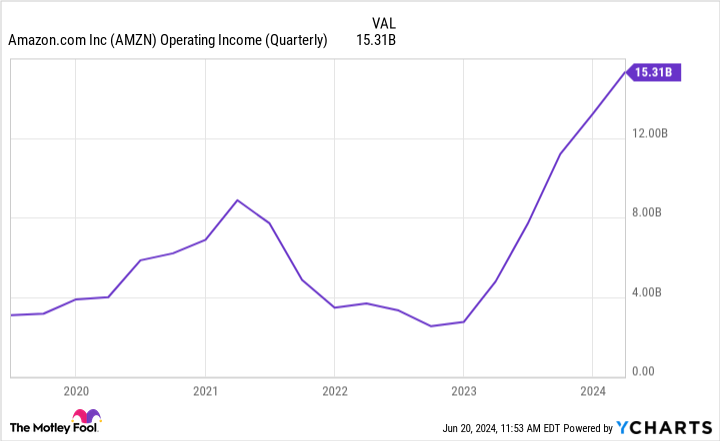

Amazon has already established itself as an e-commerce leader, but the real growth will likely come from its cloud computing service, Amazon Web Services (AWS). AWS is the world’s leading cloud platform and Amazon’s largest profit generator, responsible for more than 61% of its first quarter operating revenue ($9.4 billion).

AWS’s first-mover advantage helped it capture a large market share, but competitors love it Microsoft Azure is gaining ground. However, advances in AI could help this with a new spark of growth. This is not necessarily due to AI innovations, but because of what they enable other companies to do.

Amazon uses AWS to help companies build and deploy machine learning models (SageMaker) and build and scale AI applications (Bedrock). This allows the company to take advantage of its top infrastructure without being overly dependent on internal AI developments.

It takes a similar approach with Supply Chain by Amazon, a complete shipping and logistics service that helps companies streamline their operations and run their own e-commerce businesses efficiently.

Amazon has spent years and billions building out its technology and supply chain infrastructure, and now it’s using these investments to profit without being as dependent on constant innovation (although that remains a priority). As this approach unfolds, Amazon’s revenue streams should grow and continue to establish itself as one of the top cash cows in the world.

2. Apple

Apple (NASDAQ: AAPL) is Berkshire Hathaway’s largest holding and represents almost 43% of the stock portfolio.

Much has been made about Apple falling behind in the AI race, but it’s far better to be late and thorough than rushed and flawed. Apple has consistently taken this approach when it comes to releasing new products and features.

During Apple’s Worldwide Developer Conference, it announced its own AI: Apple Intelligence. It’s not Apple’s internal development; instead, it will integrate ChatGPT features into its operating systems starting this fall.

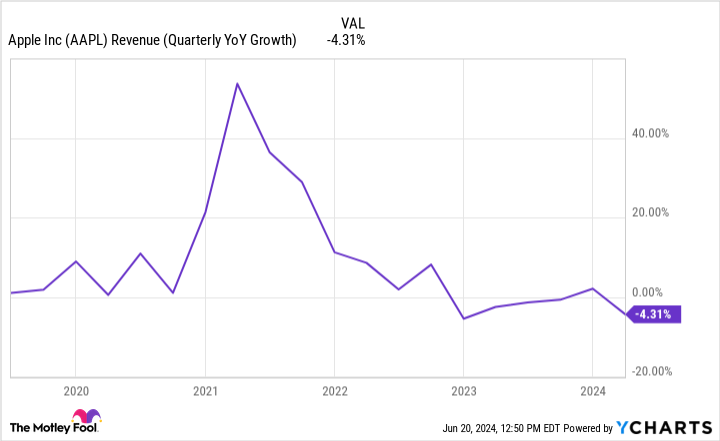

Apple’s new Apple Intelligence will only be available on the latest models of iPhones, iPads and Macs, giving consumers an incentive to upgrade their current products. The move, and the excitement surrounding it, should give Apple’s revenues a much-needed boost after lagging in recent years due to slowing iPhone sales.

An expected recovery in hardware sales will be a great addition to the company’s growing services segment, which grew 14% year over year in the first quarter and accounted for more than 26% of Apple’s revenue.

Apple has already done a good job of encouraging customers to stay in its product ecosystem. Add to that growth services such as finance and healthcare, and it will undoubtedly be one of the top companies in the world for quite some time.

3. Visa

Buffett is a big fan of companies with enormous competitive positions Visa (NYSE:V) fits that description. Its competitive position is its enormous reach, with more than 130 million points of sale and 4.4 billion cards in circulation.

As the world’s largest payment processor, Visa benefits greatly from the network effect. Potential cardholders choose Visa because it is the most widely accepted card in the world, and merchants are likely to accept Visa cards because they are the most widely used.

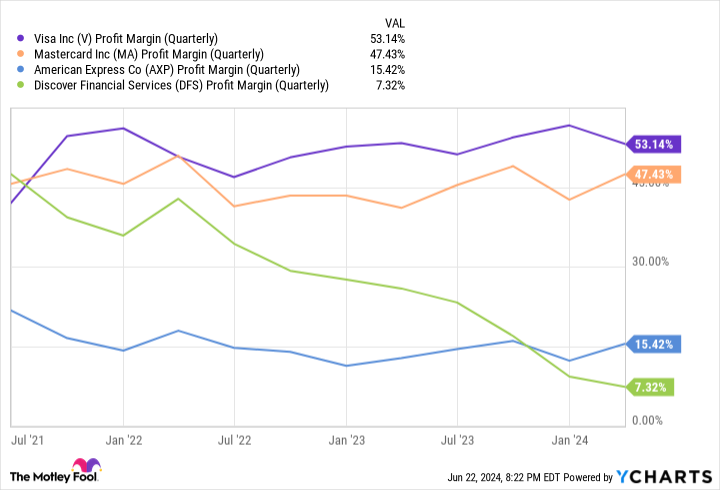

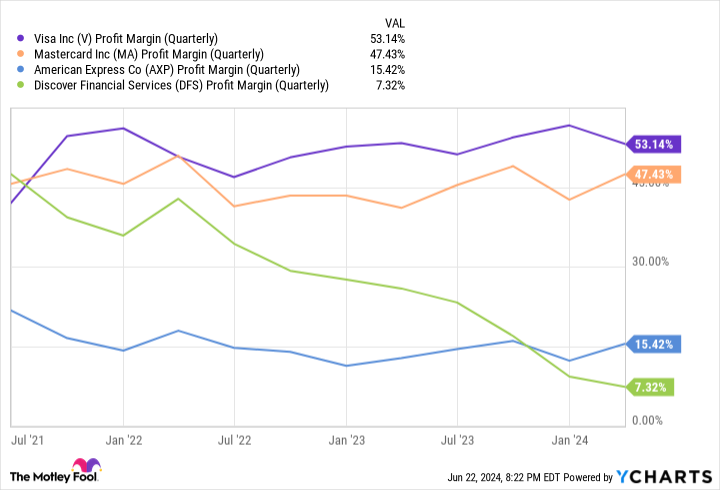

This network effect has positioned Visa to grow organically and operate with industry-leading profit margins.

The world is becoming more digitally connected by the day, but many countries still operate in a cash economy. As they transition to digital payments, Visa is positioned to capture a significant share of the growing market.

Visa has demonstrated that it is willing to make the necessary investments to innovate, expand and remain the top player in the industry. That’s what you want from a company whose shares you want to hold on to for the long term.

Should You Invest $1,000 in Amazon Now?

Before you buy stock in Amazon, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $772,627!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 24, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool board of directors. Discover Financial Services is an advertising partner of The Ascent, a Motley Fool company. Stefon Walters has positions at Apple and Microsoft. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, Mastercard, Microsoft and Visa. The Motley Fool recommends Discover Financial Services and recommends the following options: long Jan 2025 $370 calls on Mastercard, long Jan 2026 $395 calls on Microsoft, short Jan 2025 $380 calls on Mastercard, and short Jan 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

3 Warren Buffett Stocks That Are Crying for Buys Right Now was originally published by The Motley Fool