Tribute to Advanced micro devices (NASDAQ: AMD) to stay competitive with technological rivals Intel (NASDAQ: INTC) And Nvidia (NASDAQ: NVDA)That is no small feat.

Nevertheless, AMD is neither the leader of the graphics processing industry nor of the computer processor market. Considering that investors are generally told that they should (and tend to) own shares in a given company’s leading companies, Advanced Micro Devices is not a stock that is always easy to get excited about buying.

However, this may be an example where the name in second place is actually the best investment prospect among the companies in question. Four charts illustrate why.

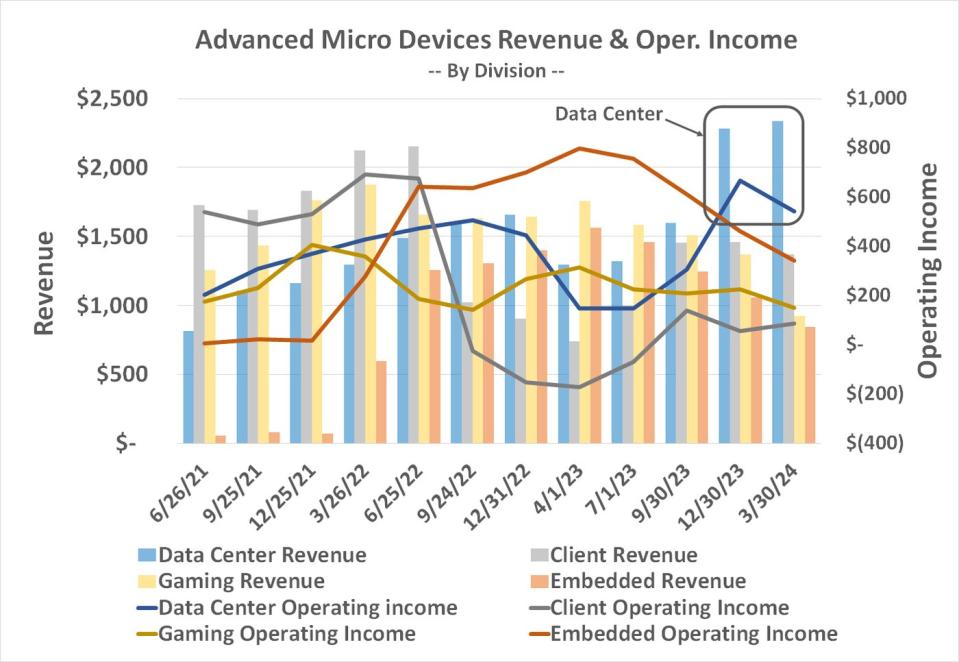

Data centers are now the breadwinner

The first chart looks complicated at first glance, but it’s not. It’s just a comparison of how each of AMD’s business units (datacenter, gaming, embedded, and client) has evolved over time. The bars are revenue and the lines are operating income; each business’s revenue and operating income are also color coordinated.

As you can see, thanks to the growing interest in all things artificial intelligence, data centers are now the largest source of revenue and profit for the company.

This is an encouraging development. Not only are data centers the best growth opportunity for the technology sector for the foreseeable future, but the continued growth of AI will make it the most consistent, reliable business that Advanced Micro Devices is in for that time. Precedence Research suggests that the AI hardware market is poised to grow at an incredible 24.3% compound annual rate through 2033, which is in line with a handful of other industry forecasts.

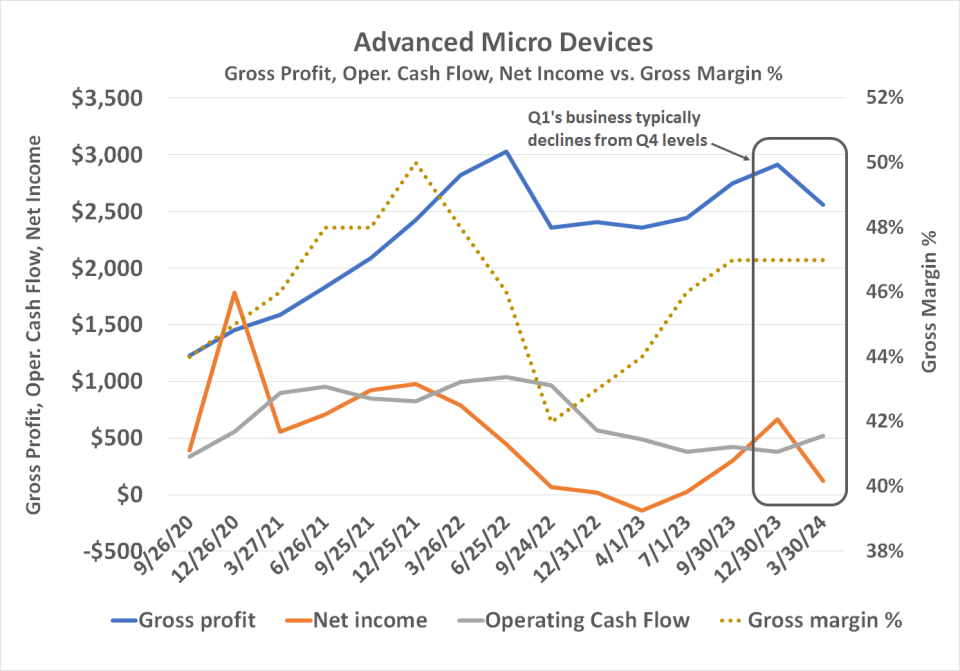

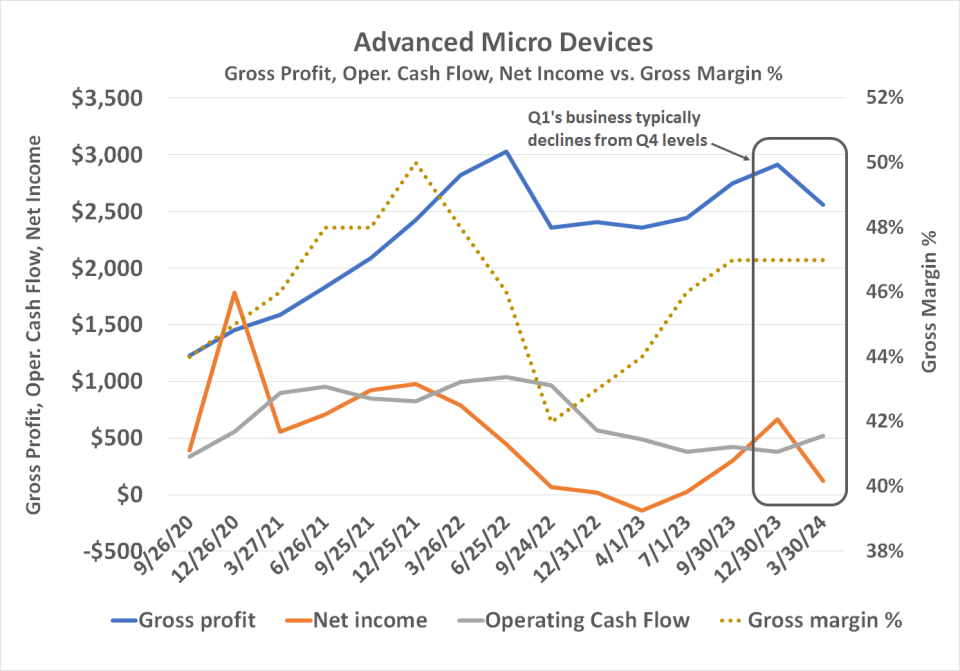

The money is flowing again

AMD hasn’t always been waist-deep in the AI hardware business. Until a few quarters ago, it lagged far behind Nvidia. Advanced Micro Devices likely only seized the opportunity late last year with the unveiling of its M1300X graphics processing unit, purpose-built for AI applications. Before that, its technology was anything but the go-to name for AI applications.

Problem? Developing or redeveloping an entire hardware architecture is not cheap. The company has been spending a lot of money on research and development lately, with no immediate return on its investment. It has also been gradually booking costs for the Xilinx acquisition in early 2022, which has hit its net income in the meantime.

However, there is light at the end of the tunnel: as can be seen from the graph, after a clear lull last year, operating cash flow and net income are normalizing again to a positive level. (Last quarter’s dips are largely seasonal and not indicative of new headwinds.)

Gross profits are clearly flat, with Advanced Micro Devices forced to be price competitive in AI hardware. But that’s okay. The company is still winning this business; it will gain pricing power as its AI technology continues to prove itself. Gross profit margins are now stable.

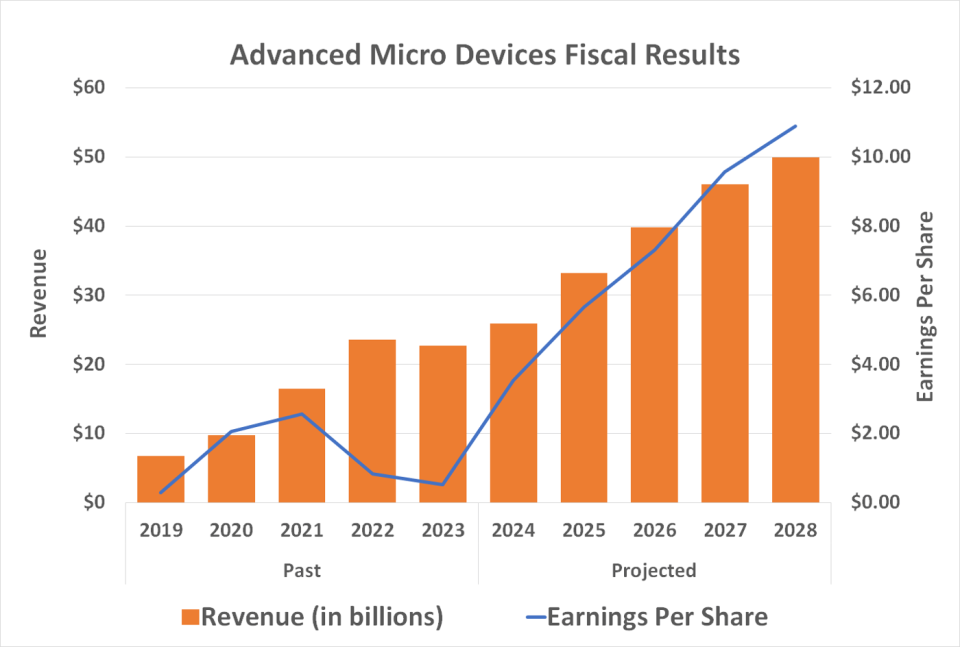

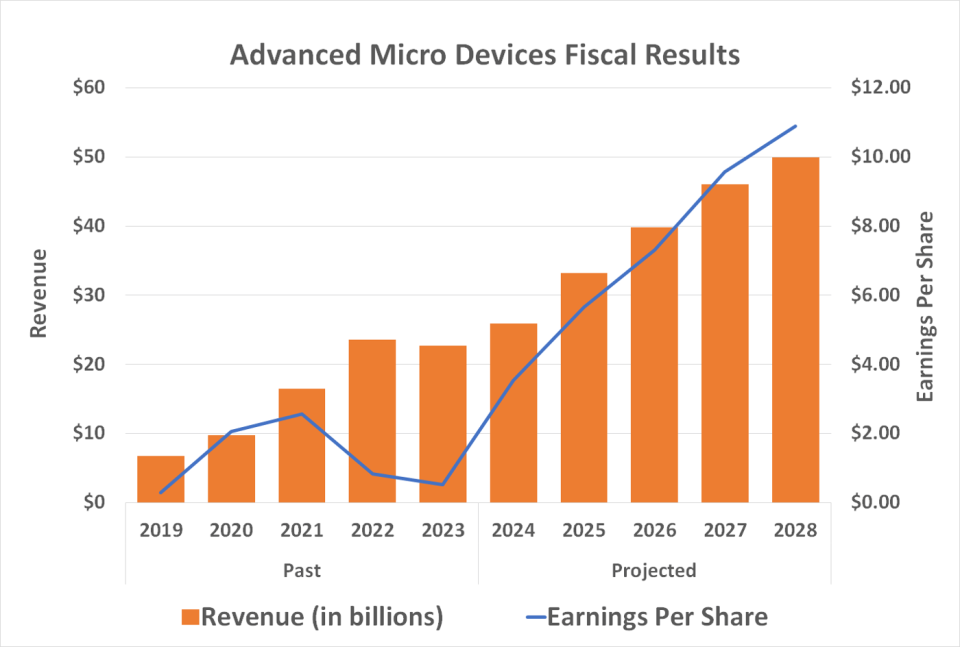

With that in mind, analysts expect earnings per share to grow from $2.65 last year to $3.51 per share this year, on track to reach $5.59 per share next year. Then the fun really begins, with this year’s expected earnings per share expected to nearly triple by 2028.

The bottom line? Shareholders don’t have to worry about AMD being able to operate the way it wants to simply because there’s no revenue or extra cash to work with.

And speaking of extra money…

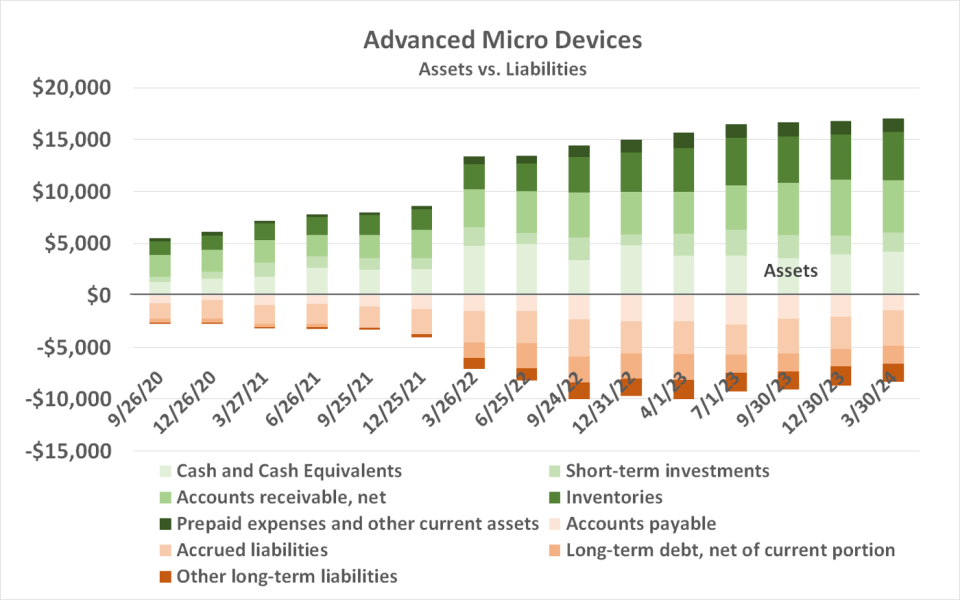

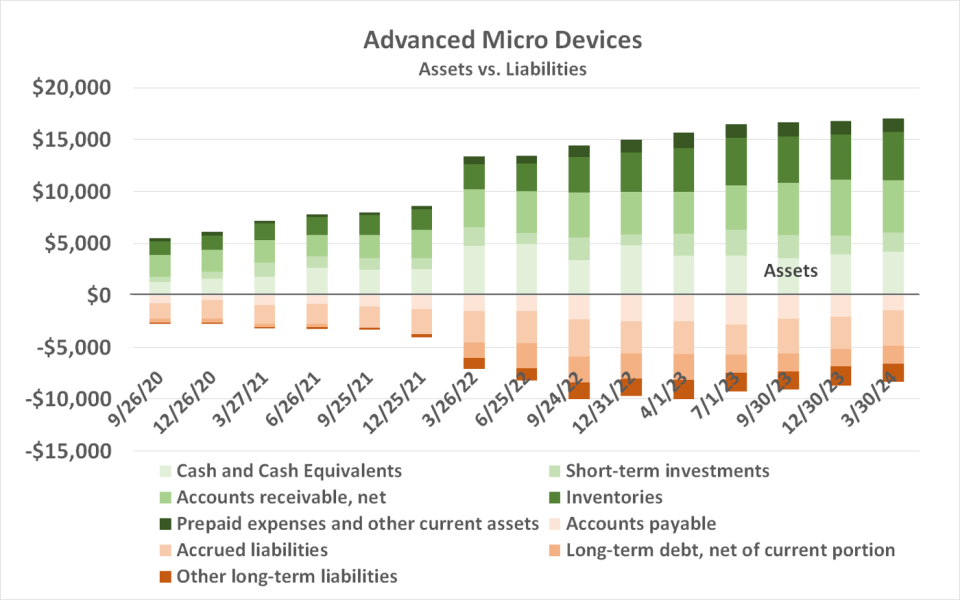

Advanced Micro Devices is virtually debt-free

Last but certainly not least, AMD has very little debt, and could be debt free if it wanted to be.

As of the end of March, the company had paid down only about $1.7 billion in long-term debt, while holding about $6 billion in cash or near cash on its balance sheet. It also has nearly $10 billion in assets, such as inventory and accounts receivable, on its books that could become cash at short notice if necessary. For perspective, Advanced Micro Devices’ current market cap is $257 billion.

Don’t read at much in the message: AMD has nearly $1.8 billion in “other” long-term obligations that don’t qualify as debt. It also has just over $3.4 billion in accrued short-term debt. There are bills to pay, to be sure.

Still, Advanced Micro Devices, with $17.1 billion in current assets and less than half that amount in short- and long-term liabilities, enjoys far more tax flexibility than many other tech giants. Also note that AMD’s total liabilities are simply decreasing.

More than enough to buy AMD stock

The usual risks apply, of course. Chief among them is the possibility that Intel and Nvidia will both make a specific move to rein in AMD before the upstart steals even more market share.

The fiscal trajectories shown in the charts still paint a clear picture, however. This company is doing several things right and is now — finally — reaping the rewards. More of the same progress is in the works, too. Most other companies would Love to be in this particular position.

So connect the dots: Even if it’s mostly for mathematical reasons, this stock’s decline from its March peak is a buying opportunity.

Should You Invest $1,000 in Advanced Micro Devices Now?

Before you buy Advanced Micro Devices stock, you should consider the following:

The Motley Fool Stock Advisor analyst team just identified what they think is the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The ten stocks that made the cut could deliver monster returns in the years to come.

Think when Nvidia made this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, you would have $759,759!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of June 24, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: long Jan 2025 $45 calls on Intel and short Aug 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

4 Charts That Make AMD Stock a Buy originally published by The Motley Fool