By disrupting Red Bull’s energy drink duopoly Samplefunctional energy drink upstart Celsius (NASDAQ: CELH) has grown into a brand that accounts for 11.5% of US sales, making it the only new brand to reach this figure in the past decade.

Celsius is now clearly the No. 3 brand in energy drinks and is bigger than the No. 4 and No. 5 labels combined. It has grown from just 3.5% of its share two years ago to its current double-digit levels, and the company has seen its share price more than double since 2022.

With the company’s share price down 35% in the past month on short-term concerns, the time seems right to buy Celsius, thanks to these four key reasons.

1. Celsius unlocks new opportunities with PepsiCo

After signing a huge deal with drinks giant PepsiCo (NASDAQ: PEP) in 2022, Celsius finally got the distribution muscle it needed to push its sales into full hyper-growth mode. In the two years following the deal, the company experienced average triple-digit revenue growth. The company picked most of the low-hanging fruit after joining PepsiCo’s network. However, there should still be plenty of growth in this distribution deal.

First, building on its land-and-expand strategy, Celsius now wants to execute the “expansion” part of this game plan by expanding the display space it has in all the new stores it recently opened with the help of PepsiCo. Highlighting this point in its first-quarter 2024 earnings press release, management explained: “We estimate that retailers’ spring shelf resets were approximately one-third complete as of March 31. Company history.”

At an investor conference on June 11, CEO John Fieldy explained that labor shortages have led to delays in these shelf resets, but that gains should be clearly visible in the summer and fall quarters.

Second, the partnership with PepsiCo has opened Celsius up to the foodservice channel. Case counts for this industry grew 186% in the first quarter and already account for 12% of Celsius’s total sales to PepsiCo. This fast-growing channel will not only drive sales growth, but it should also increase brand awareness of Celsius drinks as they become increasingly common in a wider range of locations.

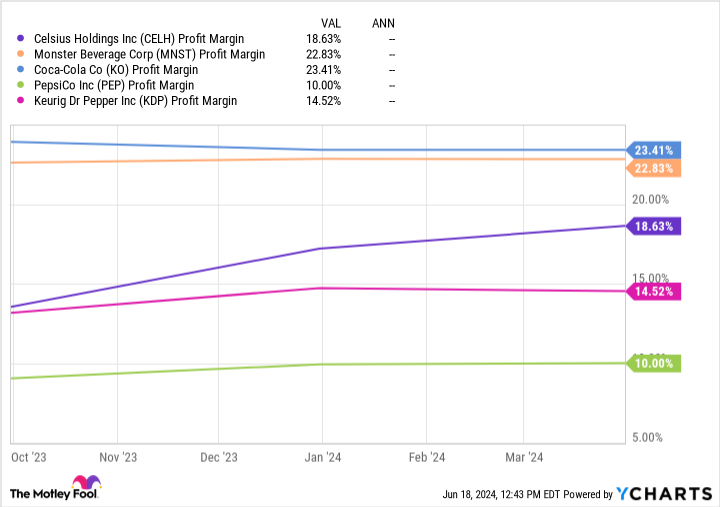

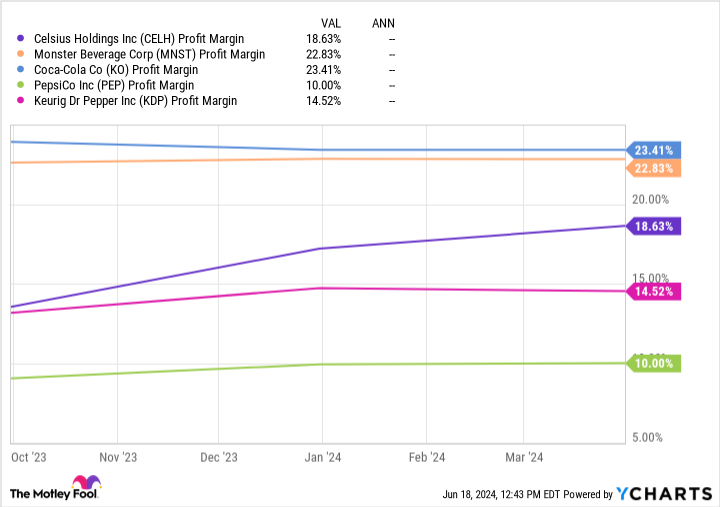

2. First-class margins

What makes Celsius’ incredible sales growth in recent years all the more impressive is that it already has a net profit margin of 19%. While this profitability is relatively new and the company won’t break even until 2023, it already ranks favorably against some of its major beverage competitors – an incredible feat considering the company’s rapid growth.

This robust net profit margin is a promising sign for shareholders, as high profitability often indicates pricing power for brands with loyal customer bases.

Furthermore, achieving profitability means that Celsius is now self-sufficient in terms of its growth and will have excess cash to spend on potentially rewarding shareholders or international expansion.

Speaking of which…

3. International growth ambitions have only just begun

After signing several distribution deals with Japanese drinks giant Suntory in early 2024, Celsius plans to expand into Australia, New Zealand, Great Britain, Ireland and France. Similarly, the company recently started selling in Canada after expanding its distribution agreement with PepsiCo.

With international sales accounting for only 5% of the company’s total revenue, these foreign markets could represent the next chapter of the Celsius growth story. To put the length of this growth trajectory for Celsius into perspective, consider that energy drink peer Monster generated 37% of its total sales in international markets in the fourth quarter of 2023.

The company generated $16 million in international sales in the latest quarter, compared to Monster’s $637 million. Celsius could still have decades of growth ahead of it if it continues to disrupt the energy drink industry worldwide.

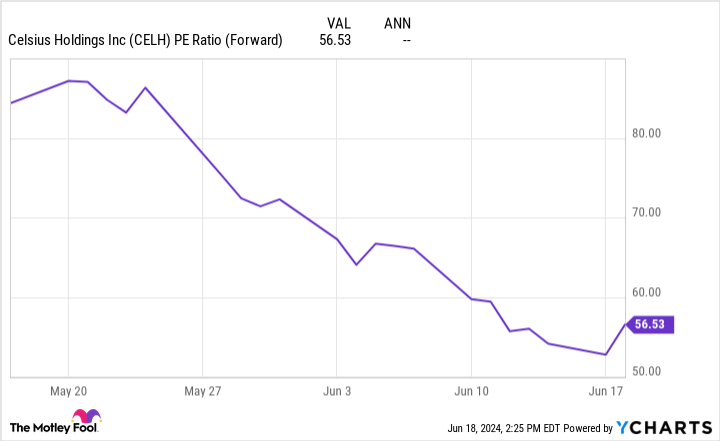

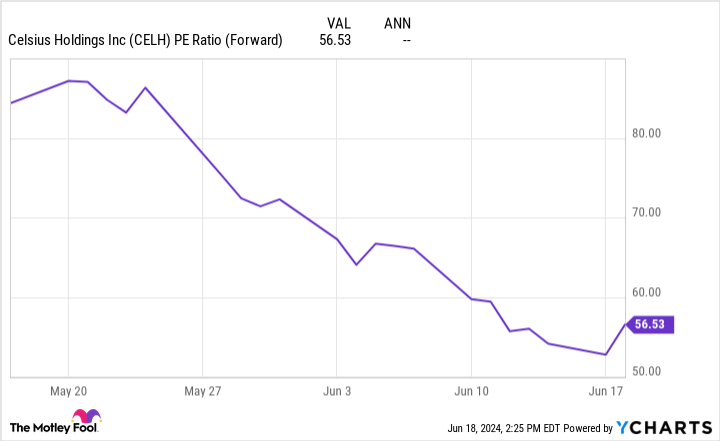

4. A more reasonable valuation

With the company’s stock price down 35% in the past month due to short-term concerns about a few weeks’ worth of sales data, the time may be right for long-term investors to reconsider adding to their Celsius position. While the company still trades at a lofty 57 times forward earnings, this is much more reasonable than the mid-80s figure it was trading at a month ago.

While this is almost three times the S&P 500’s price-to-earnings ratio of 21, analysts expect Celsius to grow its bottom line by 40% in 2024, compared to just 9% for the index as a whole.

Ultimately, the four factors mentioned here show that Celsius, despite its premium valuation, still has plenty of room to run – but investors should be prepared for a turbulent ride down the road.

Don’t miss this second chance at a potentially lucrative opportunity

Have you ever felt like you missed the boat on buying the most successful stocks? Then you would like to hear this.

On rare occasions, our expert team of analysts provides a “Double Down” Stocks recommendation for companies they think are about to pop. If you’re worried that you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: If you had invested $1,000 when we doubled in 2010, then you have $20,730!*

-

Apple: If you had invested $1,000 when we doubled in 2008, you would have $40,941!*

-

Netflix: If you had invested $1,000 when we doubled in 2004, you would have $364,469!*

We’re currently issuing ‘Double Down’ warnings for three incredible companies, and another opportunity like this may not happen anytime soon.

See 3 “Double Down” Stocks »

*Stock Advisor returns June 11, 2024

Josh Kohn-Lindquist holds positions in Celsius. The Motley Fool holds positions in and recommends Celsius and Monster Beverage. The Motley Fool has a disclosure policy.

4 Reasons to Buy Celsius Stock Like There’s No Tomorrow was originally published by The Motley Fool