Do you have some money left over that you want to use, but don’t know where to put it? Consider taking a stake in a retail giant DIY store (NYSE: HD)Shares of the DIY retailer have been unimpressive of late, falling from their March peak but eventually reaching their highest level of 2021.

There’s a reason the stock remains within striking distance of both price points, though. That’s because at least a few investors understand that the stock is undervalued and the company’s future looks bright. To that end, here are four specific reasons to buy Home Depot stock right now.

1. Home Depot is built to last—and thrive

It may be down now, but it’s far from out. Home Depot stock will bounce back just like it always has, because the underlying business is poised to bounce back, too. That rebound will be fueled in large part by its sheer size and subsequent reach.

With more than 2,300 locations in North America, Home Depot is the largest home improvement store chain in the world. Certainly, its closest competitor Lowe’s Companies is also quite large, with just over 1,700 locations. Home Depot is the clear dominant name in the industry, however, doing 60 percent more business than Lowe’s, largely due to its greater number of relationships with professional contractors (which account for about half of the retailer’s total sales).

According to data from market research firm Numerator, Home Depot alone facilitates about 30 percent of the country’s total spending on home improvement. That’s huge.

Of course, being bigger doesn’t always mean being better. Many smaller companies are great opportunities, too. However, this is a case where being bigger is a sign that Home Depot is logistically better at delivering what consumers and contractors want at a price they like. Just being geographically “there” doesn’t hurt either.

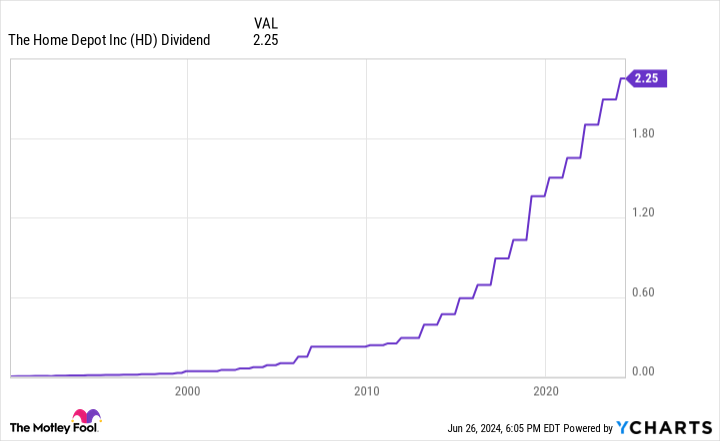

2. It is working on its dividend pedigree

Investors looking for reliable dividend income growth won’t quite get it from Home Depot. While the company has paid out a little cash each quarter since it began paying dividends in 1987, it hasn’t increased those payments like clockwork.

For example, after the dotcom implosion in 2000, the home improvement store’s dividend stagnated briefly, as did the subprime mortgage crisis in 2008. Given the uncertain economic conditions at the time, Home Depot was wise enough to be conservative with its cash.

However, don’t let these shortcomings in the company’s dividend growth deter you from recognizing that Home Depot is still a great dividend stock with an impressive dividend history. It still paid dividends during those tough times.

As long as the economy remains reasonably healthy, this retailer is willing and able to increase its annual dividend, as its quarterly dividend payment has grown at an annual rate of 18% since growth resumed in 2010.

3. The stock is down 14% from its March peak

A 14% discount to a recent peak is not a bargain by most stock market standards. That is especially true when the peak in question follows a meteoric rise as in this case.

Home Depot stock isn’t like most other stocks, though. It doesn’t go on sale much more often than it does now. It also doesn’t stay at a discounted price for long.

Along similar lines, the 2.6% expected dividend yield isn’t the highest you’ll find among blue chip stocks, but it’s about the highest level of Home Depot stock yield in more than a decade.

In other words, don’t be so stubborn about your entry price that you miss out on a great opportunity.

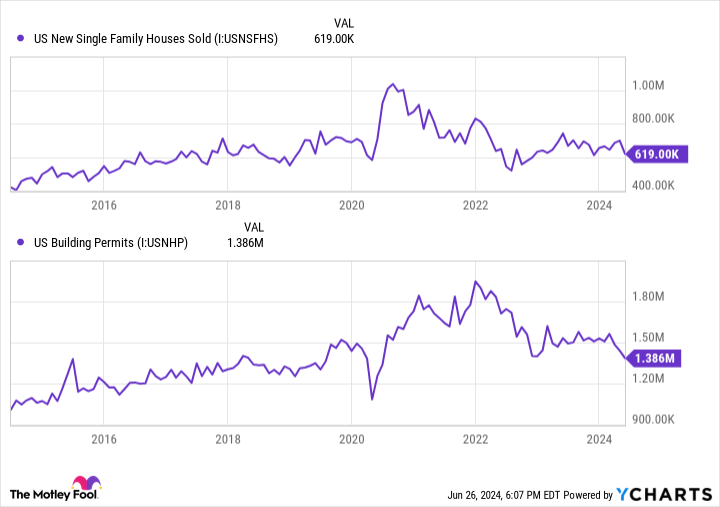

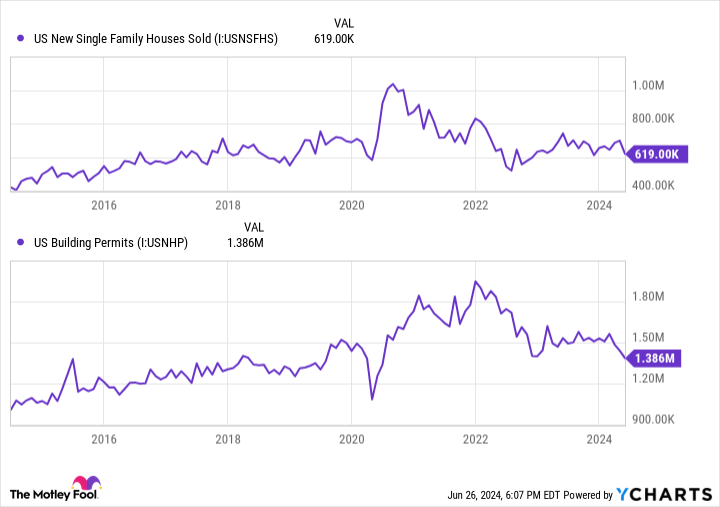

4. A recovery in housing construction is in sight

And last but not least, interested investors might want to take a chance on Home Depot stock, simply because the main reason for its underperformance since early 2022 is likely to disappear soon.

That, of course, is dried-up demand for new homes. With both real estate prices and interest rates still uncomfortably high, consumers are buying far fewer homes. The annual pace of new home sales in the United States fell to a six-month low of 619,000 units in May, well below the late-2020 peak pace of more than 1 million new homes built. The number of new building permits issued in May also fell to an annual low of more than 1.4 million. It’s just bleak.

As the old saying goes, nothing lasts forever. The real estate market is predictably cyclical, meaning that a turnaround in most aspects is likely on the horizon. This includes lower prices, lower interest rates, and an increase in new home construction as buying becomes more affordable.

It is not entirely clear when such a recovery will take shape. Therein lies the rub. It may not manifest itself this year or even next year (although it seems unlikely that the calm will last that long).

What we Doing The thing is, such reversals only become apparent after they’ve already begun. We also know that stocks tend to predict these recoveries rather than react to them. That’s why the recent pullback in Home Depot stock is a buying opportunity. You’ll want to be positioned before that inevitable rebound happens, especially since half of the company’s revenue comes from contractors.

Should You Invest $1,000 in Home Depot Now?

Before you buy Home Depot stock, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Home Depot wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $757,001!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of June 24, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Home Depot. The Motley Fool recommends Lowe’s Companies. The Motley Fool has a disclosure policy.

4 Reasons to Buy Home Depot Stock Like There’s No Tomorrow was originally published by The Motley Fool