One of the best ways to understand what the “smart money” on Wall Street is thinking is to sift through the quarterly 13F filings. Large hedge funds must file a 13F every quarter, detailing which stocks they buy, hold and sell.

One of the best money managers of the past thirty years is David Tepper of Appaloosa Management. Between 1993 and 2013, Tepper averaged a stunning annualized return of 40%, and from 1993 to today he had a net historical return of roughly 23%-25%.

It goes without saying that investors might be interested in knowing which stocks Tepper likes right now. With a preference for both high-quality growth stocks and affordable value stocks, Tepper appears to have swapped one type of stock for the other in the first quarter of 2024.

Fixing the Magnificent Seven for China’s ‘Magnificent Seven’

Tepper has clearly benefited from a bet on the artificial intelligence wave, with many of his top holdings set to end up in leading Magnificent Seven stocks or large-cap semiconductor stocks in 2024, with both categories set to benefit handsomely from the AI revolution impacting corporate America floods.

But in the first quarter, Tepper cut the vast majority of these leading US tech stocks and reinvested the profits in the Chinese tech sector – essentially swapping five US Magnificent Seven shares for a basket of ‘Magnificent Seven-type’ Chinese tech. shares.

Appaloosa’s new purchases include four stocks, Alibaba.com, PDD companies (formerly Pinduoduo), BaiduAnd JD.comalong with two China-focused Exchange Traded Funds (ETFs), the iShares China Large Cap ETF and the technology-oriented KraneShares CSI China Internet ETF.

|

Company |

% increase compared to the previous quarter |

% of Appaloosa Portfolio End Q1 2024 |

|---|---|---|

|

Alibaba.com (NYSE: BABA) |

158.6% |

12.05% |

|

PDD companies (NASDAQ:PDD) |

171% |

3.61% |

|

Baidu (NASDAQ: BIDU) |

188% |

2.81% |

|

iShares China Large Cap ETF (NYSEMKT: FXI) |

New |

2.27% |

|

JD.com (NASDAQ: JD) |

New |

1.48% |

|

KraneShares CSI China Internet ETF (NYSEMKT: KWEB) |

New |

1.35% |

Data source: Whale Wisdom.

As you can see, Tepper has made a very big bet on Alibaba, making it his largest position at the moment. But the optimism likely extends to the broader Chinese tech sector and, in fact, the entire country’s economy. While there’s a big bet on tech stocks here, the FXI ETF also includes some state-owned and government-owned banks in its top 10 investments.

In short, Tepper and his team may have concluded that a long-awaited turnaround for the Chinese economy is imminent.

The Chinese economy may be picking up

China’s economy has really been in a recession since COVID-19 because the country didn’t want to use American vaccines and so the country tried to lock down every time there was a new outbreak, disrupting things. In addition, the government has decided to reduce regulatory pressure on the country’s leading technology companies, limiting their growth and often suggesting or mandating splits and asset divestitures. In addition, China burst the real estate bubble, causing many major developers to go bankrupt, leaving many prepaid housing projects unfinished.

But over the past year, the government appears to have made a U-turn, easing the regulatory burden on tech companies while trying to stimulate the economy and encourage growth. The result was six consecutive months of positive growth in China’s manufacturing sector, as reflected in the Caixin/S&P Global Manufacturing PMI. And perhaps most importantly, Chinese officials have recently considered buying up unfinished housing projects from bankrupt developers and converting them into affordable or rental housing. The recovery of the real estate sector would be a key to stabilizing the Chinese economy.

The Chinese technology giants are extremely cheap

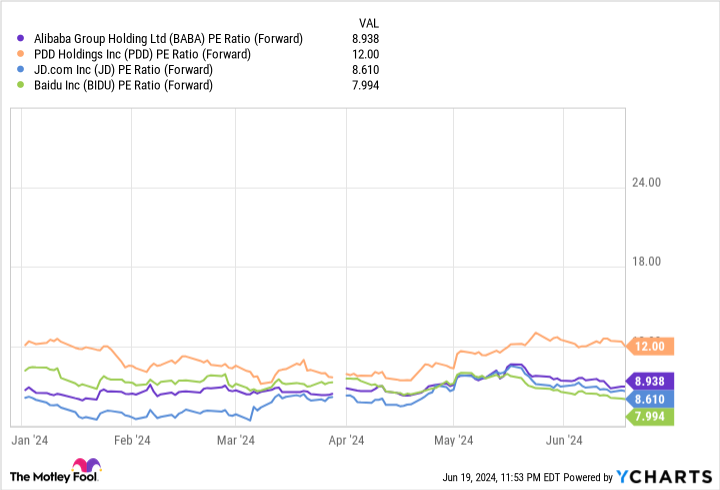

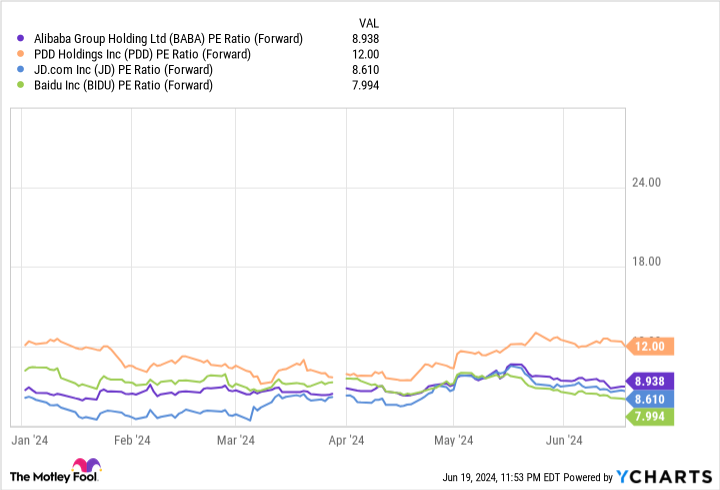

It seems that Tepper’s team has expected growth in the country to pick up, or that AI can help Chinese tech giants because they have American tech stocks. Meanwhile, China’s leading tech stocks have fallen to absolute bargain base valuations, especially compared to high-flying U.S. tech stocks. PDD Holdings now trades at just 12 times earnings, while Alibaba, JD and Baidu each trade between eight and nine times this year’s earnings estimates.

In light of cheap valuations and picking up growth, most Chinese tech companies have streamlined costs and launched large share buyback programs. Alibaba increased its buyback authorization by $25 billion in the first quarter and repurchased $4.8 billion worth of shares in the first quarter, dropping its share count by 2.6% in just one quarter. JD.com bought back $1.2 billion, or 2.8% of its shares, in the first quarter before approving another $3 billion program. And Baidu authorized a $5 billion share buyback program in February, repurchasing $898 billion worth of stock this year, according to its first-quarter earnings report.

So it might not be surprising to see Tepper cut some of his US AI winners while rebalancing into much cheaper Chinese tech stocks buying back their shares, especially if he and his analysts also believe the Chinese economy will continue to recover to recover.

Should You Invest $1,000 in Alibaba Group Now?

Consider the following before buying shares in Alibaba Group:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Alibaba Group wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $801,365!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Billy Duberstein and/or his clients have no positions in the stocks mentioned. The Motley Fool holds and recommends positions in Baidu and JD.com. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.

Billionaire David Tepper Goes Bargain Hunting: 6 Stocks He Just Bought was originally published by The Motley Fool