The shares of the “Magnificent Seven” — Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta PlatformsAnd Tesla — have significantly outperformed the stock market over the past five years. For example the median performer out the group, Microsoft, has a compound annual growth rate (CAGR) of 26% during this period. That is almost double the return generated by the S&P 500 (15%).

But investing means looking forward, not back, and it’s always important to ask yourself what could make a high-flying stock fly even higher. SoWhich of these stocks can help investors live a lifetime? Here are the two I have my eye on now.

Meta platforms

The first Magnificent Seven stocks that can help investors for life are Meta platforms.

Meta, which manages social networks included Facebook and Instagram have over 3.3 billion monthly active users (MAUs), which is about 40% of the world’s population.

With so many people accessing its platforms, it’s no wonder that the company makes billions from advertising placement on its networks. In the second quarter of this yearMeta reported revenue of $39 billion, nearly all of which — about 98% — came from advertising sales.

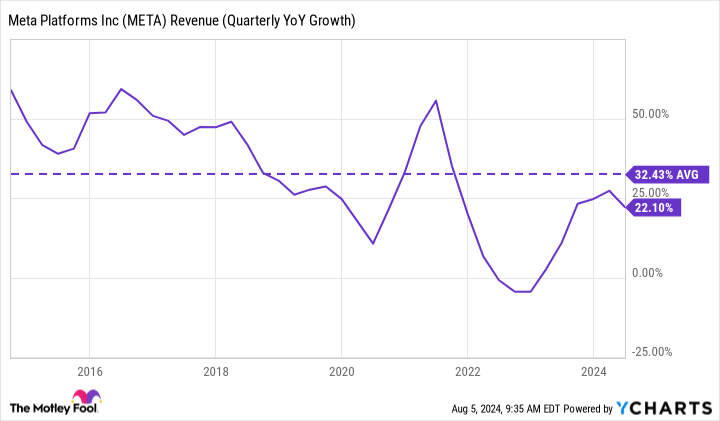

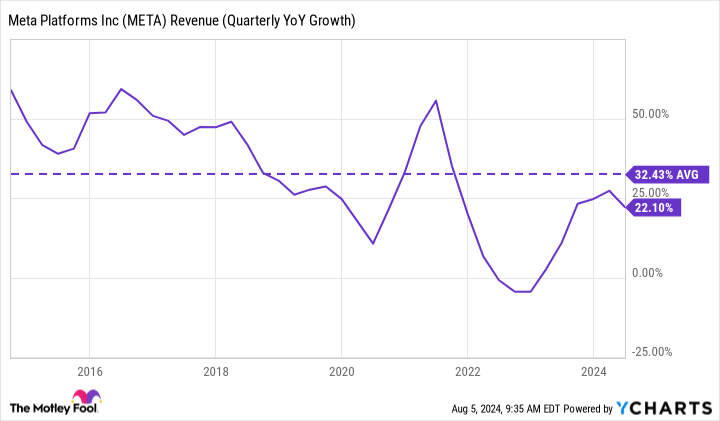

Yet, despite its massive size and singular focus on digital advertising, it remains an unstoppable growth engine. The company grew its total revenue by 22% year-over-year in its most recent quarter, which is exceptional for such a large company. In fact, it has achieved an incredible 32% quarterly revenue growth dating from 2014.

Moreover, Meta isn’t just growing in its top figures. Take free cash flow (FCF) per share, a crucial financial metric that shows how much cash a company is generating on a per-share basis. Meta’s Free Cash Flow Per Share has been steadily increasing. The company now generates $18.82 per share in FCF, upwards from $6.60 less than two years ago.

That’s crucial for investors because FCF per share measures how much cash a company generates, which can then be used for dividend payments, stock buybacks, debt repayment and other purposes. In other words, it gives a company’s management the opportunity to create value for shareholders.

Thanks to its immense size and high profit margins, Meta’s business model is likely continue to deliver shareholder value for many years to come to come. This makes it a share that can help investors throughout their lives.

Alphabet

Similar to Meta Platforms, Alphabet is a important player in the digital advertising market.

Through the Google Search and YouTube segments, The company generates hundreds of billions in advertising revenue. In the second quarter, Alphabet posted total revenues of $85 billion. That’s nearly 1 billion dollars per day. And $65 billion, or 76%of this total from ads on Google Search, Google Network, and YouTube.

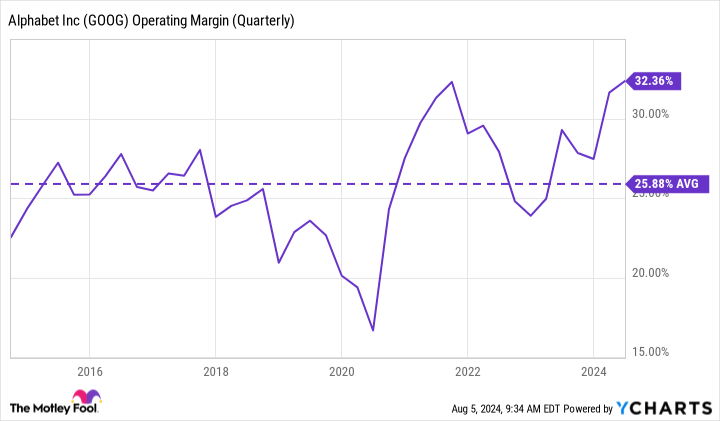

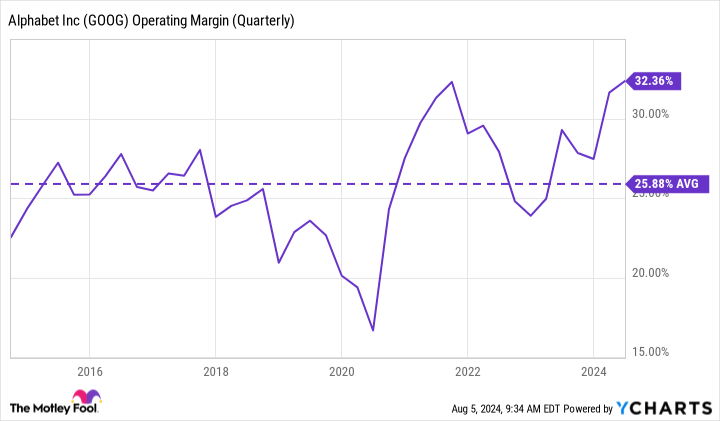

What’s really impressive is how efficient Alphabet is at turning its revenues into profits. The company’s operating margin is 32%, the highest in more than a decade and is therefore well above the 10-year average of 26%.

High profitability is key for each share. It indicates that a company is managing its operations well and generating profits that can then be are used to create shareholder value or grow the business.

Admittedly, Alphabet faces challenges, including a recent federal government ruling on anti-monopoly measures that has yet to be heard in court and general market volatility that has increased dramatically in recent weeks.

But long-term investors should remember that uncertain times are in many ways the best times to invest. Warren Buffett famously said that it’s better to be fearful when others are greedy and greedy when others are fearful, insofar as investors should follow their emotions. Given Alphabet’s excellent business model and solid operating margin, savvy investors should give the internet giant a serious look.

Should You Invest $1,000 in Alphabet Now?

Before you buy Alphabet stock, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $641,864!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 6, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former chief market development officer and spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Amazon, Nvidia and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 “Magnificent Seven” Stocks That Can Set You Up for Life was originally published by The Motley Fool