Eli Lilly (NYSE: LLY) And New Nordisk (NYSE: NVO) give new meaning to the word “unstoppable” in the context of pharmaceutical stocks. While Lilly’s stock has seen a total return of 245% over the past three years, Novo Nordisk’s has risen 165%, meaning both have easily outpaced the broader market’s growth of just 25%.

There’s little indication that either company is about to slow down significantly, even in the face of some headwinds. In fact, I predict their growth will likely continue to accelerate for at least another year or so. Here’s why.

Expect momentum to increase further

There are a few reasons to believe that Novo Nordisk and Eli Lilly are just getting started on their monstrous growth spurts.

First, neither company has been able to meet all the market demand for its weight-loss therapies, as Lilly’s Zepbound has — in the U.S. or elsewhere — even as supply conditions have improved. Nor have they been able to meet all the market demand for its type 2 diabetes drugs, such as Novo Nordisk’s Ozempic, which use the same active ingredient as the weight-loss drugs.

Both companies have invested billions of dollars in expanding their manufacturing facilities in the US and EU, and have taken emergency measures, such as halting new patient enrollments and even suspending marketing activities, to ensure existing patients have access to the very limited supply.

This situation will not last forever and according to some estimates there will be no shortage of these products within a year.

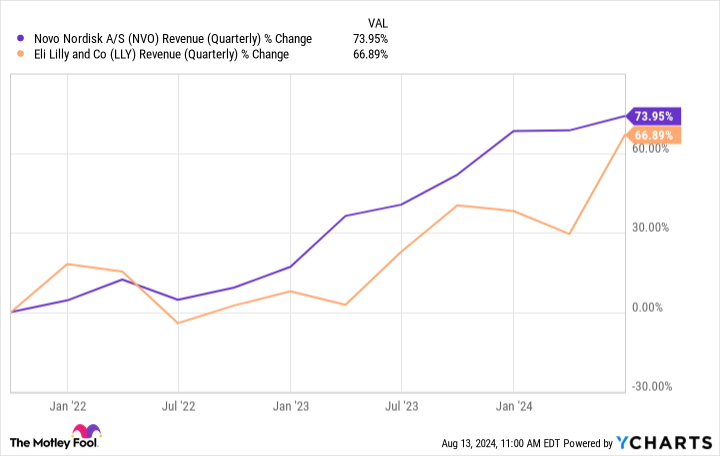

But that’s not the end of revenue growth. It’s the end of acceleration of sales growth, currently artificially trapped below demand levels, which continue to rise. Just look at how much quarterly growth these two have recorded over the past three years:

And that growth rate is just coming from the first few quarters of demand for these drugs’ core indications. The revenue impact from the expanded set of indications both companies are exploring hasn’t even begun. In terms of trailing-12-month (TTM) revenue, the two are virtually even; Novo Nordisk had $37.4 billion in revenue and Eli Lilly had $38.9 billion.

In a few years, it will be clearer whether Novo Nordisk’s semaglutide molecule (Ozempic and Wegovy) can treat the symptoms or pathology of Alzheimer’s disease. It is currently being studied for that purpose in phase 3 clinical trials. It may not prove to be a cure. But if it is still a useful treatment and regulators agree, bringing it to market for that indication will lead to even more growth.

In the longer term, some of the more speculative potential indications for these drugs, such as treating addiction or mood disorders, will be explored. There is a good chance that at least one of those avenues will bear fruit and ultimately lead to an even broader indication and an even larger addressable market.

And that’s not even mentioning the vast array of research and development (R&D) opportunities (both ongoing and available) to compete more effectively in today’s markets.

For example, Ozempic and Mounjaro are both formulated as injections, but clinical trials are underway to develop pill formulations of each, which could reach more patients. Likewise, testing combinations of already-marketed drugs, and potentially creating more effective therapies, is a given; that will help keep the growth train rolling even if the original molecules lose their intellectual property protections and manufacturing exclusivity.

There is no shortage of opportunities for future growth

As optimistic as the above may sound, it doesn’t even begin to cover all the opportunities that Eli Lilly and Novo Nordisk have ahead of them in the coming years. Both generate so much free cash flow (FCF) that their coffers will be hard to empty, even if they ramp up production and perhaps reinvest in R&D.

One logical place where their management teams might choose to spend excess cash is in partnerships, acquisitions, and licensing deals. Acquiring or partnering with biotechs developing next-gen interventions would protect their market share and lead to owning pharmaceutical assets that could be useful to bundle into a combination therapy, or to try to sell into a medical niche that is not being adequately addressed. Likewise, licensing technologies, particularly in areas like advanced drug delivery systems and manufacturing, will help these two leaders maintain their edge.

There is also a good chance that these companies will return capital to investors through larger share buyback programs and perhaps dividend increases. In short, the future looks quite optimistic.

Should You Invest $1,000 in Eli Lilly Now?

Before you buy Eli Lilly stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Eli Lilly wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $763,374!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 12, 2024

Alex Carchidi has no position in any of the stocks mentioned. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

Prediction: These 2 Unstoppable Pharma Stocks Will Keep Rising Through 2025 and Beyond was originally published by The Motley Fool