Bank stocks are an attractive option for many investors because they offer attractive dividends and solid long-term returns. I say “tend to bid” because not all bank stocks are created equal, and not all bank stocks perform well.

If you’re looking for the best bank stock ideas right now, the two choices below have real potential. And the second one might just surprise you.

1. TD Bank: This stock has a proven history of profitability

When it comes to making money with bank stocks, Toronto-Dominion Bank (NYSE: TD) is a great case study. TD Bank (as it is better known) stock has delivered an incredible total return (including reinvested dividends) of 3,140% over the past 30 years. S&P 500The total return was 1,340% over the same period.

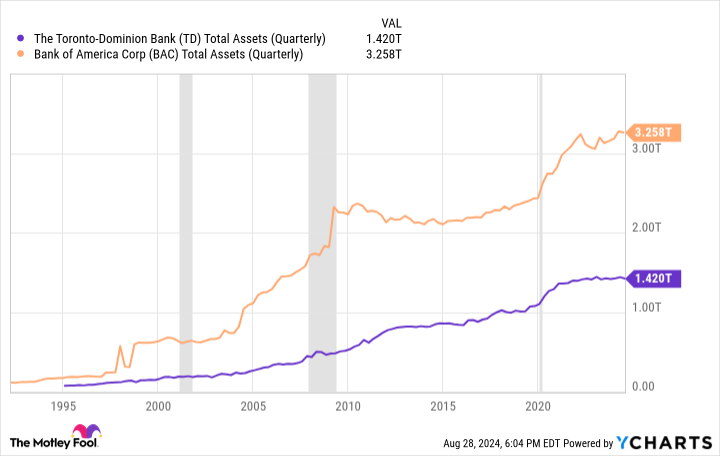

What made TD Bank’s rise so spectacular? Part of it is the unique operating environment of the Canadian banking sector, where regulations are driving consolidation in the industry. For example, TD Bank is currently the second-largest bank in Canada, with $1.4 trillion in assets. The second-largest bank in the U.S. is Bank of Americathat has assets of $3.3 billion, despite the U.S. banking sector being many times larger than Canada’s. Outsized market share has allowed TD Bank to post profits and returns on equity that its U.S. counterparts can’t quite match. For example, TD Bank’s average annual return on equity over the past five years has been about 13.2%. Bank of America, by comparison, has averaged just 9.7%.

To be fair, TD Bank’s performance in more recent years hasn’t matched its historical average. Over the past three years, the stock has delivered a total return of just 2%, compared to the S&P 500’s total return of 30%. That disappointing performance reflects the problems in the banking industry as a whole. Bank of America shares, for example, are up just 0.8% over the same period. It’s also facing some U.S. regulatory issues from 2023 regarding the bank’s anti-money laundering controls, which TD Bank is trying to resolve. Until those are resolved, TD’s growth could be slowed somewhat.

Investors could use this underperformance to their advantage. TD Bank currently trades at just 1.4 times book value, a discount from its three-year average of 1.6 times book value. Its dividend yield has also recently reached new heights, now surpassing 5%. If you’re looking for a banking stock with a solid, well-covered dividend and a good value, TD Bank is for you.

2. Berkshire Hathaway: A Secret Way to Bet on the Best Banking Stocks

Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) is not a bank stock, but it does have holdings in enough bank stocks to qualify. For decades, Berkshire CEO Warren Buffett has made Berkshire a major investor in several banks. Currently, Berkshire’s portfolio is worth tens of billions of dollars in well-known banks such as Capital One, Citigroupand Bank of America, but also lesser-known banks such as Ally Financial And Now HoldingsIn total, Berkshire’s portfolio has more than $40 billion directly invested in bank stocks, with another $43 billion committed to financial services companies such as Mastercard, American Express, And VisaBerkshire is more of a banking stock than many people realize.

Of course, buying Berkshire stock also exposes you to a wide range of other companies, and your direct exposure to banks will be relatively small. But the advantage is that you can outsource your bank stock picking to one of the best investors of all time: Warren Buffett. Buffett has laid out his strategy for investing in bank stocks before.

“It’s a business that can be a very good business if it’s run right,” he told investors in 1996. “There’s no magic to it. You just have to stay away from stupid things.” With Buffett managing your bank stock portfolio, you’re much less likely to invest in a bank stock crash.

Despite recently surpassing $1 trillion in market cap for the first time, Berkshire Hathaway’s valuation is very reasonable, especially considering the quality of the conglomerate. Shares trade at just under 1.7 times book value, a figure that is likely inflated by massive share buybacks, which increase shareholder value but tend to depress book value.

It’s an odd choice for a banking stock, but Berkshire could be a good choice for companies looking to invest more in the banking sector while also spreading out a lot of the risk.

Should You Invest $1,000 in Berkshire Hathaway Now?

Before you buy Berkshire Hathaway stock, consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $731,449!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Ally is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Citigroup is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising partner of The Ascent, a Motley Fool company. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America, Berkshire Hathaway, Mastercard and Visa. The Motley Fool recommends Nu Holdings and recommends the following options: long Jan 2025 $370 calls on Mastercard and short Jan 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

The Smartest Bank Stocks to Buy Now with $500 was originally published by The Motley Fool