Are you looking for investment income? Dividend stocks are an obvious place to start your search, but there are so many! For most people, narrowing down your prospects to the 30 stocks that make up the Dow Jones Industrial Average not only makes hunting easier, but also ensures that you have high-quality names.

But which Dow stocks? It’s tempting to just dive into the three highest-yielding names in the index and leave it at that. But there’s something you might want to know about that strategy before you use it.

The Dow Stocks With the Highest Dividend Yield Right Now

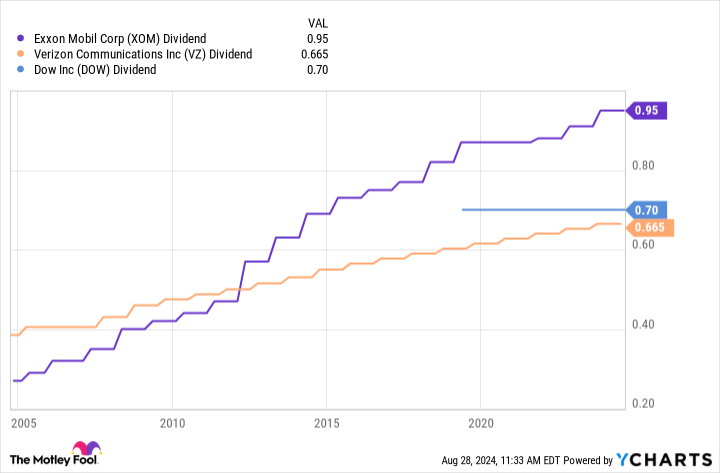

In case you’re wondering, the Dow names with the highest dividend yields right now are telecom giants Verizon Communications (NYSE: VZ)chemical company Dow Inc. (NYSE:DOW)and oil giant Chevron (NYSE: CVX)with trailing yields of 6.5%, 5.3% and 4.5% respectively. You could certainly do worse.

However, as experienced investors can attest, every investment has a downside. In the case of above-average dividend yields, it is likely that you will see below-average dividend growth and/or below-average capital appreciation. It is also possible that high dividend yield stocks simply pose above-average risks to their owners.

In the case of Verizon, Dow, and Chevron, it’s mostly the first two considerations. That is, these are all solid companies, but none of them are in growth sectors that will support big dividend growth or share price appreciation. Respectable growth? Sure. Great growth? No.

If your only priority is above-average yields and inflation-beating dividend growth, these three tickers are fine. It’s clear that the need for wireless telecom services will never go away, and neither will the need for industrial chemicals. Even the old-fashioned energy sector is reasonably well-protected for the foreseeable future. Thanks to population growth and ever-expanding industrialization,

Goldman Sachs believes that global crude oil consumption will continue to grow through 2034 and will be needed for many, many years beyond that. Energy giant ExxonMobil also predicts that we will use as much oil in 2050 as we do now.

Given this outlook, Chevron’s dividend will remain strong for a long, long time. And in at least two out of three cases, future dividend growth will continue impressive dividend growth histories. (Dow spun off from its parent company in 2019 — just before the COVID-19 pandemic — and as such has not had a fair chance to increase its dividend payment.)

There is good reason to expect strong capital growth from these three names as well, despite their currently unusually high dividend yields.

Dogs of the Dow

Have you ever heard of the Dogs of the Dow stock-picking strategy? If not, it’s not complicated. The strategy simply involves buying the 10 highest-yielding Dow stocks at the end of any given calendar year and holding on to them for the entire following year. The theory is that these high-yielding blue chips are needlessly undervalued and ripe for a price recovery; the dividends they pay in the meantime are just a nice bonus.

The point is, the strategy works! While they aren’t successful every year, these high-yield tickers outperform the Dow itself and the S&P 500The tactic is even more productive with the so-called Small Dogs of the Dow (sometimes called Puppies of the Dow), which are simply the five lowest-priced Dogs of the Dow stocks in a given year. In both cases, investors create mathematically undervalued blue chips and then reap the rewards of not thinking too much about their choices (instead of talking themselves out of what might have been a smart trade).

Of course, this rules-based strategy doesn’t quite apply here and now. It’s not year-end yet, and we’re only interested in three stocks — not 10, or even the five lowest-priced tickers of those 10. But the underlying premise still applies. That is, you’re buying proven, dividend-paying blue-chip stocks at a discount. The calendar and the quantity aren’t factors if you’re a true long-termer just looking for reliable income stocks to own.

Just do it now

Admittedly, the idea seems too simple to be effective. Stock picking is (in theory) supposed to be complicated, and requires a lot of research that ultimately leads to a judgment. This approach is anything but a complicated judgment. And to be honest, there is certainly no guarantee that this approach will work for you.

At the very least, embrace the underlying idea. Investors have a knack for making things more difficult than they need to be, and in doing so often undermine their net returns by not taking a position they should have taken.

Or, more simply, don’t overthink things if your universe of possibilities is already limited to the market’s best blue chips. If you’re looking for above-average dividend income right now — with reasonable hope for more of the same in the future — the Dow’s three highest-yielding names should do just fine.

Should You Invest $1,000 in Verizon Communications Now?

Before you buy Verizon Communications stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Verizon Communications wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $731,449!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 26, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron and Goldman Sachs Group. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

Should You Buy the 3 Highest Dividend Paying Stocks in the Dow Jones? was originally published by The Motley Fool