When you think of artificial intelligence (AI), you might think of self-driving cars and humanoid robots. Counterintuitively, when a big new trend emerges, it’s often a good idea to think about how products are actually brought to life. Some of the most lucrative opportunities are often the least obvious.

To make AI work well, companies need to invest large amounts of capital expenditures (capex) in data centers. While data centers may seem like a piece of real estate, they are much more sophisticated and important. They house critical IT infrastructure, such as chipsets known as graphics processing units (GPUs) — a key component of generative AI applications.

Today, Nvidia is one of the biggest names in the data center realm. But what if I told you that I see another opportunity as the superior choice among data center investments, and it’s not even a technology company?

It’s important to consider all options, even the most tangential ones. Let’s take a look at a nuclear power stock that I think could be the most important data center company in the long run and explore why this could be a lucrative opportunity for investors.

Nuclear data centers are on the rise and…

A key selling point of AI is that the technology can bring a new wave of efficiency to a wide range of use cases. From breakthroughs in enterprise software to self-driving cars, AI promises new levels of productivity and safety never before seen.

While that sounds great, as with all things, AI comes with some significant trade-offs. Namely, building AI applications is an expensive endeavor. GPU hardware and high-performance computing software are some of the more obvious expenses in AI development. One of the more subtle costs in an AI roadmap lies with data centers, specifically their energy consumption.

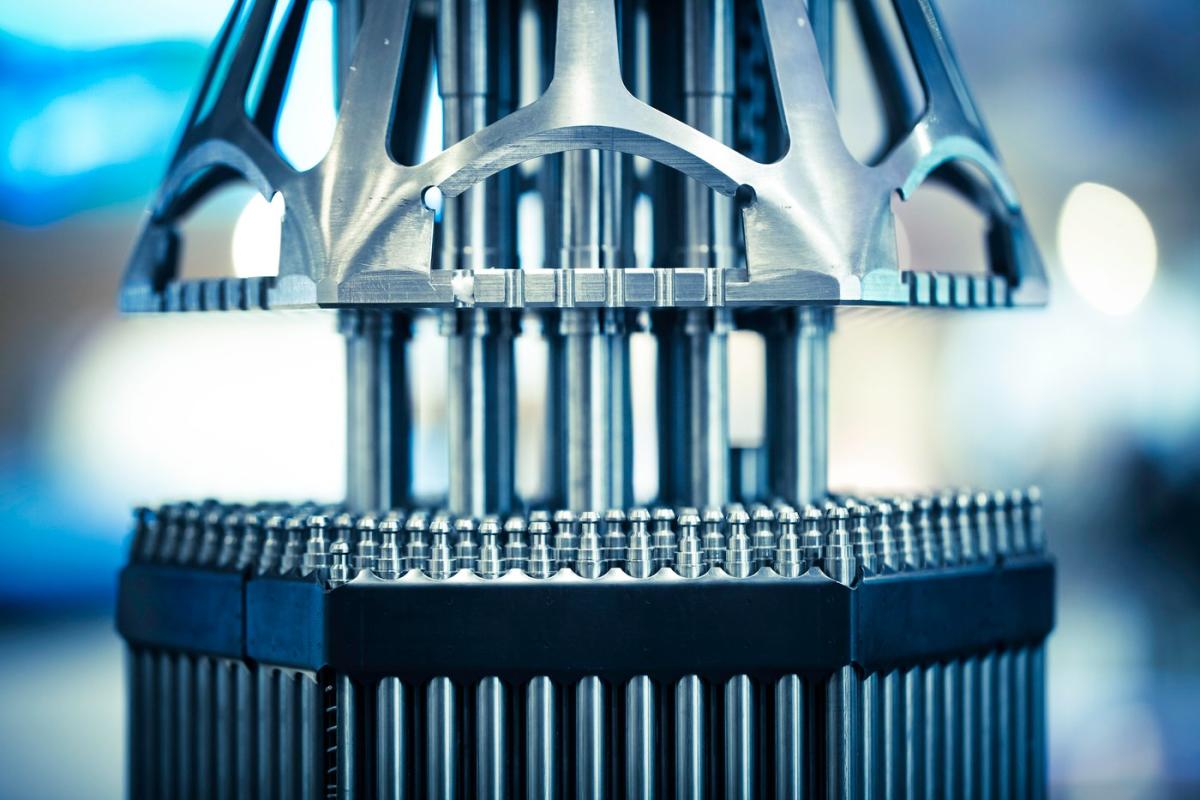

GPUs are constantly running complex algorithms and performing advanced computational tasks. As a result, IT architectures such as server racks consume a lot of energy and, in particular, emit a lot of heat. Data centers are equipped with a number of temperature control protocols, such as air conditioning units, fans and generators.

However, both of these solutions are expensive and can be inefficient compared to other sources of energy management. A rising trend at the intersection of data centers and energy consumption is nuclear power, and some truly notable companies and business leaders are getting involved.

…there are a lot of big names involved

A notable company involved in nuclear powered data centers is Amazon. One of the largest companies in Amazon’s ecosystem is the cloud computing platform, Amazon Web Services (AWS). Earlier this year, AWS acquired a nuclear-powered data center from Talen Energy for a reported $650 million.

Another player emerging in the nuclear energy field is Okay. Oklo is developing nuclear fission reactors that The goal is to sell to data centers and utilities.

While still private, Oklo raised funding from Peter Thiel and OpenAI co-founder Sam Altman. A few months ago, Oklo went public via a special purpose acquisition company (SPAC).

According to the investor presentation, the company has received interest in its reactors from major companies, including Diamondback energy, Equinix, Siemens Energyand even the US Air Force.

While this caliber of attention and Altman’s backing are impressive, I see Oklo as a risky bet at this point. The company is still pre-revenue and the potential deals referenced above are in the early stages of negotiations.

Oklo is likely to incur high costs for ongoing research and development (R&D) to expand its reactors, which will drain the company’s liquidity as long as no material sales are coming in.

My favorite at the intersection of nuclear and data centers is…

My first choice among nuclear energy suppliers for data centers is Constellation energy (NASDAQ: CEG)The company offers a range of energy services, but focuses specifically on sustainability and nuclear energy.

One of the company’s well-known customers in the field of nuclear energy is the member of “Magnificent Seven”. MicrosoftDuring the company’s second quarter earnings call in late August, CEO Joseph Dominguez referenced Comcast and Johns Hopkins as other key customers of Constellation’s carbon-free energy services.

Other mega-cap tech companies are likely to follow in Amazon and Microsoft’s footsteps. Constellation’s diverse customer base suggests that green energy isn’t just a use case for data centers or big tech hyperscalers.

Investors with a long-term horizon may want to consider a position in Constellation Energy now. I think nuclear energy solutions will become more mainstream as the AI revolution continues to unfold. Given how early the AI story appears to be, I think an opportunity like Constellation Energy is largely overlooked or undervalued, making it a tempting buy alongside other opportunities in AI, data centers, and energy consumption.

Should You Invest $1,000 In Constellation Energy Now?

Before buying shares in Constellation Energy, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Constellation Energy wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $722,320!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Amazon, Constellation Energy, Equinix, Microsoft, and Nvidia. The Motley Fool recommends Comcast and recommends the following options: long Jan 2026 $395 calls on Microsoft and short Jan 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Forget Nvidia: This Other Stock May Prove to Be the Most Important Data Center Opportunity of Them All, and It’s Not a Tech Company was originally published by The Motley Fool