Reaching a market cap of $1 trillion is such a challenging milestone that only a handful of companies have achieved it. The list includes several tech giants such as Nvidia (NASDAQ: NVDA), Metaplatforms (NASDAQ: META), Apple (NASDAQ: AAPL), Amazon (NASDAQ: AMZN)And Microsoft (NASDAQ: MSFT). Although this elite club is very exclusive, more companies will eventually join it. Stocks moving in this direction may be worth serious consideration. Let’s look at two: Visa (NYSE:V) And Novo Nordisk (NYSE: NVO). These companies could be billion-dollar stocks by 2030.

1. Visa

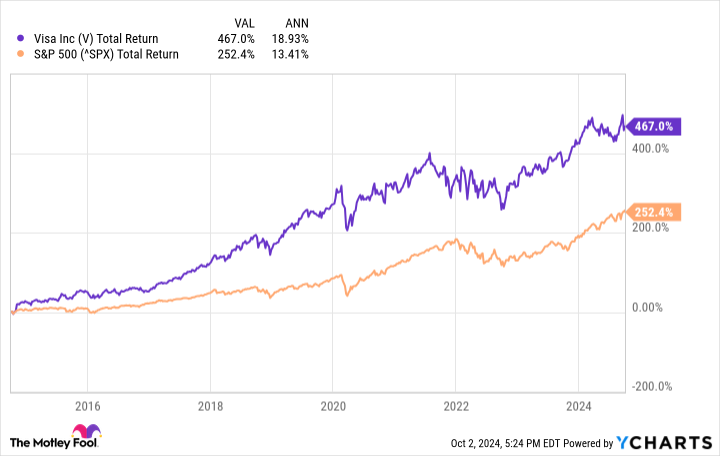

Visa operates one of the largest payment networks in the world, helping to facilitate millions of daily credit card transactions. The company has achieved excellent returns over the past decade as cash transactions are increasingly replaced by other forms of payment. Visa’s market capitalization is just under $550 billion at the time of writing. So a compound annual growth rate (CAGR) of about 10.5% is needed to become a trillion-dollar company by the end of 2030. That is well within the company’s capabilities. First, Visa has performed much better over the past decade.

Of course, that doesn’t guarantee that the company will achieve the same returns in the future, but some of the underlying factors that have led to such solid performance for the company in the past are still in place. Visa remains a leader in its industry, with the only real notable competitor MasterCard (NYSE:MA). Visa still benefits from network effects: the more people carry credit cards with its logo, the more attractive the ecosystem becomes to merchants, and vice versa. This ensures that it will remain an important player in this industry for some time to come.

Visa also still has plenty of room to grow. Credit card penetration is relatively high in many developed countries, but not in others. In developing countries there is even more potential. Visa sees a $20 trillion opportunity in a series of payments it can leverage. The company’s revenue of approximately $35 billion in the trailing twelve-month period is a small percentage of that total. If Visa can make progress in its addressable market, the company’s revenues, profits, and stock price should move in the same direction as they have over the past decade.

The company is well equipped to achieve a CAGR of over 10.5% by 2030.

2. Novo Nordisk

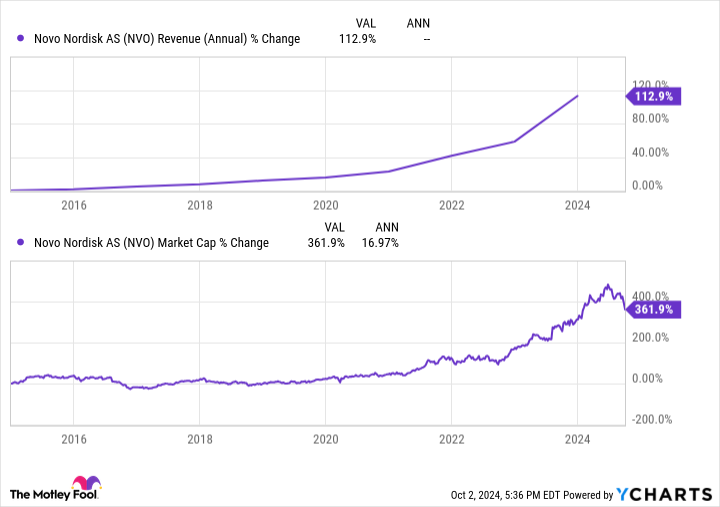

At the time of writing, Novo Nordisk’s market capitalization is approximately $400 billion. To reach $1 trillion would require a CAGR of about 16.5%. That would be an impressive average to maintain for six years, but Novo Nordisk has been more than impressive lately. Brand names such as Wegovy and Ozempic have become famous. Both are GLP-1 drugs that treat obesity and diabetes, respectively. Novo Nordisk has been one of the pioneers in the GLP-1 weight loss market, which is now attracting pharmaceutical companies left and right.

Some analysts estimate that the weight-loss drug market will reach $150 billion by the early 2030s, up from $24 billion last year. And while there will be plenty of challengers, Novo Nordisk’s pipeline in this area is unparalleled. The company’s most promising programs include an oral drug called amycretin, and CagriSema, which some estimate could generate as much as $20.2 billion in revenue by 2030.

However, that barely scratches the surface of Novo Nordisk’s pipeline. Semaglutide (the active ingredient in Wegovy and Ozempic) is being tested in the treatment of Alzheimer’s disease and non-alcoholic steatohepatitis, two areas of high unmet need. The company is developing several other drugs for diabetes and obesity, and a range of treatments for several rare diseases. Novo Nordisk’s revenue has grown rapidly over the past five years, as have its share price and market capitalization.

The drugmaker should receive key approvals in the coming years, which will help it continue to generate excellent financial results through the end of the decade. Becoming a trillion-dollar stock by 2030 is well within Novo Nordisk’s reach, and beyond that it should continue to beat the market.

Should You Invest $1,000 in Visa Now?

Before you buy shares in Visa, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Visa wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Amazon and Meta Platforms. The Motley Fool holds positions in and recommends Amazon, Apple, Mastercard, Meta Platforms, Microsoft, Nvidia and Visa. The Motley Fool recommends Novo Nordisk and recommends the following options: long calls in January 2025 of $370 on Mastercard, long calls in January 2026 of $395 on Microsoft, short calls in January 2025 of $380 on Mastercard and short calls in January 2026 from $405 on Microsoft. The Motley Fool has a disclosure policy.

Prediction: These Two Stocks Will Join Nvidia, Meta, Apple, Amazon, and Microsoft in the Trillion-Dollar Club by 2030 originally published by The Motley Fool