This has been another great year in the stock market, with the broader indices reaching new highs. But Warren Buffett’s commentary of Berkshire Hathaway‘S (NYSE: BRK.A) (NYSE: BRK.B) The annual shareholder meeting and changes in the company’s public stock ownership indicate that Berkshire is not a net buyer in today’s market.

Berkshire has reduced its stake in its largest public equity stake. Appleby almost 50%, reduced its position Bank of Americaand more. In total, Berkshire has sold more than $100 billion in shares this year and built up a cash and government bond position of more than $300 billion.

However, Berkshire appears to remain confident in the utilities and energy sector, as evidenced by its significant positions in the sector Chevron And Western petroleumas well as a decision to purchase the remaining 8% stake in Berkshire Hathaway Energy (or BHE for short), giving Berkshire full control of the entity.

Here’s a primer on how Berkshire Hathaway Energy fits into the broader sector, the benefits of investing in dividend-paying utility stocks, and a low-cost exchange-traded fund (ETF) worth considering now.

BHE fits nicely into Berkshire’s public and private portfolio

Berkshire is known for its public equity stakes. But there is a lot of additional value in the insurance business, owned by BNSF Railway, BHE and other business units. Berkshire likes boring companies that make money and can steadily grow their profits and their dividends Coca-cola And American Express. BHE embodies this philosophy.

BHE contains several electricity and gas utilities, pipelines and other infrastructure assets. Domestic regulated energy interests include four regulated U.S. utilities and five U.S. integrated natural gas pipelines with 21,000 miles of pipelines operated.

Unlike the exploration, production or refining side of oil and gas, whose profit margins are highly dependent on oil and gas prices, the mid-market oil and gas industry functions like a toll road: it charges fees to transport energy products from areas with a high income across the country. production to consumption or export areas.

Regulated utilities work with government agencies to set prices that are fair to consumers. This could provide utilities with a return, allowing them to invest in more infrastructure and pay dividends to shareholders.

Investors can buy shares of Berkshire Hathaway to gain exposure to BHE. But a simpler and more direct approach might be to buy an ETF with broad exposure to the utilities sector.

The utility sector could be given room

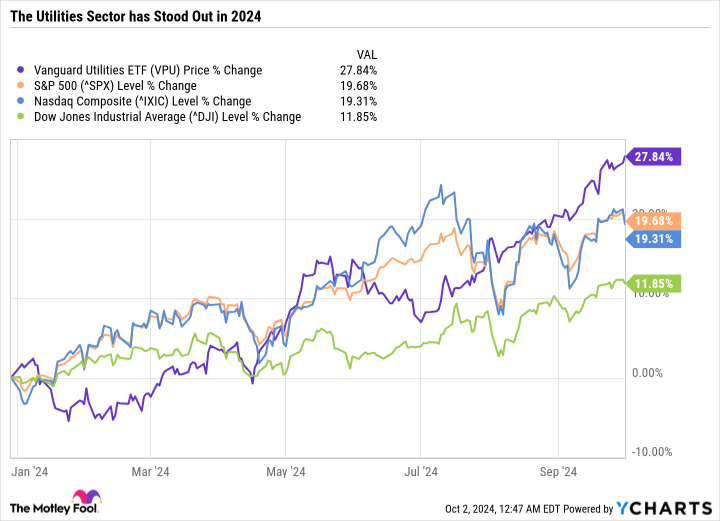

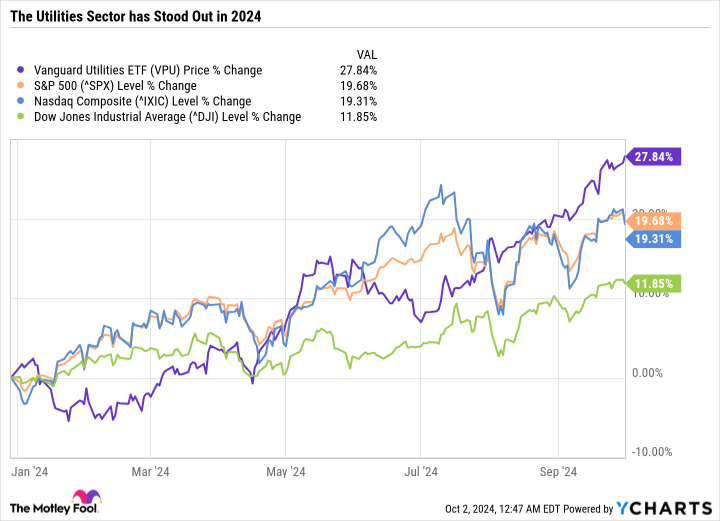

The Vanguard Utilities ETF (NYSEMKT: VPU) reflects the performance of the utility sector. The fund is up an impressive 27.8% year to date – better than the S&P500, Nasdaq CompositeAnd Dow Jones Industrial Average.

The Vanguard Utilities ETF has an expense ratio of 0.1%, has a minimum investment of just $1, and yields 3%. Even after its run-up, the index still has a somewhat reasonable price-to-earnings ratio of 25 – which is lower than the S&P 500, but high for a sector that has traditionally seen little growth.

The sector has been a beacon of safety for value investors looking for passive income in an otherwise expensive market. But after the surge, investors may be wondering whether this is the best sector to buy.

Context is critical in the stock market. The utilities sector fell slightly from 2020 to the end of 2023, lagging the broader indexes by a wide margin over those four years. So the recent recovery may be partly due to the sector being oversold.

Additionally, increased demand for computers to power artificial intelligence models could be a boon for electric utilities and justify infrastructure investments.

Lower interest rates add even more fuel to the fire. The Federal Reserve just cut interest rates for the first time in four years. Lower interest rates reduce the cost of capital and increase the potential return on investment for capital-intensive projects, such as power generation, transmission and distribution.

Many utilities also have a significant amount of debt on their balance sheets. Lower financing costs can help these companies refinance their debt and reduce their interest costs.

A boring but effective way to boost your passive income stream

The utilities sector is no longer the bargain it was at the beginning of the year, but remains a solid sector for passive income-oriented investors. The year-to-date gains may seem massive and overextended at first glance, but a large part of that is down to the way the sector was beaten into the year.

Investors looking for safe, reasonably valued parts of the market can consider the Vanguard Utilities ETF as a simple yet effective way to achieve diversification in the utilities sector.

Should you invest $1,000 in the Vanguard World Fund – Vanguard Utilities ETF now?

Consider the following before purchasing shares in Vanguard World Fund – Vanguard Utilities ETF:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Utilities ETF wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 30, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising partner of The Ascent, a Motley Fool company. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Apple, Bank of America, Berkshire Hathaway and Chevron. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

With Warren-Buffett Led Berkshire Hathaway Buying Remaining Stake in Berkshire Hathaway Energy, Is It Time to Buy Utility Dividend Stocks? was originally published by The Motley Fool