Are you looking for a new growth investment? Consider an interest in Celsius companies (NASDAQ: CELH). Shares of this fast-growing company have fallen 70% since hitting their all-time high last year.

But the reasons behind the big discount are only temporary. Bargain-oriented growth investors will sooner or later want to make their choice for Celsius shares.

Celsius heralds the next generation of energy drinks

Celsius Holdings may not yet be a household name, despite its 11% share of the energy drink market. That industry is still dominated by Red Bull and Monstrous drink.

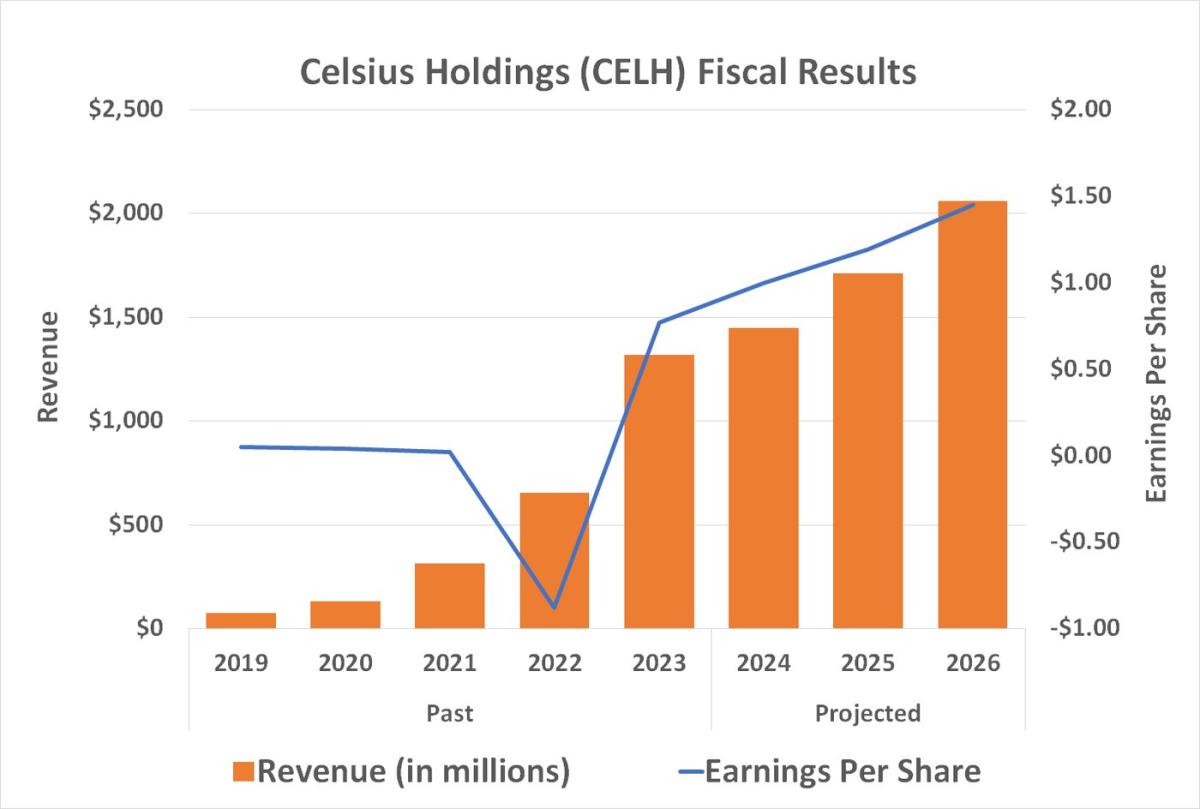

However, Celsius Holdings is making impressive progress. Its 11% share of the North American market – where it does almost all of its business – is up from virtually nothing a few years ago. Last year’s revenue of $1.32 billion was ten times higher than 2020’s revenue of just $131 million.

Like most other energy drinks, Celsius drinks are made with a combination of caffeine, vitamins, minerals and botanicals. However, unlike most other energy drinks, there is no sugar, corn syrup, aspartame, or artificial colors or flavors. The company’s marketing claims that its drinks are scientifically formulated, backed by a handful of published university studies that measure the thermogenic (metabolic) properties of the drinks.

CEO John Fieldly clearly also has his finger on the pulse of the energy drinks sector. Although Celsius was founded in 2004, the vast majority of growth took place after Fieldly took over in 2018.

Given the recent sell-off, why is Celsius Holdings such a must-have name now?

3 reasons to buy Celsius shares sooner or later

Three reasons stand out from the rest.

1. It grows (with plenty of room to continue doing so)

Investors familiar with Celsius Holdings may take issue with the claim. The company is growing, but the expected revenue growth of 7% in 2024 is not particularly convincing compared to previous years.

There is an important footnote to add to that number, however, as the year-over-year comparison is heavily skewed by minority owner and distribution partner. PepsiCo. The beverage giant bought too much of the energy drink last year and is now reducing its inventory until some of the backstock is out of the way. Once it does, look for revenue growth to accelerate back to a double-digit pace.

There is certainly room for the company to grow further. Consumer research firm Straits Research suggests the global energy drink market will grow at an average annual rate of 8.5% through 2032. With the company’s recent entry into international markets such as France, Britain and Ireland, Celsius could easily earn more than its competitors. a fair share of this growth.

2. This is the direction the energy drink industry is heading

That said, there’s a very specific reason why Celsius is well-positioned to outpace any industry-wide growth in the US or abroad.

As is the case with most industries, energy drinks evolve as time goes on. While Red Bull and Monster became staples for students and video gamers, Celsius is expanding the appeal of its products by targeting the fitness-oriented audience.

It also appeals to women: Celsius has benefited from not having to reposition its brand, while its bigger rivals have focused on male consumers for years.

Whatever the customer base looks like, its marketability is not in question. Sugar-free and ‘better for you’ products are increasingly becoming the norm in the beverage world. The energy drinks part of the market is no exception.

3. Celsius stock is undervalued

Celsius stock is now down 70% from its previous peak and is simply undervalued.

At least that’s the word from the analyst community. While investors have been in turmoil since the release of the company’s first-quarter results, which first sparked warnings of a sales slowdown, analysts have remained largely unfazed. Their current consensus target is $46.87 per share, or 63% above the current share price. Furthermore, most of Wall Street considers Celsius Holdings not only a buy, but a strong buy.

The shares are currently priced at 36 times this year’s expected earnings and less than 30 times 2025 earnings expectations. That’s not cheap, but it’s a bargain for a company capable of the kind of growth Celsius can achieve; growth that it will probably achieve again early next year.

Just make sure you can tolerate the volatility

Celsius shares are still not for everyone. While there is a bullish case for a recovery, volatility is the norm here, and this stock is not for the faint of heart.

However, if you’re a growth-oriented investor willing to take calculated risk, Celsius Holdings is an attractive prospect. It has the right product at the right time and has already proven that it can win in a highly competitive sector.

Should You Invest $1,000 in Celsius Now?

Before buying shares in Celsius, please consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Celsius wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $812,893!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns October 7, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Celsius and Monster Beverage. The Motley Fool has a disclosure policy.

3 Reasons to Buy Celsius Holdings Stock Like There’s No Tomorrow was originally published by The Motley Fool