The advent of artificial intelligence (AI) has been a boon for many companies, but probably nothing more than that Nvidia (NASDAQ: NVDA). As a leading supplier of processors for AI, the company has experienced unprecedented growth. In the first quarter of 2025 (ended April 28), Nvidia’s revenue grew 262% year-over-year to $26 billion, while earnings per share (EPS) rose 629% to $5.98. This was the fourth consecutive quarter of triple-digit revenue and profit growth. This has sent Nvidia’s share price up 650% since the start of 2023.

In conjunction with its financial report, Nvidia announced a 10-for-1 stock split, which will be initiated after the market closes on Friday, June 7. The stock will trade on a split-adjusted basis from Monday, June 10. Nvidia noted in its announcement that the split was intended to “make stock ownership more accessible to employees and investors.”

From a historical perspective, stock splits follow a period of sustained business and operating performance, which fuels the rising stock price. While this describes Nvidia well, there are other companies benefiting from the spread of AI. One such company that could be also be ready for a stock split Broadcom (NASDAQ:AVGO).

A chip from the old block

Broadcom is one of the world’s largest suppliers of custom semiconductors, but that’s just the beginning. The company provides a wide range of products used in data centers, cloud computing, networking, broadband, wireless, infrastructure, storage, AI and more. Many Broadcom products form the backbone of the AI ecosystem.

Such a wide range of products can be both a blessing and a curse. For example, cyclicality in wireless communications has been a drag on business in recent years, even as AI activities have increased. On the other hand, as one of the leading suppliers of 5G wireless chips and systems, Broadcom is well positioned to benefit from an industry recovery.

Overall, Broadcom’s business is accelerating. In the first quarter, revenue of $12.9 billion rose 34% year over year, while adjusted earnings per share (EPS) of $10.99 was only 6% higher, as the company worked to process its recent acquisition of VMWare. Management expects Broadcom’s strong growth to continue and lead to annual revenues of $50 billion, which would represent growth of 40%.

A solid candidate for stock split

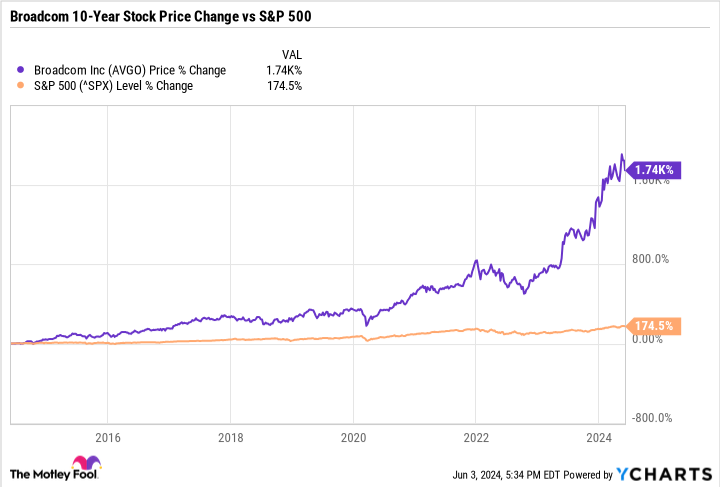

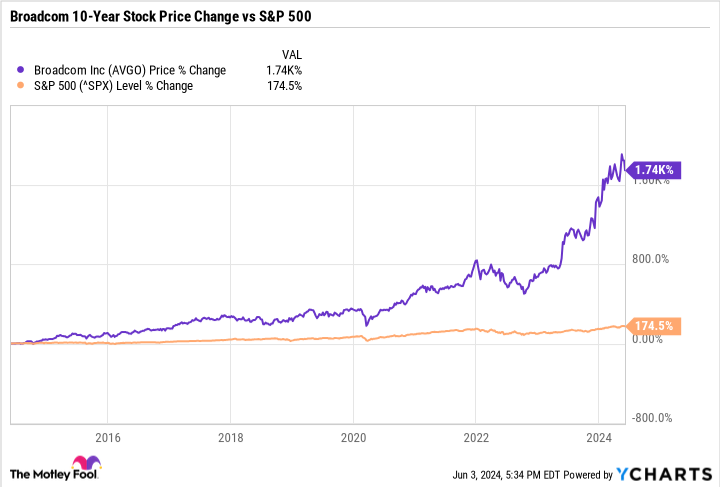

A look at Broadcom’s track record and current stock price explains why the company is a solid candidate for a stock split. Over the past decade, Broadcom has grown its revenue by 843% (at the time of writing), while net income has increased by 882%. This solid operational and financial performance has lit a fire under the shares, which have risen as much as 1,740% – all without the huge opportunities presented by generative AI.

To be clear, Broadcom has never initiated a stock split, but that doesn’t mean it isn’t a prime candidate. Its stock price clocked in at nearly $1,322 when the market closed on Monday, making it one of the top 15 most expensive stocks trading on US markets.

There is more. One of the byproducts of AI’s rapid adoption is the staggering upgrade cycle taking place in the data center space. The servers that currently house many data centers lack the computing power needed to run AI. bank of America Analyst Ruplu Bhattacharya estimates that the resulting upgrade cycle will see the data center market grow at an average annual rate of 50% over the next three years. As one of the leading providers of technology used in data centers, Broadcom is well positioned to benefit from these long-term tailwinds.

The increasing pace of AI adoption could be the most attractive opportunity for Broadcom. Management recently revealed that software revenue increased 156% year over year and now estimates that AI-related revenue will rise to $10 billion, representing 35% of Broadcom’s semiconductor solutions and 20% of total sales in fiscal year 2024.

That’s not a reach given the breadth of AI capabilities. According to global management consulting firm McKinsey & Company, generative AI is expected to generate between $2.6 trillion and $4.4 trillion in annual revenue over the next decade. That estimate actually doubles when the impact of embedded software is included.

Finally, at roughly 28 times forward earnings, Broadcom’s valuation is only a small premium, compared to a multiple of 27 for the sector. S&P500. But that’s not an apples-to-apples comparison, as Broadcom is close to delivering results 10 times the returns of the S&P 500 over the past ten years. That, combined with its position in the AI ecosystem and its significant growth potential, illustrates why Broadcom presents an attractive opportunity – even if it doesn’t initiate a stock split.

Should You Invest $1,000 in Broadcom Now?

Consider the following before buying shares in Broadcom:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $750,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Danny Vena has positions at Nvidia. The Motley Fool holds positions in and recommends Bank of America and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

After Nvidia’s 10-for-1 Stock Split, This Artificial Intelligence (AI) Stock Could Be Next Originally published by The Motley Fool