Successful investing is about building the right portfolio and filling it with stocks that will generate solid returns over the long term. Sounds simple, right? The only “trick” is finding stocks that fit that profile, and the key is right in front of us, waiting in the raw data of the stock market.

Therein lies the rub. The markets offer a huge amount of information, based on thousands of traders trading thousands of stocks. The result is millions of transactions every day, and it is the work of a lifetime to give meaning to them. Even the best Wall Street analysts will typically focus on one segment of the whole.

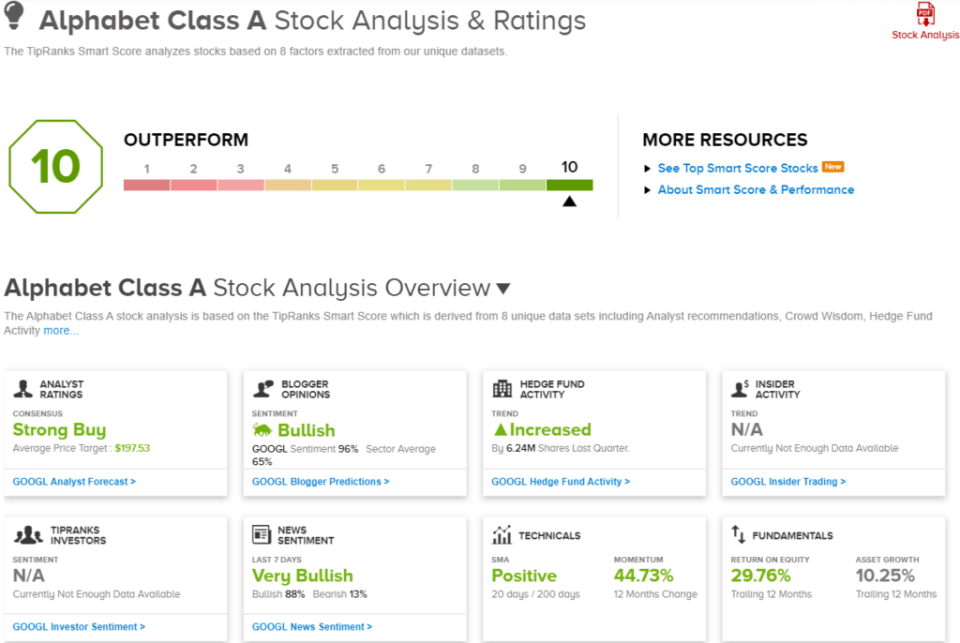

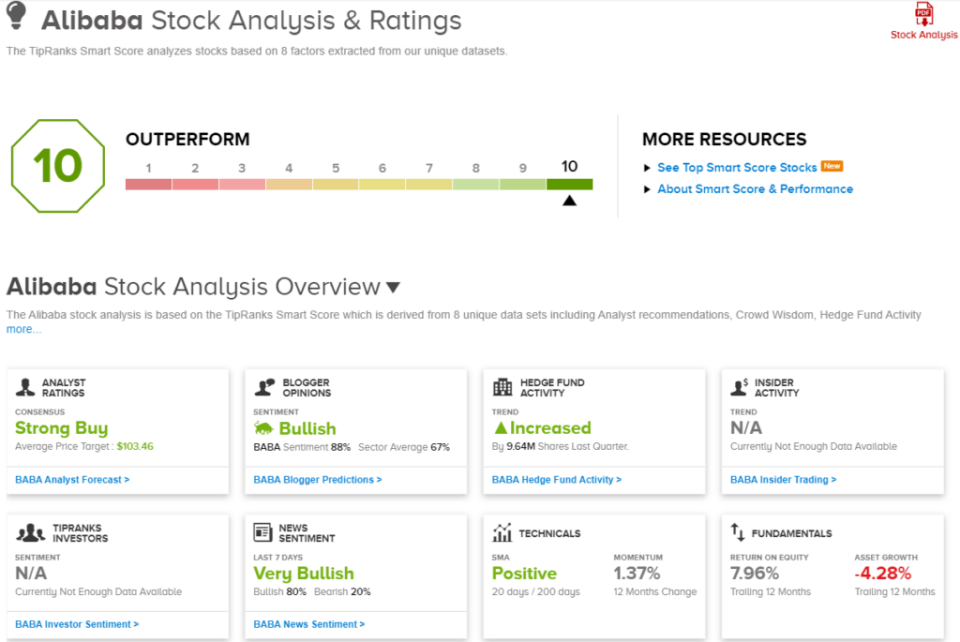

This is where the TipRanks Smart Score comes into the picture. It is a data sorting and aggregation tool based on a combination of AI and natural language processing, designed to collect all the data about a given stock and then compare that stock’s performance against a range of factors. known as accurate predictors of future outperformance. The stock comparison results are then converted into a single score, on a scale of 1 to 10. A stock with a ‘Perfect 10’ is one that has certainly generated additional investor interest.

That’s especially true when market-leading companies like Alphabet (NASDAQ:GOOGL) and Alibaba (NYSE:BABA) earn ‘Perfect 10’ scores. We used the TipRanks database to look up the bigger picture of both; These top-scoring stocks also bring strong Buy ratings and double-digit upside potential. Here are the details.

Alphabet

First of all, a giant from the tech world. Alphabet is best known as the parent company of both Google and YouTube. It is the market leader in the world of online search and has a dominant position in online advertising and video content distribution. The company recently became only the fourth Wall Street firm to surpass $2 trillion in market capitalization, and is one of only six publicly traded companies with a market cap of more than $1 trillion. Currently, Alphabet is valued at $2.17 trillion.

Given its overall strong position in technology, Alphabet is at the forefront of AI development, applying generative AI to its Google search engine and Google Cloud subscription service. Alphabet even has an autonomous driving division, Waymo, which has put AI-based self-driving vehicles on the streets of San Francisco.

Financially, Alphabet’s revenues have shown an upward trend over the past year. In the company’s most recent earnings report, which covers the first quarter of ’24, Alphabet reported earnings per share of $1.89, up from $1.17 last year and 38 cents per share better than expected. The company’s revenues, which totaled $80.54 billion and exceeded forecasts by $1.84 billion, were driven by advertising revenue. Advertising revenue for the quarter was $61.7 billion, up 13% year over year.

All of this – its solid business model, technology leadership and strong financials – has caught the attention of Tigress analyst Ivan Feinseth, who writes of Alphabet: “Search and advertising revenue will continue to see accelerated growth, and the continued integration of AI functionality will continue to strengthen its leadership position in all major technology trends and business areas. GOOGL continues to benefit from strong advertising revenue and user engagement, delivering another quarter of strong results across all key business areas, including Cloud, which continues to benefit from increasing AI integration.”

The five-star analyst then gives these shares a buy rating with a price target of $210, which indicates a one-year upside potential of 20%. (To view Feinseth’s track record, click here)

Like most tech giants, Alphabet has picked up a lot of Wall Street recommendations – no less than 37, with 32 Buys and 5 Holds supporting the Strong Buy consensus rating. Shares in GOOGL are selling for $174.99 and the average price of $197.53 implies a gain of almost 13% over the next twelve months. (To see GOOGL Stock Prediction)

Alibaba.com

Next up is Alibaba, best known as the ‘Amazon of China’. That’s actually a bit unfair. Alibaba is a powerful online retail and service technology company in its own right. The company’s founder is the near-legendary Chinese tech entrepreneur and innovator Jack Ma, and his creation is the absolute leader in China’s domestic online retail market. The company has been around since 1999 and has expanded beyond Chinese borders and beyond e-commerce.

The company offers a wide range of online retail services to the global market and has moved into other technology sectors including digital media, entertainment and cloud computing. The company has several business segments, including innovation initiatives, but its main business remains the Chinese trading segment.

This core activity gives Alibaba a solid foundation to stand on. China has a population of approximately 1.4 billion, of which approximately 800 million live in growing urban regions. In the domestic market, Alibaba offers an unparalleled range of products and prides itself on delivering everything anywhere in China, with guaranteed next day or two-day delivery. The global online retail side of the business includes nearly 6,000 product categories and more than 200,000 suppliers making more than 200 million products available in more than 200 countries.

Alibaba last reported financial results for the fourth quarter of 24, which ended on March 31 this year. The company’s revenue was $30.73 billion, up 7% from the fourth quarter of the previous fiscal year and about $310 million above estimates. Operating income was reported at $1.40 based on non-GAAP measures, missing the forecast by 2 cents per share.

This retail and technology company received a review from Benchmark analyst Fawne Jiang, who thinks BABA’s strengths outweigh its potential headwinds. Jiang writes: “The main drivers for the next share price in our view are 1) sustainability of positive market share dynamics, 2) improvement in e-commerce revenues thanks to the launch of new advertising products (planned in the second half of 25) to close the gap in CMR. and GMV; and 3) reaccelerated cloud growth, supported by the AI cloud (F2H25). Uncertainty remains in light of 1) GMV growth largely depends on consumer confidence (recently improving); 2) investments may cause volatility in profitability in the near future and in FY25. On net, we are increasingly comfortable for a potential full-fledged turnaround in the second half of 25, along with a stabilizing macro backdrop.”

For Jiang, another of the Street’s five-star stock pros, these shares have a buy rating along with a $118 price target, which suggests a 45% one-year upside. (To view Jiang’s track record, click here)

BABA’s 17 recent stock ratings include 14 Buys to 3 Holds, for a Strong Buy consensus rating, and the average price target of $103.46 implies an upside of 27% from the current share price of $81.26. (To see BABA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is for informational purposes only. It is very important to do your own analysis before making an investment.