Any exchange-traded fund (ETF) that generates a twelve-month return of nearly 7.7% and pays monthly income will catch the attention of investors looking for income. After all, invest enough in it and you can live off the monthly passive income. But every investment comes with risks, and the JPMorgan Equity Premium Income ETF (NYSEMKT: JEPI) is no different.

Here’s what you need to know before investing in the fund.

What the JPMorgan Equity Premium Income ETF is

Launched in May 2020, this ETF aims to provide investors with monthly income while capturing some of the upside of the price. S&P500 index with low volatility. Management invests in two asset classes:

-

At least 80% of the assets are placed in an actively managed equity portfolio through an investment process.

-

Up to 20% of assets go into equity-linked notes (ELNs), selling out-of-the-money call options on the S&P 500 index.

The equity component of the ETF aims to capture the potential gains in the stock market and generate monthly income through dividends. Investing such a large stake in stocks means that management must find a way to reduce volatility in the ETF’s performance to achieve its intended goal. This stems from its investments in ELNs.

When investors buy a call option on the S&P 500, they pay a premium for the right to buy the index at a certain price (the strike price) by an expiration date. It is typically purchased by investors who are bullish on the index. An S&P 500 call option is in the money when the strike price is lower than the current S&P 500 index. This is unlike an out of the money option when the strike price is above the current S&P 500. You can think of buyers of in-the-money call options as bulls and buyers of out-of-the-money call options as very bullish: they don’t mind paying a premium and hope that the strike price rises enough above the index level to cover the premium that they have paid to compensate.

This ETF effective sells call options. So premiums will rise when the performance of the S&P 500 over the period is negative and the index does not rise enough above the strike price.

Therefore, if stock markets fall (which typically takes the ETF’s 80% of stocks), the ETF will still generate income from dividends. And premiums from the sale of call options. This helps reduce the ETF’s downside exposure to the S&P 500. When the market has a strong month, the ELN/selling call options assets will lose money, and this will offset the gains of the 80% of the ETF held in stocks.

In summary, the ETF:

-

Performs very well when the S&P 500 produces moderately positive monthly returns; the equity assets should do well, and the ETF can earn premiums.

-

Performs relatively well, but can still be negative in a strongly negative month; the stock assets will likely fall, but the ETF will raise premiums.

-

In a strongly positive month, stocks will underperform: stocks will rise in value, but selling call options will result in losing money on them.

How the strategy works in practice

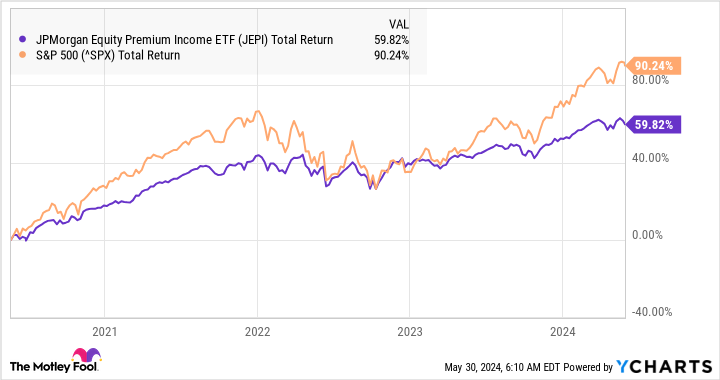

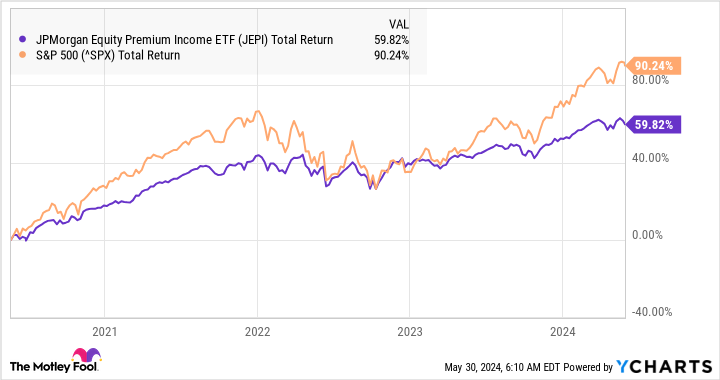

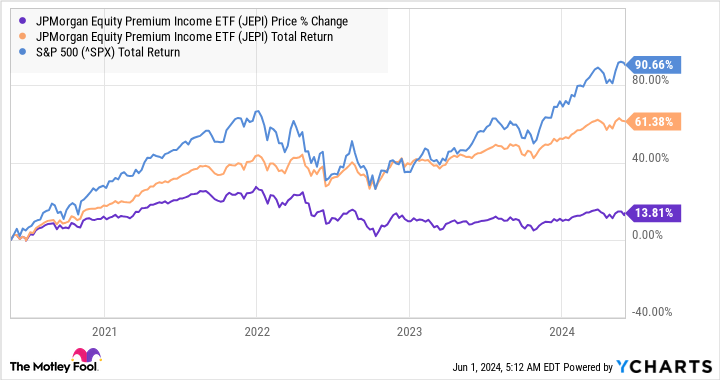

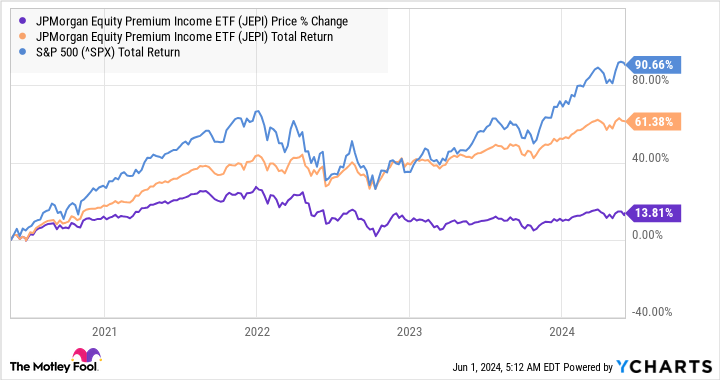

As you can see below, the ETF has underperformed the S&P 500 on a total return (dividend reinvestment) basis since its inception. This level of performance is expected during a strong period for the index.

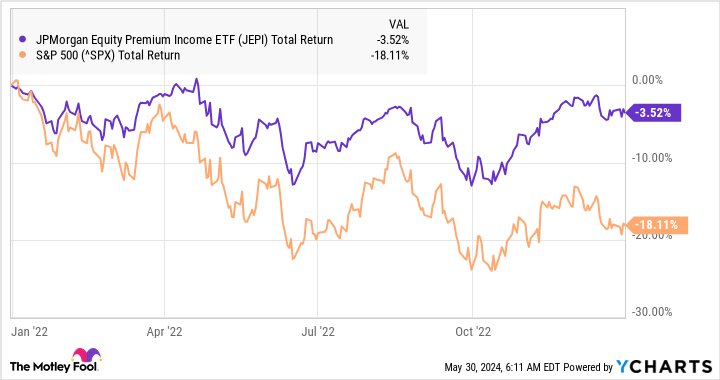

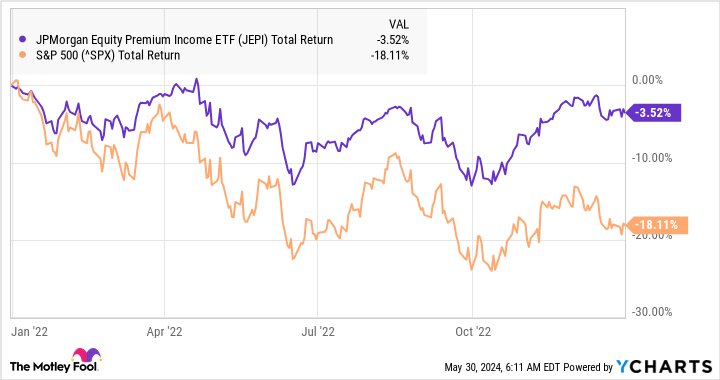

However, keep in mind that the index significantly outperformed the index during the 2022 bear market.

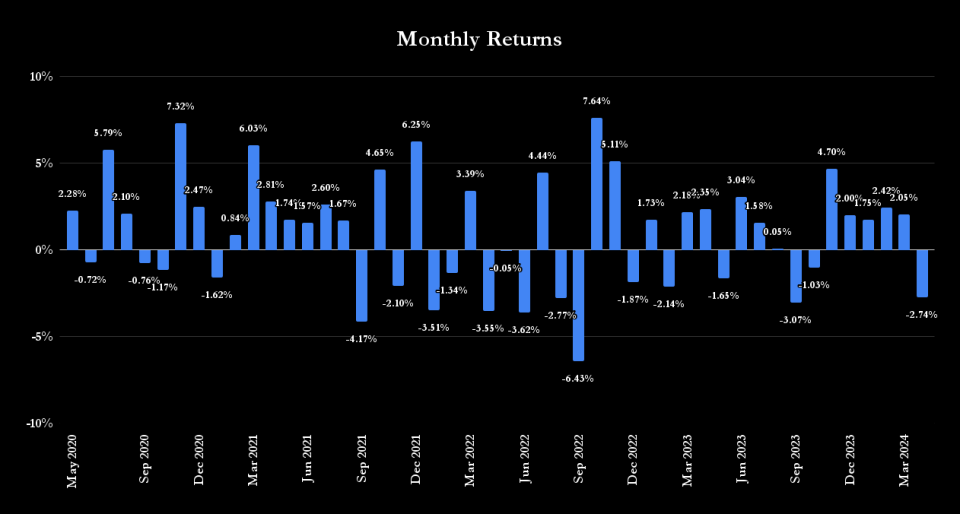

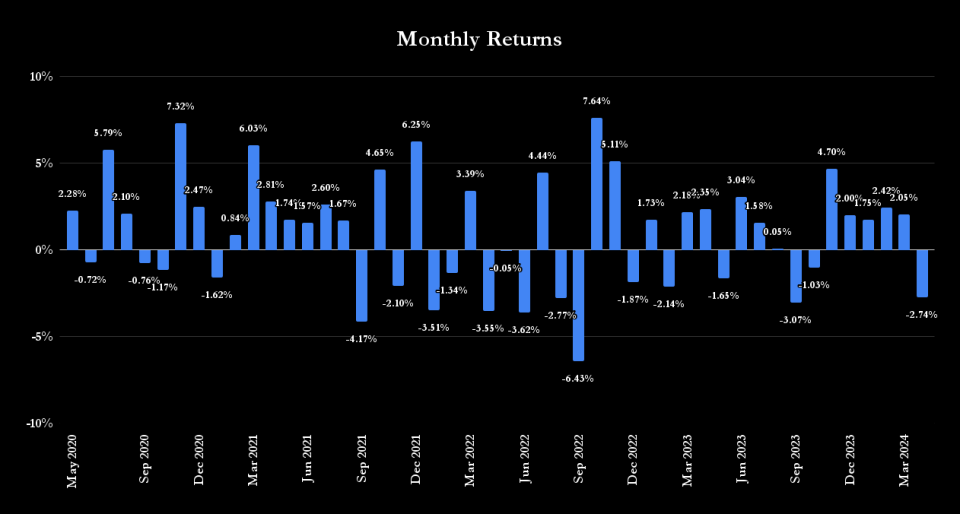

Furthermore, management is doing an excellent job of limiting negative impacts. The chart below shows the fund’s monthly returns since its inception. The maximum drawdown was 6.4% in September 2022, when the S&P 500 fell 9.6%. The ETF has had just one month since inception with a drawdown of over 4%.

How to think about investing in the fund

This ETF is unlikely to outperform in bull markets, even on a total return basis. As such, it is probably not an ETF for aggressive and bullish investors.

However, it is suitable for investors looking for a reliable monthly income and relatively low volatility. That said, investors should consider reinvesting the dividend because, as the chart below shows, the ETF would have significantly underperformed since inception without reinvesting the dividends.

While there are risks (the equity portfolio is actively managed so there is an element of managerial skill involved, and there is counterparty risk with ELNs in the event of a financial crash), the ETF’s performance indicates that it is can achieve objectives. However, investors should consider reinvesting at least some of the dividends in the ETF to reap the full benefit of the strategy.

Should You Invest $1,000 in the JPMorgan Equity Premium Income ETF Now?

Before you buy shares in the JPMorgan Equity Premium Income ETF, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and the JPMorgan Equity Premium Income ETF wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $704,612!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

Lee Samaha has no positions in the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

An ETF with a 7.7% yield is very attractive, but here’s what you need to know before you buy. originally published by The Motley Fool