Artificial intelligence (AI) has taken the tech world by storm over the past eighteen months. The popularity of OpenAI’s ChatGPT and other generative AI tools has pushed it into the mainstream and made it an unavoidable topic in the technology and business world.

The biggest beneficiary of this new AI hype is Nvidia (NASDAQ: NVDA). The share prices of a company of this size are some of the best you will ever see. It is up nearly 620% in the past two years and more than 160% this year, making it the third most valuable company in the world, with a market capitalization of more than $3.2 trillion as of June 17.

Nvidia’s impressive rally was great news for its investors, but with its high valuation outpacing even the most optimistic fundamentals, the stock could be due for a correction. But do not worry. There are plenty of companies involved in AI that are making great investments.

Here are three to consider now:

1. Semiconductor manufacturing in Taiwan

Taiwanese semiconductor manufacturing (NYSE: TSM)or TSMC for short, is the world’s largest semiconductor foundry and a company that I would say flies under the radar when it comes to its importance to the tech world.

While Nvidia has received a lot of attention, it cannot be overstated how important TSMC is to its business. People are flocking to Nvidia for its powerful GPUs, which are needed to train and power AI applications. However, TSMC produces the high-end chips that Nvidia uses for its GPUs.

Can Nvidia and others buy chips from another manufacturer? Certainly. Will these chips be as advanced and efficient as those from TSMC? Unlikely. The chips are essentially the foundation of the AI ecosystem. Take them away, and every part of the AI pipeline becomes less effective.

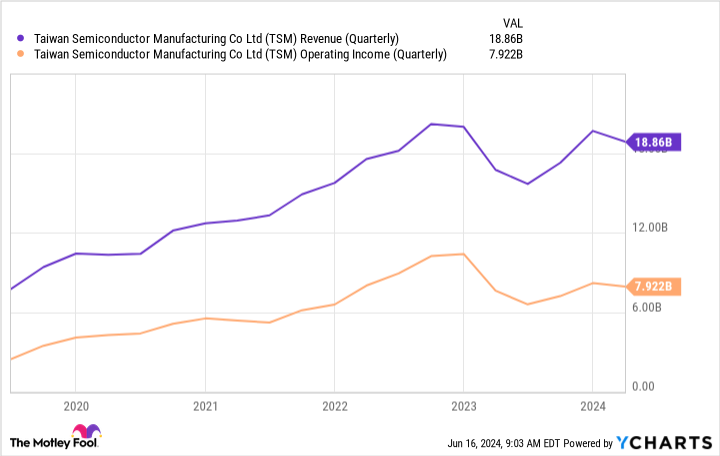

The company’s CEO said he expects sales of some of its AI processors to more than double this year and account for a low percentage of total sales. That’s great news after it saw its revenue and operating profit decline last year due to a weak smartphone and PC market.

2. Amazon

Amazon (NASDAQ: AMZN) has been using AI for a while now for everything from Alexa to store recommendations to aligning supply chain logistics.

The real profit maker is the cloud platform Amazon Web Services (AWS). Although it only generated nearly 16% of the company’s revenue in the first quarter, it accounted for more than 61% of operating income. AWS can also benefit the most from AI improvements.

It is the leading cloud platform, with a 31% market share, and tops the number two spot ahead of Azure Microsoft (NASDAQ: MSFT) at 25%. While Amazon has expanded AWS to include AI features, the way it uses the platform to enable companies to develop and scale their own AI applications could be a huge growth driver for the near future.

For example, with Amazon SageMaker, companies can do that build, train, and deploy machine learning (ML) models for virtually any purpose. Amazon Bedrock offers companies the opportunity to do that build and scale generative AI applications that transform their operations and customer experiences.

By providing the infrastructure and tools companies need to leverage AI, AWS is becoming an important part of the technology ecosystem. As Amazon continues to innovate and expand its AI capabilities and infrastructure, it should remain a major player in the technology world.

3.Microsoft

Perhaps more than any other technology company, Microsoft has done an excellent job of diversifying its business and building a comprehensive suite of products and services. That’s largely why it has had so much sustained success over the decades and is now the most valuable publicly traded company in the world.

The tech powerhouse has its hand in many aspects of the business world. Companies rely on it for productivity tools (including Excel, Word, and Teams), enterprise software (Dynamics365), cloud services (Azure), recruiting (LinkedIn), operating systems (Windows), and other essential business applications.

After signing a partnership with OpenAI that gives Microsoft exclusive licenses to OpenAI’s major language models (LLMs), the company has the opportunity to strengthen its product suite and maintain its strong position in the world of enterprise technology.

Microsoft stock seems like a no-brainer for long-term investors, even with its relatively expensive valuation. The stock has been priced well above average in recent years, but AI – and the efficiency gains that should come with it – should provide the company with new growth opportunities and continue its strong rise with its cloud platform.

Microsoft is a stock you can buy with confidence and hold for the long term. It has excellent financial health, a history of consistent growth, and its importance to the business world means it won’t be easily replaced. It’s a trifecta you can’t go wrong with today.

Should You Invest $1,000 in Amazon Now?

Before you buy stock in Amazon, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $830,777!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Stefon Walters has positions at Microsoft. The Motley Fool holds positions in and recommends Amazon, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

An Nvidia correction may be unavoidable. Here are 3 artificial intelligence (AI) stocks I would buy instead. was originally published by The Motley Fool