Apple Inc (NASDAQ:AAPL), Qualcomm Inc (NASDAQ:QCOM), Nvidia Corp (NASDAQ:NVDA), and Advanced Microdevices, Inc (NASDAQ:AMD) are almost fully booked Taiwan Semiconductor Manufacturing Company Ltd (NYSE:TSM) 3nm chip manufacturing process through 2026, reflecting the frenzy of artificial intelligence.

This demand spike reflects the rapid evolution of AI technology, pushing TSMC to further innovate in advanced manufacturing, TechNode reports.

N3E, which began mass production last quarter, focuses on AI accelerators, advanced smartphones and data centers. N3P, which will go into mass production later this year, will focus on mobile devices and consumer electronics. This will probably be the standard by 2026.

To meet growing demand, TSMC plans to convert approximately 5nm equipment to increase 3nm production capacity, potentially increasing 3nm wafer production to between 120,000 and 180,000 units per month . TSMC stock is trading higher on Thursday.

The contract chipmaker continues to expand its geographic footprint beyond Taiwan. Recent reports indicated that TSMC is looking to hire 2,000 employees in Europe, coinciding with its plans to build a wafer factory in Dresden.

Moreover, TSMC has significantly beaten the leading Chinese chipmaker Semiconductor Manufacturing International Corp (SMIC), with a market share of 62% in the first quarter. It posted 30% revenue growth to $7.1 billion in May as intense demand for AI shows no sign of going away anytime soon.

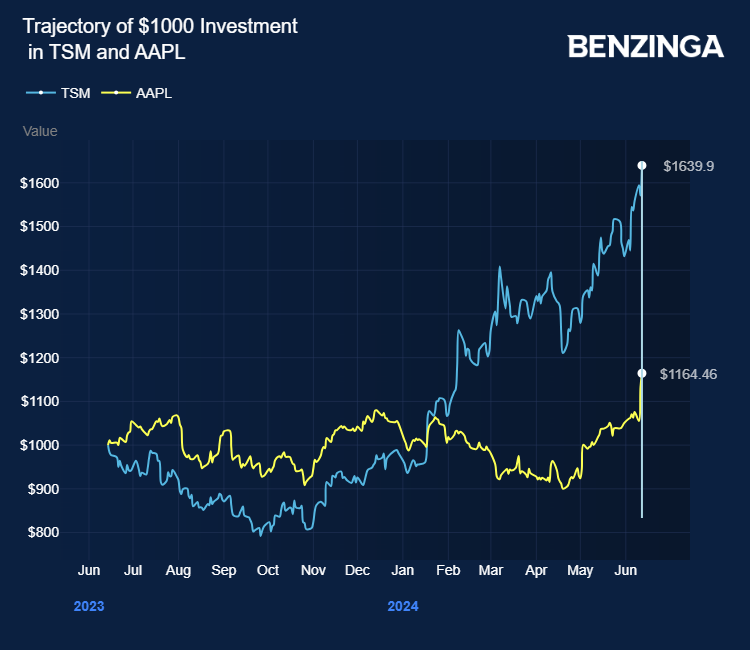

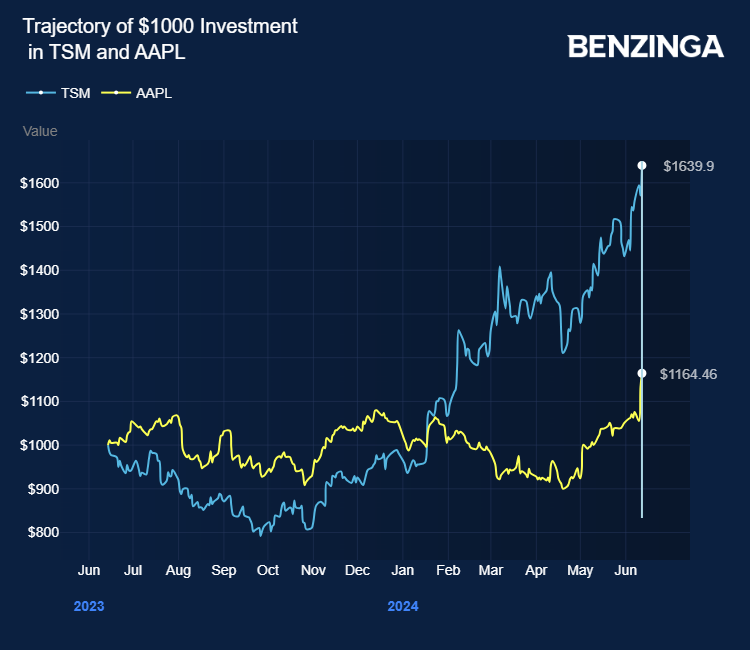

Shares of Taiwan Semiconductor are up 62% in the past twelve months. Investors can gain exposure to the semiconductor sector through First Trust Exchange-Traded Fund VIII First Trust Active Global Quality Income ETF (NYSE:AGQI) and First Trust S-Network Electric & Future Vehicle Ecosystem ETF (NASDAQ: CARZ).

Price promotion: TSM shares were trading 0.99% higher at $174.70 premarket at last check on Thursday.

Disclaimer: This content was produced in part using AI tools and was reviewed and published by Benzinga’s editorial staff.

Photo by Ivan Marc via Shutterstock

“SECRET WEAPON OF ACTIVE INVESTORS” Boost your stock market game with the #1 trading tool for “news & everything else”: Benzinga Pro – Click here to start your 14-day trial now!

Want the latest stock analysis from Benzinga?

This article Apple, Nvidia Secure the Future with Taiwan Semi’s Advanced Chips as AI Demand Rises originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.