As two of the largest and most prolific drug manufacturers in the world, Pfizer (NYSE:PFE) And AstraZeneca (NASDAQ: AZN) both have big visions of how they can become even bigger in the coming years. And with billions of dollars spent on research and development, it is almost certain that this will lead to the discovery of new golden goose drugs that should enrich shareholders.

But for investors, the details of how those billions will be spent and how the winning therapies will be found are crucial. And on that basis, it seems like investors will like AstraZeneca’s plans more than Pfizer’s. Let’s explore why that is the case.

These ambitions are bigger and better

Pfizer’s strategic plan for 2030 is to grow total revenue by at least $45 billion, using a combination of internal research and development (R&D) and business development activities such as acquisitions, licensing agreements, collaborations and the purchase of attractive pharmaceutical assets.

While the vision calls for continuing to compete in many of the same segments as before, cancer medicines are an area of particular focus. If all goes according to plan, the company will produce at least eight new blockbuster drugs before the end of this decade.

In 2023, Pfizer generated $58.5 billion in revenue. Therefore, the goal is to reach $103.5 billion in sales. That means it hopes to recapture the glory days of 2022, when annual sales topped just over $100 billion thanks to incredible demand for its coronavirus vaccines and antiviral pills. However, it will take years of focused effort to surpass its record highs in sales.

On the other hand, AstraZeneca’s latest strategic plan is even more ambitious. Sales reached $45.8 billion in 2023; Management now hopes to reach $80 billion by 2030, launching at least 20 new drugs. Twelve of these new drugs each have the potential to generate at least $5 billion in annual sales.

If management is to be believed, the company doesn’t need to do too much to achieve its goals, other than executing the core pipeline as it exists now. Cancer medicines, rare disease therapies and biologics will be the areas of focus.

And while there are some plans for collaborations, acquisitions and licensing deals along the way, AstraZeneca’s overall approach doesn’t emphasize the need to do extensive business development work. So it probably won’t have to take out much debt, leaving more capital to invest in growth or return to shareholders in the coming years.

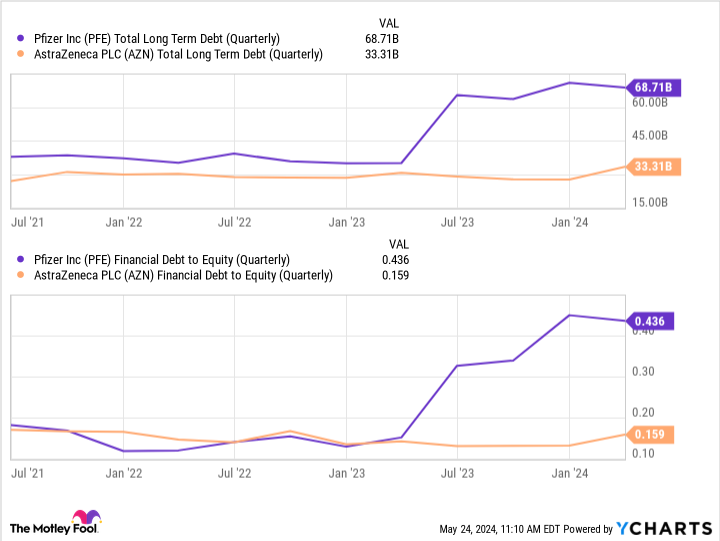

To see how this will differentiate AstraZeneca from Pfizer, check out this chart (can you guess when Pfizer started taking steps to acquire companies as part of its strategic roadmap?):

Ultimately, that money will have to be repaid, and the process will likely take a long time. AstraZeneca won’t have that challenge and will likely have more high-profile drugs on the market by 2030.

Don’t get too lost in the weeds here

All of the above factors mean that AstraZeneca shares are likely to sustainably outperform Pfizer’s if clinical trials go as expected and ultimately produce profitable drugs.

Direct competition between the companies, most likely in the field of antibody-drug conjugates (ADCs) for cancer, could result in one company gaining the upper hand over its shares in specific markets. But from an investment perspective, AstraZeneca still looks better.

Undertaking extensive business development activities to keep the pipeline filled with promising programs is nothing new in the pharmaceutical industry. But need to do this, as Pfizer’s leaders seem to think, shows a subtle lack of confidence in the consistency of the company’s pipeline (both in terms of volume and quality). And nothing is more important to a pharmaceutical company than a healthy pipeline.

Based on the ambitions of these companies, it is therefore safer to buy AstraZeneca shares than Pfizer in the coming years. Pfizer’s grand plan is unlikely to fail. But – especially if you want to invest in something that will grow consistently – it now looks like AstraZeneca is a better option.

Should You Invest $1,000 in AstraZeneca Plc Now?

Before buying shares in AstraZeneca Plc, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and AstraZeneca Plc wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $697,878!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 28, 2024

Alex Carchidi has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in Pfizer. The Motley Fool recommends AstraZeneca Plc. The Motley Fool has a disclosure policy.

AstraZeneca has simply improved Pfizer enormously. Here’s What It Means for the Stock was originally published by The Motley Fool