There is no denying that investing in Nvidia (NASDAQ: NVDA) stocks have been a boon for long-term shareholders. The stock is up nearly 23,000% since 2014, and growth has accelerated recently. The shares are up 112% so far this year (at the time of writing), almost ten times the gains of the S&P500adding to his brutal run.

Several catalysts have conspired to send stocks higher over the past decade. Nvidia’s graphics processing units (GPUs) have long been the gold standard for serious gamers. However, Nvidia has adapted its advanced chips to accelerate data over the air, becoming the go-to for data centers and cloud computing. GPUs have also proven their skills in dealing with artificial intelligence (AI), and adoption is spreading like wildfire, fueling the stock’s recent rally.

What does this mean for investors who were on the sidelines during Nvidia’s blistering run? Is there any more upside for this market darling, or has that train already left the station? Let’s examine the evidence.

A long track record of performance

Without further investigation, you could easily conclude that you’ve already missed your chance with Nvidia, but investors have been making the same mistake for years. One of the keys to the company’s continued success is its ability to find new and innovative ways to adapt its technology. Nvidia’s previous work with machine learning and other areas of AI laid the foundation for the company’s current success with the explosive demand for generative AI.

Nvidia’s secret sauce is its mastery of parallel processing, or the ability to perform a large number of mathematical calculations simultaneously. The company pioneered this technology to generate lifelike visuals in video games, but it proved equally adept at data center and cloud computing applications and had the raw computing power needed for the rigors of AI.

More relevant to the question at hand is that these markets all have potential upside, which could drive Nvidia stock even higher.

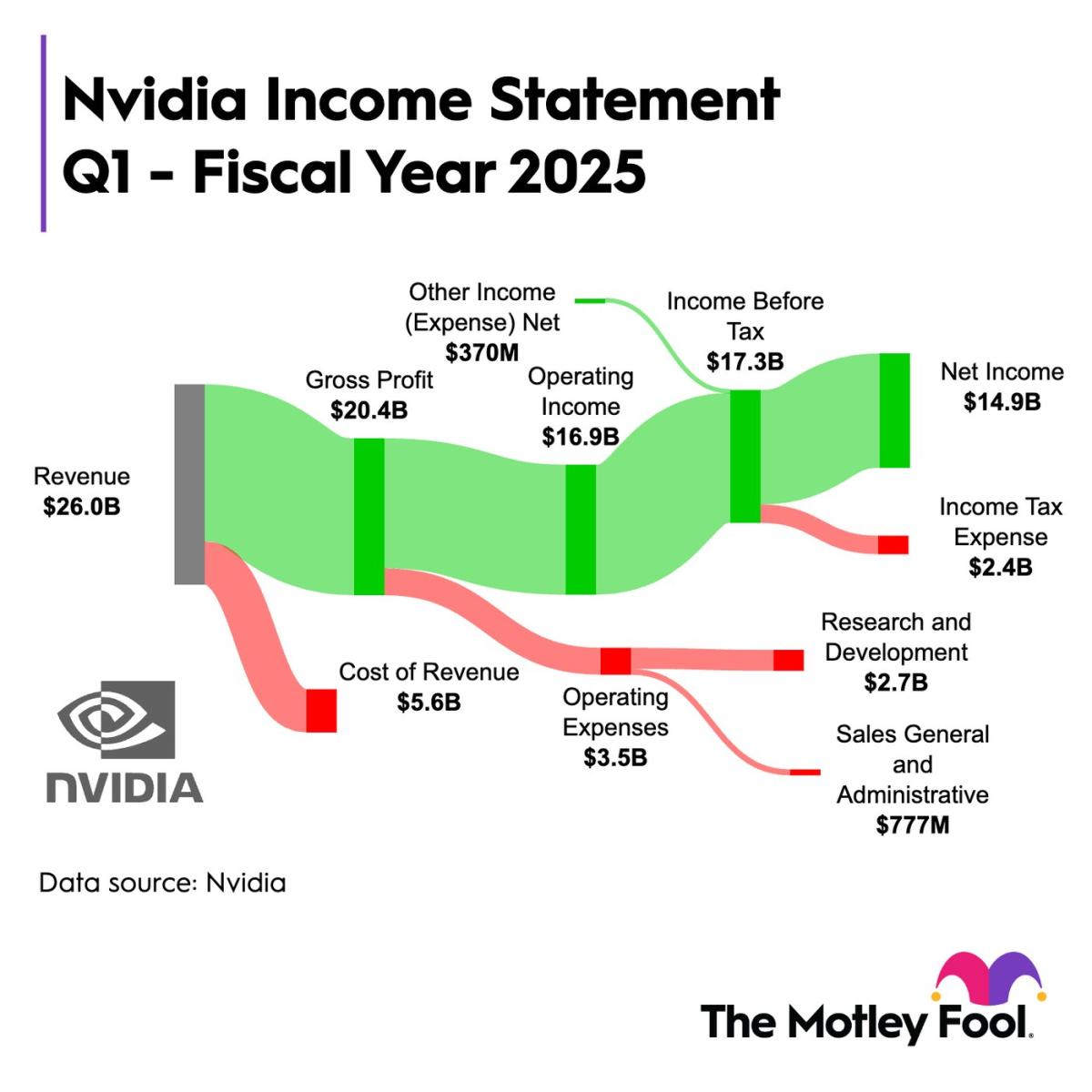

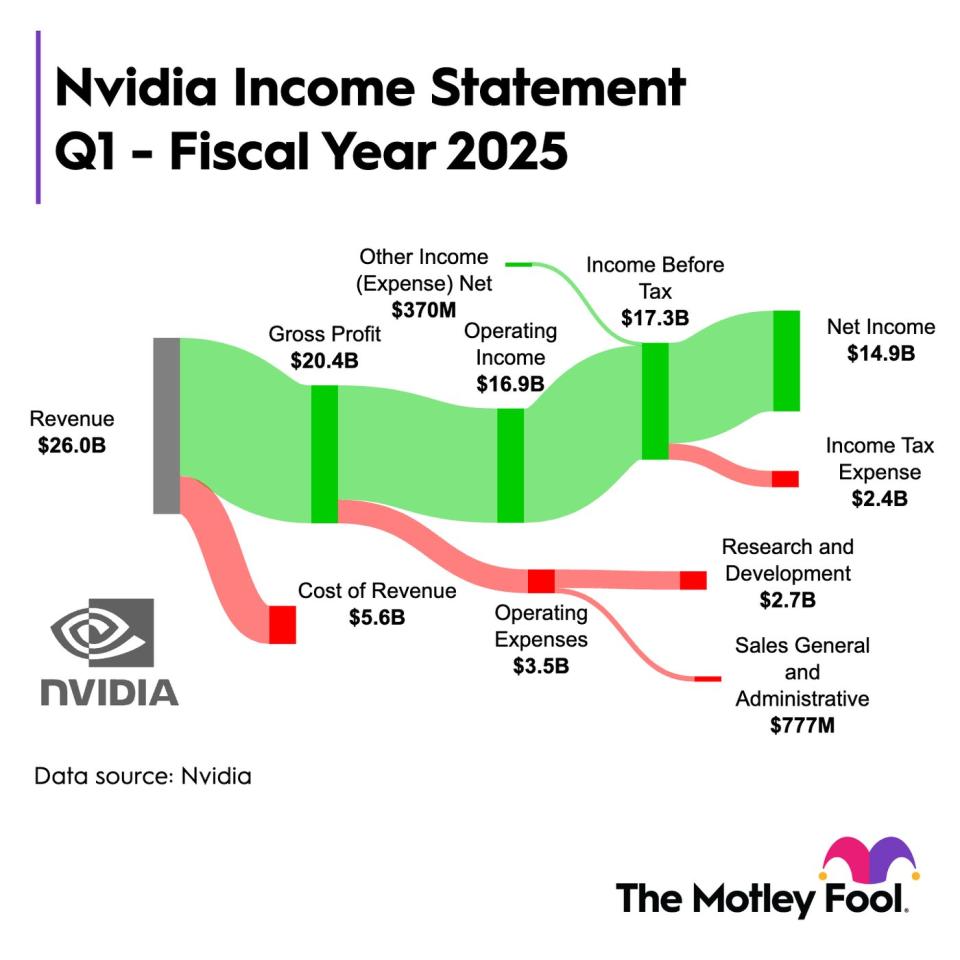

The company’s recent financial report provides ample evidence to support this claim. In the first quarter of 2025 (ended April 28), Nvidia generated a record quarterly revenue of $26 billion, up 262% year over year. The results were primarily driven by the data center segment, including AI, which delivered record revenues of $22.6 billion, an increase of 427%. The premium continued to feed into operating income as diluted earnings per share (EPS) rose 629% from $5.98.

For investors worried that the rally is on its last legs, Nvidia’s prospects should ease concerns. For the second quarter, management forecasts record revenue of $28 billion, which would represent year-over-year growth of 107%. Management even announced a stock split to make the sky-high share price more affordable. While investors shouldn’t expect these triple-digit increases to continue, this clearly shows that Nvidia’s growth is far from over.

More room to run

Nvidia’s two biggest opportunities are generative AI and data centers.

Generative AI adoption, while robust, is still in its early stages. Estimates vary widely on the opportunities, but one of the more conservative approaches suggests that the generative AI market will grow to between $2.6 trillion and $4.4 trillion in the coming years, according to global management consulting firm McKinsey & Company. As a leading supplier of processors used for AI, Nvidia will benefit from these long-term tailwinds.

Additionally, the data center industry is in the midst of one of the largest upgrade cycles ever. bank of America Analyst Ruplu Bhattacharya estimates that the market will grow 50% annually over the next three years. Nvidia controls an estimated 92% of the market for GPUs used in data centers, suggesting it has a long and lucrative road ahead.

These two markets should continue to drive Nvidia’s growth. This illustrates the enormous opportunities before us and why they are happening is not it’s too late to buy Nvidia stock, even at a new all-time high.

What about the rating?

Nvidia’s high rating is undeniable. It’s currently selling for 89 times earnings, but that requires context.

The company has achieved triple-digit growth for four consecutive quarters and is setting the stage for the next quarter. The forward-looking numbers are much more reasonable, as Nvidia has a price-to-earnings (P/E) ratio of 39, although this is still higher than the S&P 500’s multiple of 27.

But while the valuation may seem unreasonable at first glance, it’s not really an apples-to-apples comparison. As mentioned, Nvidia has outperformed the S&P by a factor of 10 over the past decade, so it has earned that premium valuation.

Given its track record of performance, industry dominance, and the size of the opportunity ahead, it’s easy to see why Nvidia stock is still a buy.

Should You Invest $1,000 in Nvidia Now?

Before you buy shares in Nvidia, consider the following:

The Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $581,764!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Danny Vena has positions at Nvidia. The Motley Fool holds positions in and recommends Bank of America and Nvidia. The Motley Fool has a disclosure policy.

At a new all-time high, is it too late to buy Nvidia stock? was originally published by The Motley Fool