Investors looking for a quick and easy way to invest in the world’s largest and fastest growing technology stocks have flocked to the Invesco QQQ Trust ETF (NASDAQ: QQQ).

The ETF tracks the Nasdaq-100 index, which consists of the largest non-financial companies listed on the Nasdaq fair. The Nasdaq has historically been the stock exchange of choice for technology companies, so it should come as no surprise that the majority of the index is made up of technology stocks.

The Invesco fund has dramatically outperformed it S&P500 index over the past ten years, delivering a total return of 435%, compared to just 248% for the broader index. Still, investors should consider a few other options before putting their money into the popular ETF. Here are three to try.

1. QQQ’s little sister

Invesco launched a new ETF in 2020 called the Invesco Nasdaq 100 ETF (NASDAQ: QQQM). It tracks the same Nasdaq-100 index as QQQ, but offers investors a 5 basis point discount on the new shares versus the older ETF.

While QQQ charges 0.20% of assets each year, the new Nasdaq-100 ETF charges just 0.15%. While that difference may not seem like much, it adds up over time, and there’s no reason for investors to leave money on the table.

Invesco does not offer investors a cheaper ETF out of kindness. The company faces much more competition than it used to when it launched the QQQ Trust in 1999. While it could easily acquire assets under management at any price in the early 2000s, today it must offer much more competitive pricing.

But there are billions tied up in the older ETF. Investors with substantial unrealized capital gains may be willing to give up a few basis points to defer taxes by not selling. Additionally, the larger asset base makes the fund more liquid, which is attractive to large investors or frequent traders.

However, if you plan to buy and hold an ETF that tracks the Nasdaq-100 index, QQQM is a no-brainer compared to QQQ.

2. A contrarian ETF focused on fundamentals

If you look under the hood of the Invesco QQQ Trust, you will find a highly concentrated portfolio. The top 10 investments account for more than 50% of the entire fund. Furthermore, many of the largest holding companies are trading at high prices that are inconsistent with their fundamental financial performance.

One way to offset the high concentration and prices of the QQQ Trust is to invest in the Schwab Fundamental US ETF for large companies (NYSEMKT: FNDX). The ETF tracks an index that ranks and weights securities based on fundamental factors: adjusted sales, operating cash flow and cash returned to shareholders. The result is a portfolio with much less concentration and a lower overall price compared to fundamentals.

The Schwab fund has a price-to-earnings ratio of just 19.4 times, compared to the Invesco fund’s 39.5 times price-to-earnings ratio. While it still has substantial holdings in some of the Nasdaq-100’s biggest names, it is also integrating more value stocks into the portfolio. In fact, the focus on fundamentals means the fund is more focused on large-cap value stocks than the growth-focused Invesco fund. But that diversification can pay off for investors in the long run.

The Schwab ETF has an expense ratio of 0.25%, higher than the Invesco QQQ ETF. But the contrarian play could pay off for patient investors.

3. A small-cap value ETF

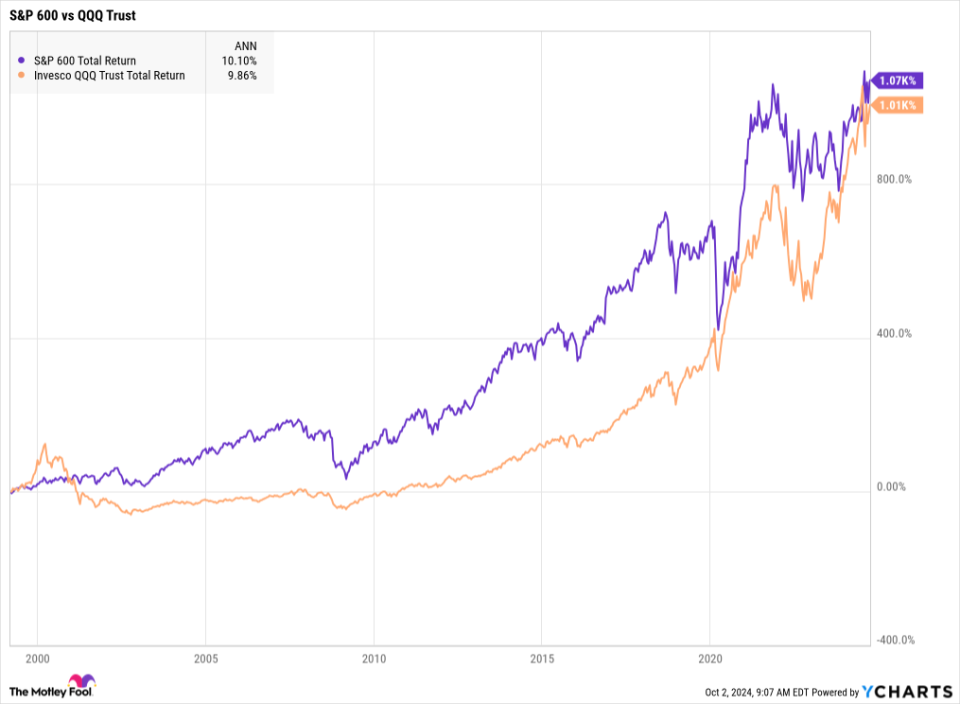

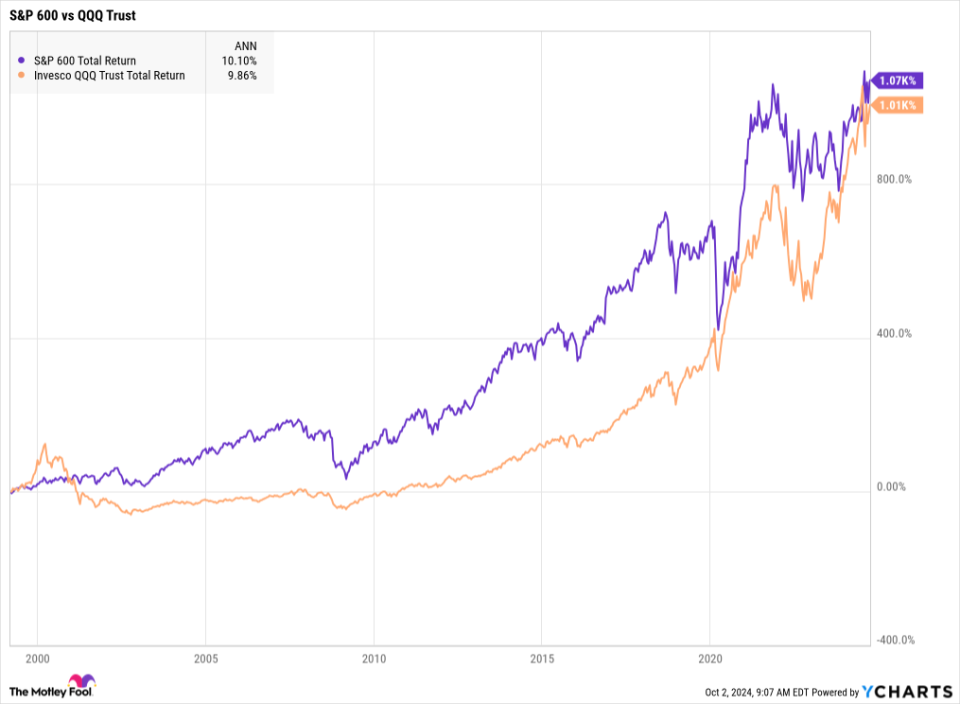

The biggest appeal of the Invesco QQQ Trust ETF is its strong track record of returns. But one group of stocks has an even better track record than the large-cap growth stocks of the Nasdaq-100. Small-cap value stocks have historically delivered the strongest returns in any segment of the stock market. The S&P600 The index, which skews toward small-cap value, has outperformed the Invesco QQQ Trust ETF since its inception in 1999, despite the Nasdaq ETF’s incredible performance over the past decade.

The Avantis American Small Cap Value ETF (NYSEMKT: AVUV) is one of the best ways to invest in small cap value stocks. Rather than blindly investing in all small-cap stocks that trade at a valuation benchmark in the bottom half of a small-cap index, the fund screens stocks based on profitability to eliminate potential value pitfalls. It then invests in the remaining companies based on market capitalization. With more than 700 shares in the portfolio, no single investment represents more than 1% of the fund.

Although the Avantis Fund is technically an actively managed fund, it shares many more characteristics with passive indexing than with active management. The strategy has an excellent track record of performance, based on the founder’s previous experience at investment firm Dimensional. The Avantis fund has almost doubled the return of its benchmark index since its inception in 2019.

For long-term investors looking for exposure to a part of the market that could provide stronger returns than the S&P 500 or the Nasdaq-100 for many years to come, the Avantis US Small Cap Value ETF could be a great option.

Should you invest $1,000 in Invesco QQQ Trust now?

Consider the following before purchasing shares in Invesco QQQ Trust:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Invesco QQQ Trust wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 30, 2024

Adam Levy holds positions in American Century ETF Trust-Avantis Us Small Cap Value ETF. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Before you buy the Invesco QQQ ETF, here are three others to try first. originally published by The Motley Fool