Both Sound dog (NASDAQ: ZOE) And Nvidia (NASDAQ: NVDA) are direct beneficiaries of AI. One is producing the chips needed to power our AI future. The other has developed its own proprietary AI platform that could power everything from cars to drive-through windows.

If you want to bet on AI, it makes sense to buy shares in both companies. But there are some serious differences that should inform your investment strategy.

Do you want maximum growth potential?

If you want maximum growth potential, SoundHound is the clear choice. The math isn’t complicated. SoundHound’s market cap is currently around $1.3 billion. Nvidia’s valuation, meanwhile, is closer to $3 trillion. Just by virtue of its size, SoundHound stock has a much better chance of rising another 1,000% than Nvidia. For its stock to rise 10x, Nvidia would have to add more value than Microsoft, Meta platforms, AppleAnd Amazon combined — and then some. SoundHound, meanwhile, would only need to add 0.3% of Nvidia’s current value.

Simply put, SoundHound’s small size gives it more potential upside than Nvidia. But will SoundHound be able to realize that potential upside? There’s one factor that works mightily in its favor. And that’s the relevance of SoundHound’s platform across a wide range of industries.

At its core, the company’s technology enables sound and speech recognition, plus natural language understanding that enables AI-driven responses. Imagine ordering food from an AI-powered drive-thru, talking to your car about maintenance issues, or simply selecting a song. You could also discuss with your TV what shows to watch next. SoundHound actually has contracts with companies working on these problems, with a total backlog of nearly $700 million — that’s up from about $330 million just a year ago.

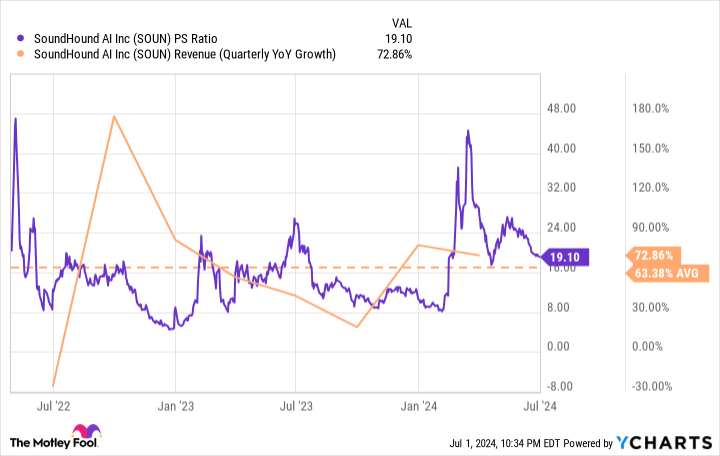

Despite all its potential, SoundHound stock isn’t priced for perfection. Shares trade at a lofty 19 times revenue, but revenue growth has averaged about 60% per year. There’s a good chance that double-digit growth rates will continue for a decade or more, a future that would make the current premium valuation seem reasonable in retrospect. Emerging tech companies like this tend to exhibit a lot of short-term volatility, but patient investors looking for maximum growth potential will be pleased with what they see.

Go all-in on artificial intelligence

Nvidia has little to prove at this point. In a very short time, the company has become the largest AI stock in the world, with a huge percentage of its business dependent on growth in the AI industry.

“In fiscal year 2022 (which ended in January 2022), Nvidia generated 46% of its revenue from its gaming GPUs, 39% from its data center GPUs, and the rest from its professional visualization, automotive, and OEM chips,” explains fellow Fool contributor Leo Sun. Oh, how quickly that split changed. For the first fiscal quarter of 2025, Nvidia generated 87% of its revenue from data center chips and just 13% from everything else, including gaming.

“It generated $22.6 billion in data center revenue in that single quarter, compared to total revenue of nearly $27 billion for all of fiscal year 2023,” Sun noted. “That breakneck expansion transformed Nvidia from a more diversified GPU maker to an all-in player in AI chips.”

This all-in approach certainly has its risks. Over the past five years, Nvidia’s valuation has risen from around 10 times revenue to nearly 40 times revenue. The company’s growth numbers – revenue grew 262% year-over-year in the most recent quarter (Q1 of FY 2025) – have more than justified the multiple’s increase. Still, there’s no denying that Nvidia’s stock price now depends on two things. First, a continued massive ramp-up in AI spending. Second, its ability to maintain its dominant market leadership.

Over the decades, chip wars have produced many repeat winners and losers. Just look at the long-term price charts of AMD, Inteland Nvidia. Today’s winners and losers won’t necessarily stay that way forever, even if the transition takes years to occur. AMD’s MI300 Instinct GPUs already beat Nvidia’s H100 GPUs on several benchmarks, as do Intel’s Gaudi 3 AI accelerators. Nvidia’s next-generation Blackwell chip is hitting the market now, and may just stem the tide of rising rivals.

Make no mistake: Nvidia is still a great investment for those bullish on AI. But if you’re looking for the best bang for your buck, don’t ignore lesser-known stocks like SoundHound.

Should You Invest $1,000 in Nvidia Now?

Before you buy Nvidia stock, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $786,046!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 2, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former chief market development officer and spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Apple, Meta Platforms, Microsoft and Nvidia. The Motley Fool recommends Intel and recommends the following options: long Jan 2025 $45 calls on Intel, long Jan 2026 $395 calls on Microsoft, short Aug 2024 $35 calls on Intel and short Jan 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Better AI Stocks: Nvidia vs. SoundHound was originally published by The Motley Fool