If there’s one thing Wall Street doesn’t lack, it’s data. Between earnings season and the monthly release of economic data, it can be easy for investors to become overwhelmed and miss something important.

About five weeks ago, during the heart of earnings season, perhaps the most important data release of the quarter took place. I’m talking about the May 15 deadline for institutions to file Form 13F with the Securities and Exchange Commission. A 13F gives investors an under-the-hood look at what Wall Street’s smartest and most successful money managers bought and sold in the last quarter (in this case, the quarter ending March 31).

As you can imagine, investors pay most of their attention to what Wall Street’s smartest billionaire investors are doing. This includes Bill Ackman of Pershing Square Capital Management, who oversees more than $10 billion in invested assets for his fund.

Unlike most billionaire investors, who oversee investments in dozens or hundreds of stocks, Ackman has historically managed a tight portfolio of six to 12 holdings. He puts his fund’s capital to work in companies he believes are undervalued, usually building a stake large enough to earn board seats and/or influence the strategic direction of the companies he bets on. In many ways, Ackman can be considered an activist investor.

As of March 31, Pershing Square Capital Management had stakes in six companies and seven securities (Ackman’s fund owns both types of stocks). Alphabet‘s stock). But the most surprising move of the first quarter is Ackman selling nearly 10% of Pershing Square’s stake in its largest (20.1% of invested assets) and longest-held position: Chipotle Mexican Grill (NYSE: CMG).

This sizzling stock split is on deck

The 81,014 shares Ackman’s fund sold in the fast-casual restaurant chain Chipotle during the quarter ended in March reduced Pershing Square’s remaining stake to 743,984 shares. Based on Chipotle’s June 18 closing price of nearly $3,428, this position is currently worth a whopping $2.55 billion.

Shares of Chipotle Mexican Grill are doing so well that the board announced its first-ever stock split on March 19. A “stock split” is an event that allows a publicly traded company to change its stock price and the number of shares outstanding without affecting its market capitalization or operating performance. In the case of Chipotle, it is conducting a 50-for-1 stock split, which will increase the number of shares by a factor of 50 and reduce the stock price to 1/50th of its value on the day it becomes effective (after the closing date). call on June 25).

Next to the behemoth of artificial intelligence (AI). Nvidiawhich completed a 10-to-1 stock split on June 7, Chipotle is one of the most anticipated and popular stock split stocks on Wall Street.

The more than 15,000% increase in Chipotle’s stock since its IPO was valued at $22 in January 2006 is largely the result of management understanding its customer base, keeping things simple and letting innovation speak for itself.

With no freezers in its restaurants, Chipotle has kept its promise to prepare its food daily, use only responsibly sourced meats, and source its vegetables locally when it makes financial sense to do so. Just as grocery stores capitalized on the demand for organic food in the 2000s, Chipotle’s management team has realized that consumers will pay a premium for higher quality food.

The company’s menu has also remained quite small over the years. Limiting the menu was done intentionally to ensure quick meal preparation and reduce wait times in the company’s restaurants.

The final piece of the puzzle is Chipotle’s innovation. While there is only so much that can be done with food-based innovation, in 2018 the company began relying on mobile order-in drive-thru lanes (known as “Chipotlanes”). These Chipotlanes became a major source of revenue that propelled the company’s growth. growth during the COVID-19 pandemic.

The three likely reasons why Ackman is selling Chipotle stock

What prompted one of Wall Street’s most successful billionaire investors to dump nearly 10% of their stake in Chipotle?

For starters, Bill Ackman and his investment team could simply be raking in some profits after a phenomenal run for their top spot. Since the start of the third quarter of 2016, Chipotle shares have returned 770%. While we don’t know exactly what Pershing Square’s cost basis for Chipotle Mexican Grill is, Ackman’s fund appears to be sitting on an unrealized gain of more than $2 billion.

You may recall that Warren Buffett recently cut back on his stocks Berkshire Hathaway‘s interest Apple reasoning that tax rates are likely to rise in the future. It’s possible that Ackman shares a similar view and wanted to lock in a little profit. This form of selling is relatively benign.

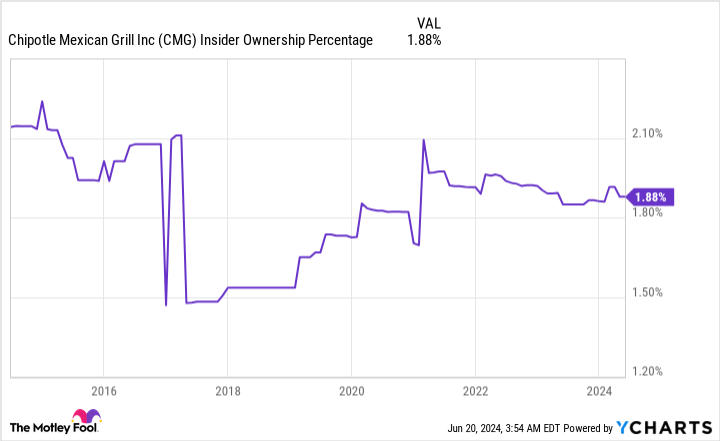

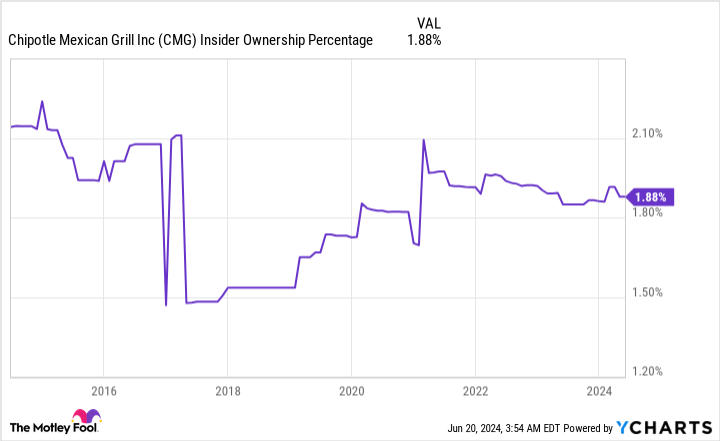

A second reason Ackman sent 81,014 shares of Chipotle Mexican Grill to the chopping block is the lack of insider ownership and buying activity. Insiders own a very small percentage of the outstanding shares, and the vast majority of insider transactions involve exercising options and selling shares. If insiders aren’t willing to buy stock in their own company, why would you?

The caveat at this point is that insider selling isn’t always bad news. For example, executing options and selling to cover a tax bill is not a red flag for investors. Nevertheless, there is only one reason why insiders buy – they believe the price of the underlying stock will rise – and there has been virtually no significant insider buying activity in Chipotle.

The biggest red flag, however, is Chipotle Mexican Grill’s rating. A fast-casual restaurant chain should not trade at respective multiples of 62 times and 51 times expected earnings for the current and next year.

While optimists are quick to point to Chipotle’s continued double-digit sales growth, it’s important to recognize that about half of this growth comes from opening new stores. During the first quarter, Chipotle’s organic growth in existing stores was 7%. While this one fantastic The organic growth rate for a chain as big as Chipotle is all the proof we need that a full-year earnings multiple of 51 isn’t justified.

Even if Chipotle continues to outperform other fast-casual restaurant chains in the operating department, the euphoria over the company’s stock split won’t last long. In other words, following Ackman’s example and reducing your stake in Chipotle could be a smart move.

Should You Invest $1,000 in Chipotle Mexican Grill Now?

Before you buy shares in Chipotle Mexican Grill, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $830,777!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Sean Williams has positions at Alphabet. The Motley Fool holds positions in and recommends Alphabet, Apple, Berkshire Hathaway, Chipotle Mexican Grill, and Nvidia. The Motley Fool has a disclosure policy.

Billionaire Bill Ackman is selling shares of one of the hottest stocks on Wall Street. Should you follow suit? was originally published by The Motley Fool