Bill Ackman is one of the most prominent billionaire investors today. When he puts money to work, the market pays attention.

He is currently betting $1.4 billion (about 13% of his entire portfolio) on one stock. This share is unknown to most and misunderstood by many. It takes some research, but there’s a reason why Ackman is willing to risk a lot of capital for his future.

This stock has a very strange history

Ackman’s pick has a household name, but the vast majority of investors can’t say what it does. The company is Howard Hughes Holdings (NYSE:HHH)named after American aerospace engineer and billionaire business magnate Howard Hughes.

Howard Hughes Holdings has a strange history. It was originally spun off from General Growth Properties in 2010. At the time, General Growth Properties was a sprawling REIT with a vast and diverse portfolio of real estate assets. To call it a business complex would be an understatement. It owned everything from New England office buildings and suburban shopping centers to air rights (the rights to build above something) on properties in Las Vegas. Management believed that the market would have a hard time accurately valuing the company as it emerged from bankruptcy, so they transferred many of these disparate assets into a company called Howard Hughes Corp, later renamed Howard Hughes Holdings.

Ackman participated in the bankruptcy of General Growth Properties at the time and was therefore appointed chairman of Howard Hughes Holdings. This is when his bet on the company began – almost 15 years ago.

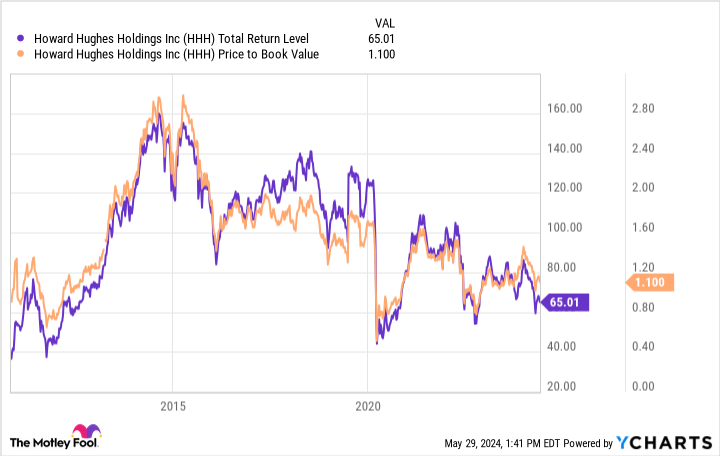

Almost immediately, the market revalued Howard Hughes’ stock, dropping its valuation from 0.4 times book value, to a 60% discount to the market value of its assets, up to 2.8 times the book value, a 180% premium. From that point on, however, the shares went back and forth over several years. They are now priced at just 1.1 times book value.

It turns out that the market is still having a hard time valuing the shares. To address this, the company recently announced that it would streamline its assets even further in an effort to become more of a Master Planned Community (MPC) company. It is this company that Ackman believes will add tremendous value to the stock in the coming years. But what exactly is an MPC company?

Ackman thinks the market doesn’t understand this stock

Master-planned communities are exactly what they sound like: communities built around a pre-designed plan. Howard Hughes owns many of these projects in places like Houston, Las Vegas, Maryland, Hawaii and Phoenix. There the company sells part of the land to commercial real estate developers and home builders. It uses these proceeds to build key strategic properties, office space, retail infrastructure, roads, schools and even fire stations. The idea is to maximize the value of raw land by building out as many value-added components as possible. The company’s success is undeniable. For example, from 2011 to 2024, the price per acre in Houston’s Woodlands MPC increased from $364 to $2,273. Howard Hughes is so good at increasing the value of its land through development that it sold 3,447 acres of land for $2.1 billion from 2017 to 2024, while the total value of its land portfolio is still increased from $3.7 billion to $4.1 billion.

MPC developments now contribute more to Howard Hughes’ profits than any other segment. But the company still owns some loose assets, such as its stake in the Lower Manhattan Seaport development, a stake in the Jean-Georges restaurant chain, ownership of the Las Vegas Aviators minor league baseball team and an 80% stake in the air rights above Fashion. Show shopping center. The company plans to spin off these assets into a separate company by the end of 2024.

When Howard Hughes was spun off from General Growth Properties, it resulted in tremendous value creation for both companies as the market was able to more accurately value the assets. The same could happen again if these additional assets are spun off from Howard Hughes this year, making the company much more of a traditional real estate company with a focus on highly profitable MPC developments.

Ackman now controls almost 38% of Howard Hughes. If his $1.4 billion bet is any indication, he thinks this year’s spinoff could quickly restore Howard Hughes’ stock price. The company’s proven success in developing MPCs should drive additional value creation in the long term. It’s a complicated investment, but Ackman seems to have a lot of confidence in it.

Should You Invest $1,000 in Howard Hughes Right Now?

Before you buy shares in Howard Hughes, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Howard Hughes wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 28, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in Howard Hughes. The Motley Fool has a disclosure policy.

Billionaire Bill Ackman just placed a one-time bet on this stock. Time to buy? was originally published by The Motley Fool