Paul Tudor Jones is a billionaire investor, probably best known for shorting the market before the stock market crash of 1987. He has traded more conservatively in recent years, but he remains an active investor.

In its 13-F for the first quarter of 2024, Jones’s Tudor Investment Corp. that it had opened a position in the memory chip maker Micron technology (NASDAQ:MU). For most of its history, Micron has been better known for its volatility, but it has started to gain traction in recent years. The question for active investors is whether they should follow Jones in this stock.

The State of Micron

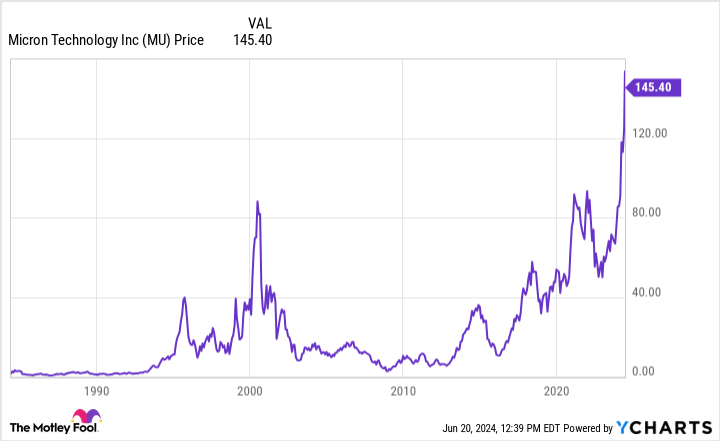

Micron is probably a once-in-a-generation gamble, as it took about a generation to return to record highs. The memory chip market is the most volatile part of the semiconductor industry. After making gains during the 2000 Internet bubble, Micron’s technology stocks struggled when down cycles in the semiconductor industry wiped out all the stock market gains in that sector between the mid-1990s and the mid-2010s.

The factor likely driving Jones and other investors to Micron stock, however, is the rise of artificial intelligence (AI). Thanks to AI, Micron is benefiting from a long-awaited increase in global demand for memory chips. It reinforced this demand by working with Nvidia and producing a high-bandwidth memory (HBM) semiconductor that will support Nvidia’s next generation H200 GPUs.

Jones’ investment began in the first quarter of this year, likely around the time Micron and Nvidia made that announcement. Thanks to this deal, Micron is up about 75% since the beginning of this year, sending its stock to record highs.

Effects on the financial situation

Production of the HBM chip has only just started, so it is still too early to see the effects. However, revenue for the first two quarters of fiscal 2024 (ending February 29) was just under $11 billion, up 36% compared to the same period last year.

During that time, Micron limited increases in cost of goods sold and reduced operating costs. This led to a loss of $441 million in the first six months of fiscal 2024, compared to the net loss of $2.5 billion in the same period a year ago. Additionally, Micron reported a profit of $793 million in its second fiscal year, so its financial results appear to have improved without the recent Nvidia deal.

Additionally, Micron expects revenue of $6.6 billion by mid-third quarter of fiscal 2024. Considering it only reported $3.75 billion in revenue in the third quarter of fiscal 2023, Micron is likely on track to continue its recovery.

Still, Micron’s rising valuation amid its rising share price should give investors pause. Its price-to-sales ratio (P/S) rose to 9. While that’s not high for other types of semiconductor stocks, investors should keep in mind that this is Micron’s highest sales multiple in more than two decades. During the first two months of this year, the price/earnings ratio was below 6, indicating that Micron has become an expensive stock.

Should Investors Follow Jones to Micron?

Given the stock’s history, shareholders should buy cautiously if they want to invest at all. Granted, Nvidia and AI have put Micron’s stock in a secular bull market, and with revenue expected to continue rising, even the most bearish investors shouldn’t expect it to return to multi-year lows.

However, the stock is at an all-time high and a change in investor sentiment will likely cause a significant decline at some point. So investors shouldn’t consider aggressive moves in Micron until the stock enters another bear market.

Should You Invest $1,000 in Micron Technology Now?

Consider the following before purchasing shares in Micron Technology:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 24, 2024

Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Billionaire Paul Tudor Jones just placed a one-time bet on this stock. Time to buy? was originally published by The Motley Fool