There’s little doubt that artificial intelligence (AI) is the driving force behind the current market rally — and for good reason. These next-generation algorithms generate original text and images, streamline processes, and automate simple and time-consuming tasks, all with a few simple keystrokes. The potential for massive productivity boosts has businesses queuing up to see how they can best leverage AI to benefit their respective businesses.

Philippe Laffont knows a thing or two about profiting from emerging technology. The billionaire was trained under the watchful eye of hedge fund legend Julian Robertson of Tiger Global Management. Laffont runs Coatue Management, the world’s top tech-focused hedge fund, which he founded in 1999. Since then, he’s turned $50 million in seed money into a financial empire with $58 billion in assets under management. What’s more, Coatue has far outpaced the broader market, with an annual return of 14% over the past three years, compared with 8% for the S&P 500.

Laffont is convinced that AI will be one of the most important investment themes of the coming decade. And he puts his money where his word is: Coatue’s five top AI stocks are his top five investments.

Artificial Intelligence Share #1: Meta Platforms — 8.2% of holdings

Meta platforms (NASDAQ: META) is Coatue’s largest AI holding — and largest overall position, with nearly 4.2 million shares worth more than $2.1 billion. Laffont trimmed the position by 3%, but second-quarter gains left the position relatively unchanged. It’s not surprising that Meta is his largest position, given the company’s long track record of using AI to its advantage. From surfacing relevant content on its social media platforms to recognizing and tagging people in photos, Meta was an early adopter of earlier branches of AI.

The company is an outlier among its big tech peers, as Meta doesn’t have a cloud infrastructure service to sell its AI. That didn’t stop the company from creating its own Large Language Model Meta AI (Llama), which is available on all major cloud services — for a fee. Ads make up the lion’s share of Meta’s revenue, so the company offers a growing suite of free-to-use AI tools to help marketers succeed on its platforms, keeping them coming back for more.

Improving economic conditions are already taking the digital advertising business to the next level. And at just 24 times forward earnings, Meta is cheap given the huge opportunity.

Artificial Intelligence Stock #2: Amazon — 8.1% of holdings

Amazon (NASDAQ: AMZN) was already Laffont’s second-largest position, but he increased it by 7% in Q2. The total now stands at about 10.8 million shares, worth nearly $2.1 billion. The e-commerce and cloud giant also has a long history of deploying AI. Amazon uses AI to find relevant products for its online shoppers, recommend programming choices to its Prime Video and Music audiences, determine the most efficient delivery routes for its e-commerce shipments, and plan inventory levels in its warehouses, among other uses. More recently, Amazon released generative AI tools to answer shopper questions and help sellers create compelling product descriptions.

Let’s not forget Amazon Web Services (AWS), which launched Bedrock AI to offer the most popular generative AI models to its cloud customers. The company also created AI-specific chips — called Inferentia and Trainium — to accelerate AI processing on AWS.

The improving economics are expected to be a boon for Amazon, and AI will undoubtedly play a role in its success. And at less than 3x sales, the price is right.

Artificial Intelligence Share No. 3: Taiwan Semiconductor Manufacturing — 7.7% of holdings

Taiwanese semiconductor production (NYSE:TSM)Often referred to as TSMC, Coatue is “the world’s largest and best semiconductor foundry,” according to the company. Given that state-of-the-art chips are at the heart of AI processing, it’s no surprise that TSMC is Laffont’s third-largest position. He added more than 1 million shares in the second quarter, increasing his holdings by 10%. Coatue’s position now stands at 11.4 million shares, worth about $2 billion.

The accelerated adoption of AI has increased demand for the world’s most advanced processors. TSMC dominates the semiconductor foundry sector, with an estimated 62% share of the market. More importantly, the company produces about 92% of the world’s most advanced chips, including most of the processors used for AI.

Given TSMC’s pivotal role in the industry and the widespread belief that the AI revolution is still in its infancy, the coming years should deliver a windfall for the company — and its shareholders. And at just 25 times forward earnings, TSMC is still fairly priced.

Artificial Intelligence Stock #4: Nvidia — 6.6% of holdings

Nvidia (NASDAQ: NVDA) could be the standard-bearer for the AI revolution, so it makes sense that it would play a prominent role in Laffont’s portfolio. Coatue trimmed his position by less than 1% in the second quarter, but the value of his holdings soared, thanks to a 37% gain in Nvidia shares. Laffont now owns about 13.8 million shares worth $1.7 billion.

The company’s advanced graphics processing units (GPUs) are already the gold standard for AI processing in data centers and cloud computing, and were previously the go-to for machine learning, an earlier branch of AI. Even with an estimated 90% market share, Nvidia isn’t resting on its laurels, and has accelerated its product release schedule to a one-year rhythm. This dramatic increase in the pace of its chip development will make it even harder for rivals to compete.

Nvidia’s triple-digit year-over-year growth for five consecutive quarters is expected to slow this year but remain high by historical standards. Despite Nvidia’s dominance in the AI chip market, the stock is fairly priced, with a price-to-earnings-growth ratio (PEG) of less than 1 — the benchmark for an undervalued stock.

Artificial Intelligence Share #5: Microsoft — 6.4% of holdings

Microsoft (NASDAQ: MSFT) was quick to join the AI revolution, integrating AI into a wide range of products and services and offering a growing suite of AI models on its Azure Cloud platform. That’s likely why it’s Laffont’s fifth-largest holding, which he grew by nearly 21,000 shares in Q2. The position now stands at 3.7 million shares worth nearly $1.7 billion.

Perhaps the company’s biggest coup, though, was the release of Copilot, its productivity-boosting suite of AI-powered assistants. While Microsoft has yet to report results, some on Wall Street believe Copilot — and, more broadly, AI — could generate as much as $100 billion in additional revenue by 2027. It’s having an impact now, too, as Microsoft’s proliferation of AI services is having a halo effect on its Azure Cloud, which contributed 8 percentage points of growth in its most recent quarter.

The shares are selling for 31 times expected earnings, an attractive price given Microsoft’s growth potential.

All long term winners

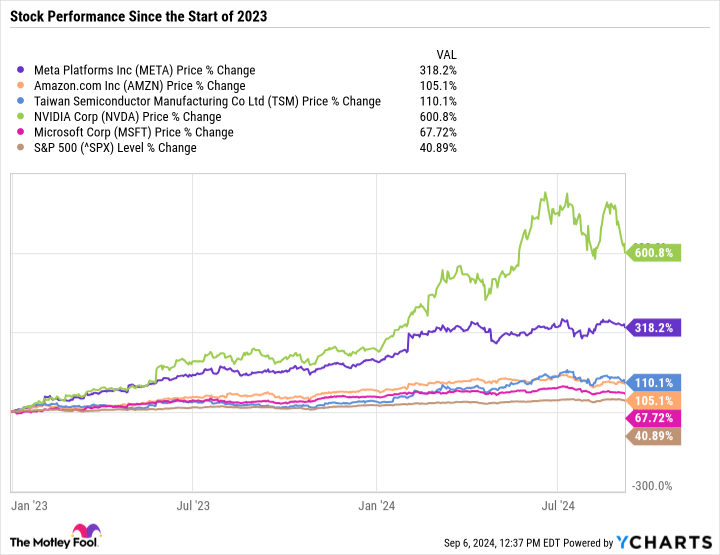

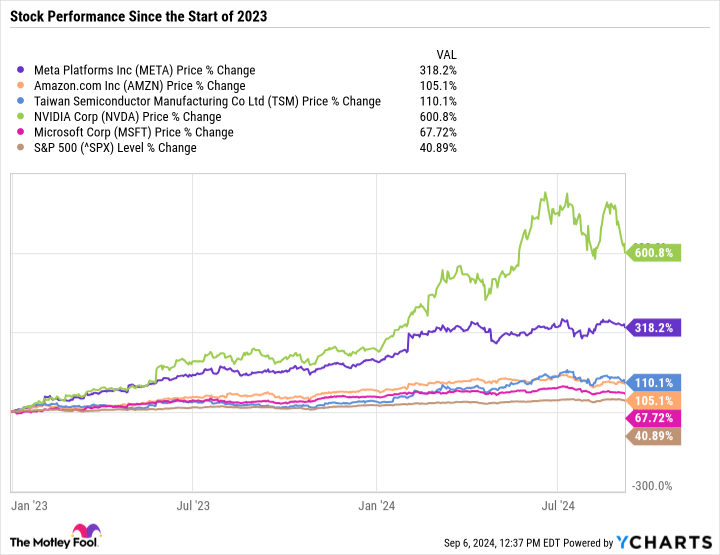

Each of these stocks has a reputation for dominating their respective industries, but it’s their performance since the AI revolution began last year that really stands out. As you can see in the chart above, each of Laffont’s top five holdings has outperformed the S&P 500, most by a wide margin.

Generative AI is expected to add between $2.6 trillion and $4.4 trillion annually to the global economy in the coming years, according to estimates compiled by global management consulting firm McKinsey & Company. Some estimates are a lot of higher. Given their pivotal positions in the emerging AI industry, each of these stocks is worth a look.

Should You Invest $1,000 in Meta Platforms Now?

Before buying shares on Meta Platforms, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $656,938!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 3, 2024

Randi Zuckerberg, former chief market development officer and spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Amazon, Meta Platforms, Microsoft and Nvidia. The Motley Fool has positions in and recommends Amazon, Meta Platforms, Microsoft, Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaire Philippe Laffont Has Invested 37% Of His $25.7 Billion Portfolio In 5 Unstoppable Artificial Intelligence (AI) Stocks was originally published by The Motley Fool