Keeping track of what billionaire hedge fund managers are doing is a great way to monitor your investment strategy. While it’s not advisable to blindly follow them, seeing what they do and comparing it to your own thoughts is a good way to see if you’re on the same page, especially if there’s a popular trend like artificial intelligence (AI).

The first quarter 13F filings were recently released and reveal some common themes among hedge funds. Although many stocks have been purchased, there is one clear favorite.

Alphabet was a common purchase across all three hedge funds

I will focus on three hedge funds: Tiger Global Management, Soros Fund Management, and Bridgewater Associates. These funds are managed by billionaires Chase Coleman, George Soros and Ray Dalio respectively. In the first quarter, all three of these funds had significant purchases of Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). Before Bridgewater and Tiger, Alphabet was the most bought stock in the first quarter.

This is a big sign of confidence towards Alphabet, especially as many initially found it difficult to roll out AI products. However, Gemini’s generative AI technology has improved dramatically and is now starting to integrate AI into search results to summarize what you’ve searched for. Many investors have been waiting for Alphabet to announce this technology, and now that it has, it reinforces the fact that Alphabet is a top player in the technology world.

But that wasn’t the only AI stock these hedge funds bought.

Bridgewater also bought Nvidia (NASDAQ: NVDA) And Metaplatforms (NASDAQ: META). Although Tiger Global didn’t buy any of these stocks in the first quarter, it is already heavily exposed, with Meta and Nvidia making up almost 20% and 5% of its portfolio, respectively. As a result, it should come as no surprise that Tiger has already stopped adding any of these stocks due to the high concentration. Soros Fund Management doesn’t own either of these companies, but it isn’t as tech-heavy as the other two.

Meta is similar to Alphabet in that its primary activity is advertising. To improve its position in this area, Meta has been rolling out generative AI tools to advertisers, and is also starting to develop its own chips to handle its AI workloads.

Nvidia hardly needs an introduction to the AI world, as its graphics processing units (GPUs) are at the core of training and processing AI models. Despite the boom, Nvidia continues to see incredibly strong demand, which will persist until all the AI infrastructure is built.

With billionaires buying these three stocks, investors may be prompted to buy them now. However, these shares were purchased between the beginning of the year and March 31, so it has been almost two months since this activity occurred. Are they still buying now?

Meta and Alphabet are still reasonably priced stocks

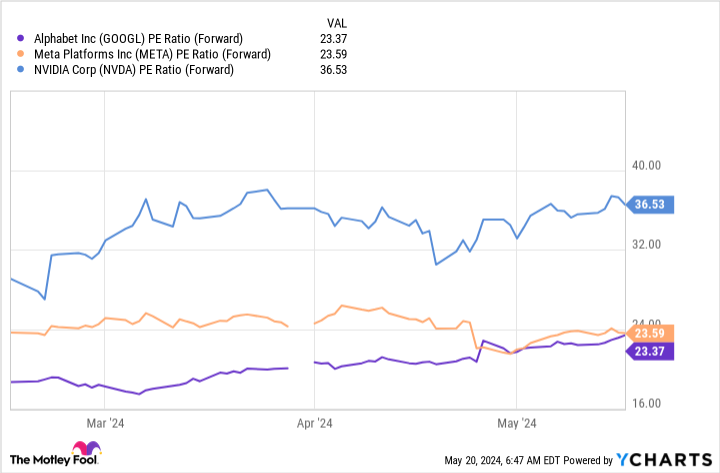

All three of these companies are mature companies undergoing drastic changes. So I will use their forward price-to-earnings (P/E) ratios to value them, as this takes into account any business shifts that may occur.

Nvidia trades at a healthy premium to Meta and Alphabet simply because it is growing quickly and has the potential to continue doing so for many years to come. This makes Nvidia one of the more difficult stocks to evaluate in the stock market.

Alphabet and Meta trade at much more reasonable valuations and offer only a small premium to the broader sector S&P500‘s expected P/E of 21.6. Still, they both posted solid earnings growth in the first quarter (Alphabet’s earnings per share rose 62%, while Meta’s rose 120%), so they’re on the right track.

Of the three, Alphabet and Meta are probably the biggest no-brainer purchases. They perform at a high level and can be purchased at a reasonable price. Nvidia requires more work and investors need to understand the expectations built into the stock as they are quite high. But it can still be a viable option for investors to scoop up.

Should you invest €1,000 in Alphabet now?

Before you buy shares in Alphabet, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $584,435!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and Meta platforms. The Motley Fool holds positions in and recommends Alphabet, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

Billionaires are buying these three artificial intelligence (AI) stocks. Should you also buy? was originally published by The Motley Fool