Billionaire stock trades can be valuable data for investors. You shouldn’t expect to discover vast secrets that reveal foolproof strategies universally shared by the ultra-rich. However, you can gain important insights into the factors that influence sophisticated investors based on the stocks most bought or sold by hedge funds and billionaires.

Billionaires withdraw their winnings from Meta

There has been a flurry of recent hedge fund selling activity Metaplatforms (NASDAQ: META). Numerous billionaires and high-profile funds, including Steven Cohen, Andreas Halvorsen, Lee Ainslie, Ken Griffin, Jonathan Soros and David Tepper, have all sold off a large volume of shares in recent months.

Meta’s recent first-quarter earnings report was strong, but largely in line with analyst expectations. The company achieved 27% revenue growth and more than doubled quarterly profit compared to the previous year.

Meta reported higher user volume, more ad interactions, and more revenue per ad. That’s a comprehensive set of improvements across the various monetization components.

Meta shares fell steeply after the earnings report, despite the strong headline numbers. The company’s second-quarter guidance fell about 1.5% below analyst consensus expectations and the company also revised its full-year operating cost forecasts. Meta’s sales forecast implies annual growth of 18% in the next quarter, which is a significant slowdown from its most recent results.

It’s strange to see such a big sell-off after quarterly earnings that were generally positive or neutral. Meta has done a phenomenal job in recent years to drive growth while reducing costs. These types of improvements are impossible to replicate year after year, but incrementally building on last year’s improvements wasn’t good enough for many investors.

This is evidence of unsustainably aggressive expectations and a “what have you done for me lately?” attitude of many shareholders. Meta’s strong operating results and big returns have attracted a crowd of traders and short-term investors who took advantage of the momentum. That’s a recipe for volatility, as we saw after the last earnings report.

It is important to note that many Meta sellers still maintain large positions and several billionaires and hedge funds have increased their Meta positions recently. Just recognize that the activity is focused on sales and reduced positions.

That’s likely to motivate many long-term investors to reassess their situation. Meta has returned 322% since the start of 2023, crushing the Nasdaq Composite’s impressive 73% return over the same period.

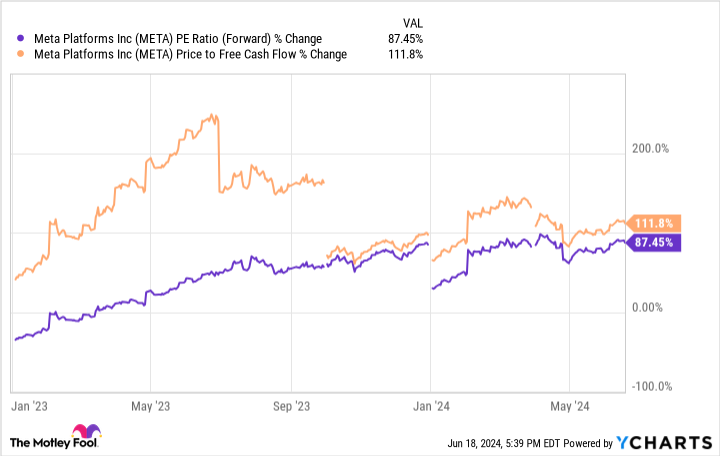

That has led to rapid inflation of the stock’s key valuation ratios. Meta’s forward price-to-earnings (P/E) and price-to-free cash flow ratios have roughly doubled this year, to above 25. Neither is particularly expensive relative to the company’s growth prospects, but the stock is no longer last year’s striking value.

Volatility has increased, analyst expectations are becoming harder to meet, growth is slowing, stocks are more expensive and there is less low-hanging fruit to drive operational improvements. It’s not hard to see why some billionaires took this opportunity to safeguard their significant profits from the past year and reallocate capital elsewhere.

Apple is getting more and more attention

It seems billionaires and hedge funds aren’t completely fed up with the ‘Magnificent Seven’, with one of Meta’s colleagues turning heads. Apple (NASDAQ: AAPL) has been a landing spot for a number of high-profile investors. Stanley Druckenmiller and Andreas Halvorsen opened large new positions, while Yan Huo, Paul Tudor Jones, Ray Dalio, Steven Schonfield, David Shaw and Ken Griffin significantly increased their existing stakes.

Apple reported a 4% decline in revenue in its most recent quarterly financial report, with notable weakness in the Chinese market and a discouraging outlook for iPhone sales. However, it posted the highest earnings per share ever and exceeded Wall Street expectations for revenue and profit.

Like many of its tech peers, Apple has reduced operating costs without hampering sales performance. It also realizes record revenues from services, which are recurring and have higher profit margins than device sales. This is important for predictably generating cash flow.

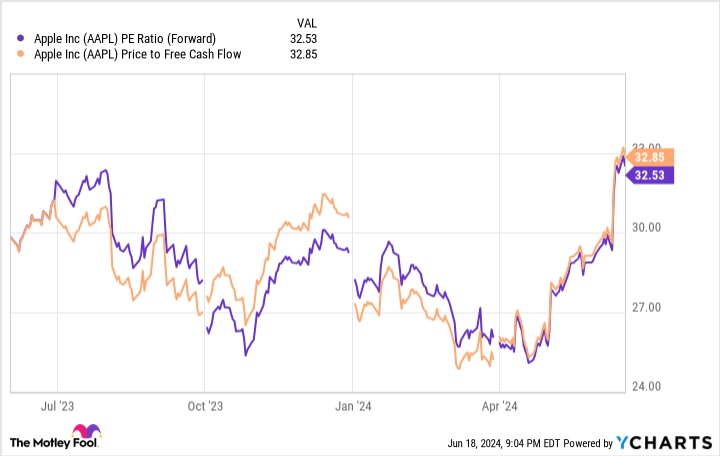

Until May, Apple’s recent stock market performance was less impressive. Shares fell about 10% between early 2023 and April 2024. The forward price-to-earnings ratio and price to free cash flow ratio hit a low of around 25 earlier this year.

Apple’s latest financials weren’t exactly encouraging compared to Meta’s, but there’s a clear trend in billionaire investor ratings. Meta’s rising valuation ratios matched Apple’s falling ratios, and the two stocks promptly reversed course. The timing of that turnaround coincides with notable hedge fund transaction activity.

Billionaire investors don’t always get it right. However, hedge fund managers and ultra-high net worth individuals have access to resources and information that are often unavailable to the general public.

Transaction data shows that sophisticated investors were assessing the valuation and prospects, leading many to sell Meta and buy Apple. Don’t just follow these movements blindly; make sure you consider the logic behind the trends.

Should You Invest $1,000 in Meta Platforms Now?

Before you buy shares in Meta Platforms, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $772,627!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 24, 2024

Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Ryan Downie has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in Apple and Meta Platforms. The Motley Fool has a disclosure policy.

Billionaires Sell Meta and Buy These Stocks Instead was originally published by The Motley Fool