Uber (NYSE:UBER) has posted impressive financial results in recent quarters, but several billionaire investors have unloaded their stakes in the ride-hailing service. That group of high-profile salespeople includes Larry Robbins, Lee Ainslie, Roberto Mignone, Steven Tananbaum, Daniel Loeb and George Soros.

High-profile stocks often feature billionaires buying and selling in large quantities during a given quarter, but recent transitions could indicate major concerns about the future of the Uber industry.

Financial results were generally strong

Uber’s most recent quarterly report was a mixed bag. Company exceeded analyst expectationswith a turnover growth of 15% compared to the previous year.

The company’s quarterly earnings per share fell short of analyst estimates, although this was largely due to non-operating, one-time costs related to a change in the valuation of several of the company’s equity investments in other companies.

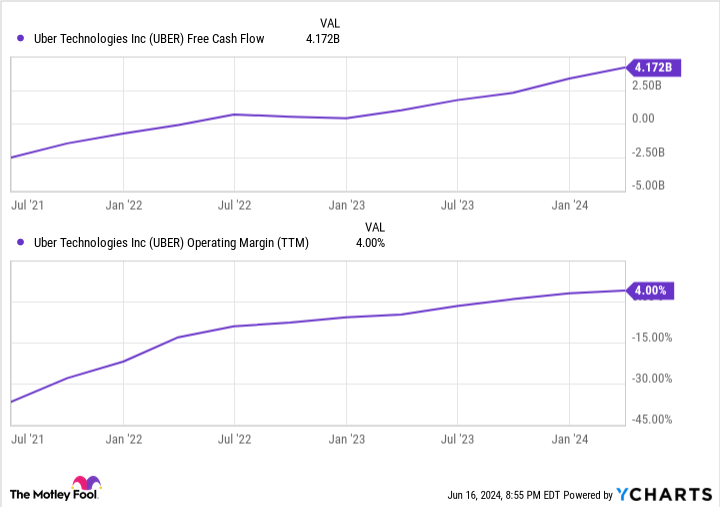

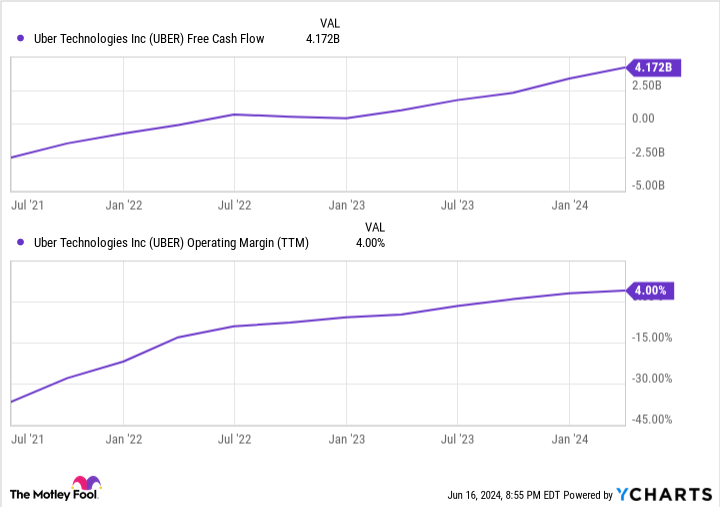

Adjusted operating profits rose more than 80% year-over-year, while free cash flow increased nearly 150%.

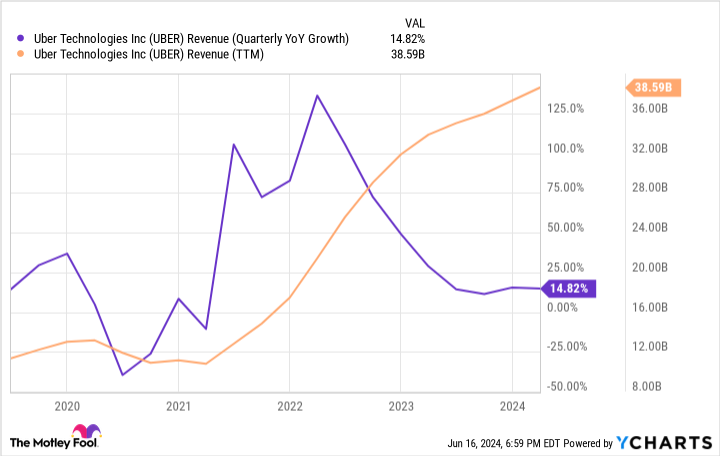

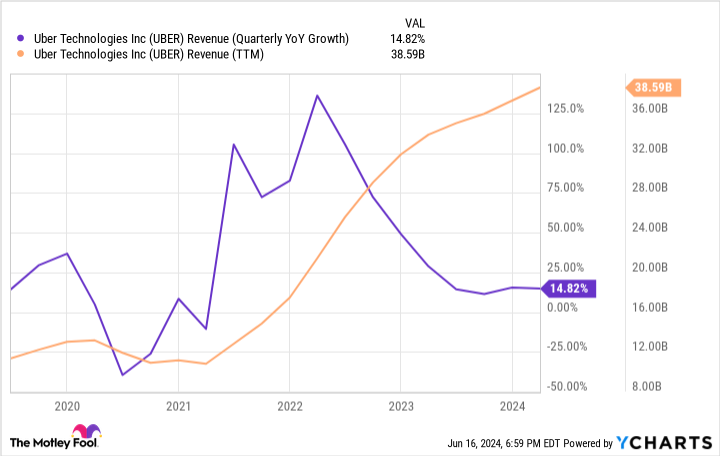

Uber’s revenue growth peaked in 2021 and 2022 as operations normalized following disruptions caused by the COVID-19 pandemic. Since then, the company’s annual sales have grown steadily between 10% and 15% per year.

Uber’s gross profit margin has been consistent over the past year, hovering around 40%. Operating expenses have grown more slowly over that period, allowing the company to achieve positive operating profit. The recent turn to profitability means Uber’s earnings per share and free cash flow growth will outpace revenue. That’s a great trend for shareholders.

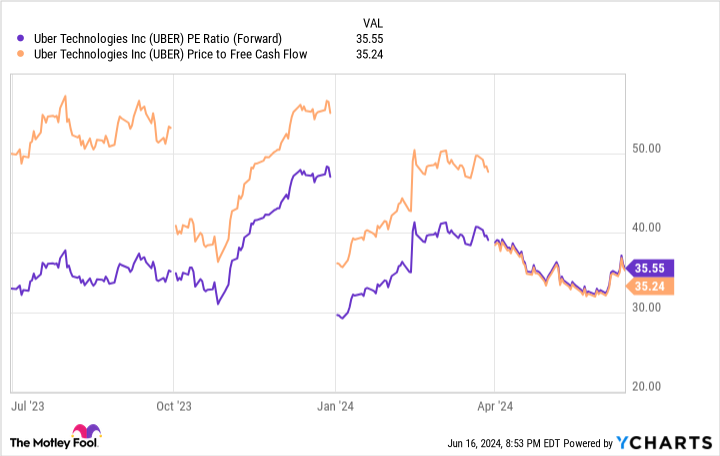

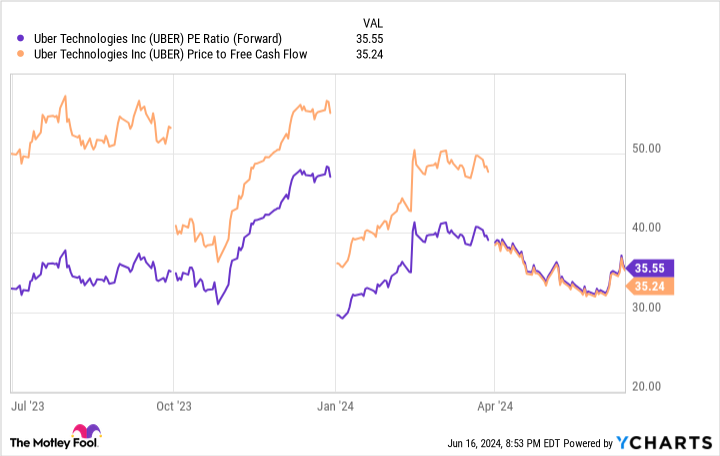

Uber’s valuation is not a problem

Sometimes billionaires and hedge fund managers cleverly exit or reduce their positions after achieving their expected investment goals. When a stock’s valuation becomes too high relative to its expected earnings or cash flows, professional investors often consider selling. It could be an opportunity to realize profits and take risks off the table by deploying that capital elsewhere.

That dynamic could be at play at Uber. The share strongly outperformed S&P500 And Nasdaq Composite over the past twelve months – the 61% return over that period is more than double that of the popular indexes. However, Uber has lagged the S&P and Nasdaq so far, and its valuation ratios have not increased to unreasonable levels.

The stock’s price-to-earnings ratio and price-to-free cash flow ratios are both around 35. These are higher than you’d expect from a mature value stock, but both are reasonable relative to Uber’s growth rate.

Maybe the billionaire shareholders are just taking some profits after a strong year.

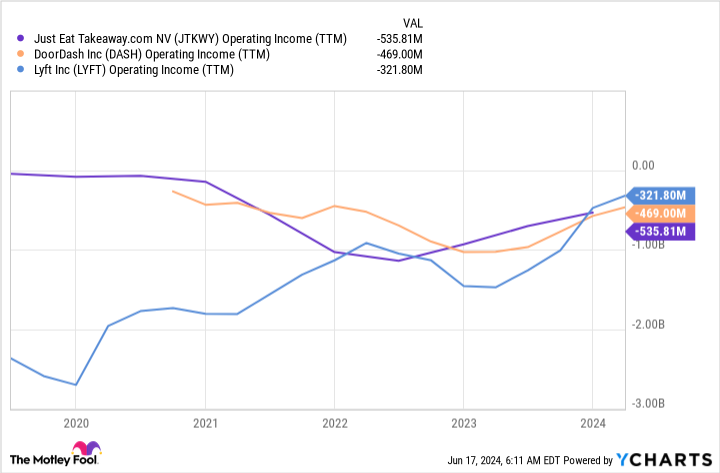

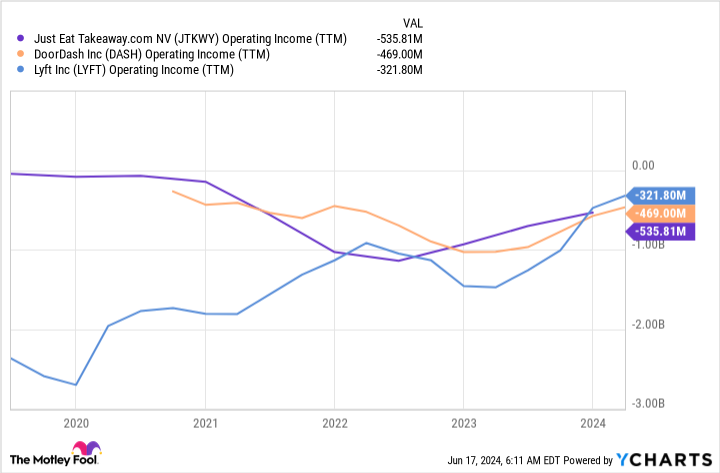

Concerns about a sustainable business model

There are concerns in some investor circles about the sustainability of Uber’s business model. DoorDash and Grubhub’s parent company, Just eat Takeaway.com are Uber’s biggest rivals in the food delivery industry, and both companies are struggling with profitability. Uber’s rideshare enemy, Lyftsimilarly reports net losses every quarter.

That clearly hasn’t stopped Uber from becoming profitable with scale, but it does highlight the challenges of its business model in a competitive market. Unfortunately for Uber and its peers, things could get more complicated in the coming years.

There are increasing concerns about driver compensation. New research shows that drivers often earn significantly below the minimum wage. That hasn’t been Uber’s problem, due to the drivers’ status as contractors rather than employees, but that could soon change.

The company has been battling regulators over driver compensation and benefits for years, and these issues appear likely to get even trickier. A driver-friendly law in California recently received support from a federal ruling, opening the door for similar legislation in other states.

Labor costs could rise significantly if Uber has to treat its drivers as employees or meet minimum wage requirements. That would dramatically change the economics of the business, and consumers may not be willing to pay higher prices to offset those higher costs.

Billionaires could sell their shares to stay ahead of a market that is rightly pleased with Uber’s financial results. There’s a chance that the upcoming legislation could be a huge challenge for ride-sharing and food delivery companies in their current form.

Note that Lee Ainslie, Paul Tudor Jones, and Ken Fisher all recently sold large amounts of Lyft stock. Jones and Ainslie’s funds have also offloaded much of their DoorDash holdings. That supports the theory that this is an industry-wide move, and not an Uber-specific one.

Concerns about further regulatory issues are purely speculation at this point, but active investors often try to make decisions before the news. Numerous professional investors appear to be recognizing the risk by selling Uber stock after the stock delivered impressive returns over the past year.

Should you invest $1,000 in Uber technologies now?

Before purchasing shares in Uber Technologies, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Uber Technologies wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $830,777!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Ryan Downie has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in DoorDash and Uber Technologies. The Motley Fool recommends Just Eat Takeaway.com. The Motley Fool has a disclosure policy.

Billionaires Decide to Sell Shares of This Well-Known Stock was originally published by The Motley Fool