(Bloomberg) — Bitcoin’s rally to a near-record high is reawakening the animal spirits — not just in the cryptocurrency market itself, but in the broader financial world that left the digital asset sector for dead last year.

Most read from Bloomberg

The change of heart can be seen in the improved deal flow outlook highlighted by Robinhood Markets Inc.’s purchase of crypto exchange Bitstamp Ltd. on Thursday, sparking a resurgence in venture capital investment to what some analysts expect to be a record. number of IPOs of companies linked to the sector.

The crypto market itself is seeing a notable return to the hallmarks of previous bull markets: celebrities are once again promoting crypto, and thousands of new tokens are being created per day, with around 330,000 coins making their debut in the Ethereum ecosystem. April and May alone, according to crypto data tracker Dune.

All told, it shows that there’s nothing better than rising prices to make investors forget the financial carnage of the past — including bankruptcies of crypto exchange FTX and lender Celsius — in a market best known for its scandals and booms -bust cycles.

“Investors tend to have short memories,” says Campbell Harvey, professor of finance at Duke University. “When market sentiment is high, they put extra weight on good news and tend to downplay the bad news that might have happened in the past.”

Bitcoin climbed this week to within 2.5% of an all-time high of $73,798 reached in mid-March, amid surging demand for newly authorized exchange-traded funds. Although the digital currency is already up nearly 70% this year, its gains pale in comparison to the returns of highly speculative memecoins like Dogwifhat and Bonk.

This year’s boom kicked into high gear when the Securities and Exchange Commission approved ETFs that invest directly in Bitcoin in January. Then in May, the agency took a step toward approving similar Ether ETFs, a move that many in the industry have seen as a concession to increased political pressure to legitimize crypto and create new laws that make it easier for digital asset companies would make it easier to operate.

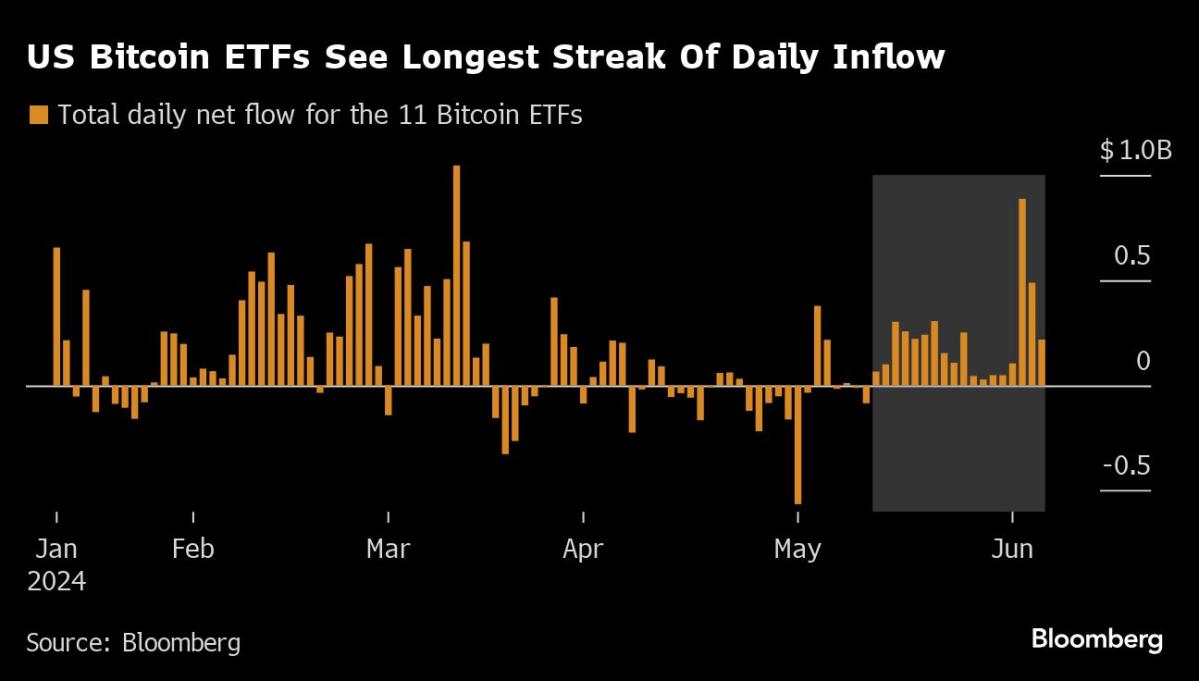

U.S. Bitcoin ETFs attracted an unprecedented 18th straight day of inflows through Thursday. Net subscriptions for the group of nearly a dozen products reached $15.6 billion, bringing total assets to $62.3 billion, according to data compiled by Bloomberg.

Major financial companies are diving deeper into crypto. Earlier this week, Mastercard resumed the ability to let users of the world’s largest crypto exchange, Binance, make purchases on its network. Binance settled with the Justice Department last year over money laundering and other violations, and is still fighting the SEC’s charges.

“Over the past few months, we have been assessing the enhanced controls and processes that Binance has put in place,” a Mastercard spokesperson said in a statement. “Based on these efforts, we have decided to allow Binance-related purchases on our network. This status is subject to ongoing reviews.”

Crypto MNA is also heating up. This week, Bitcoin miner Core Scientific Inc. rejected an unsolicited $1 billion takeover offer from artificial intelligence startup CoreWeave Inc. just days after announcing a partnership. On Thursday, Robinhood said it will acquire Bitstamp for $200 million to expand its crypto business in Europe.

“A U.S. regulatory framework creates an innovation velocity environment that accelerates an institution’s buy-over-build decision making and drives a robust M&A environment,” said Elliot Chun, partner at MNA consultant Architect Partners, in a recent note. “I will be bold and say that our industry officially transitioned from #TheGreatPurge to #TheGreatSurge in May 2024.”

According to Crypto Fund Research, crypto funds are flourishing, with more such funds being launched in the first quarter than at any time since the second quarter of 2021.

Talks of new crypto IPOs are reviving, with Kraken reportedly in talks for a pre-IPO funding round while eyeing an IPO as early as 2025, Bloomberg reported Thursday. If crypto prices continue to rise, the next 18 months could see the largest wave of crypto-related IPOs ever, according to Renaissance Capital, a pre-IPO researcher.

“I think if these companies can point to explosive sales growth or strong profits, that will pique investor interest,” said Matthew Kennedy, senior market researcher at Renaissance. “I suspect the financials are there, and investors will take them with a grain of salt. They know it is a cyclical business, many companies are like that.”

Most read from Bloomberg Businessweek

©2024 BloombergLP