-

The bull run in the semiconductor sector will continue until mid-2026, based on previous cycles, Bank of America said.

-

This will benefit three key industry themes: cloud computing, automotive and complexity.

-

Nvidia, Broadcom, NXP Semiconductors and KLA Corporation are among BofA’s top picks.

The bull run on the semiconductor industry is far from over, and AI momentum is likely to push it toward a peak in mid-2026, according to Bank of America.

Since the AI frenzy first took over the markets, the SOX index, which tracks semiconductors, has rocketed past benchmark indices and is already up 26% this year. Compared to the S&P 500, it trades at a premium of four to five times, the bank said.

Of course, a pullback could come from short-term triggers such as the US elections or monetary policy, but there is good reason to remain optimistic, analysts wrote on Monday.

That’s because the chip industry often experiences ten quarters of upswing after a down cycle, a pattern that is only just beginning.

“The current upward cycle started in late 23, so we are only into the third quarter, indicating strong strength that will likely continue until mid-26E. However, chip stocks (SOX) change direction six to nine months before the cycle turn, so the semis could potentially peak at some point. around the second half of 25, or a year or more from now,” Bank of America said.

Furthermore, the industry is expected to accelerate to double-digit annual sales growth by 2025, following last year’s inventory correction.

For investors trying to capitalize on this rally, the note offered three investment themes that will benefit them: cloud computing, autos and complexity.

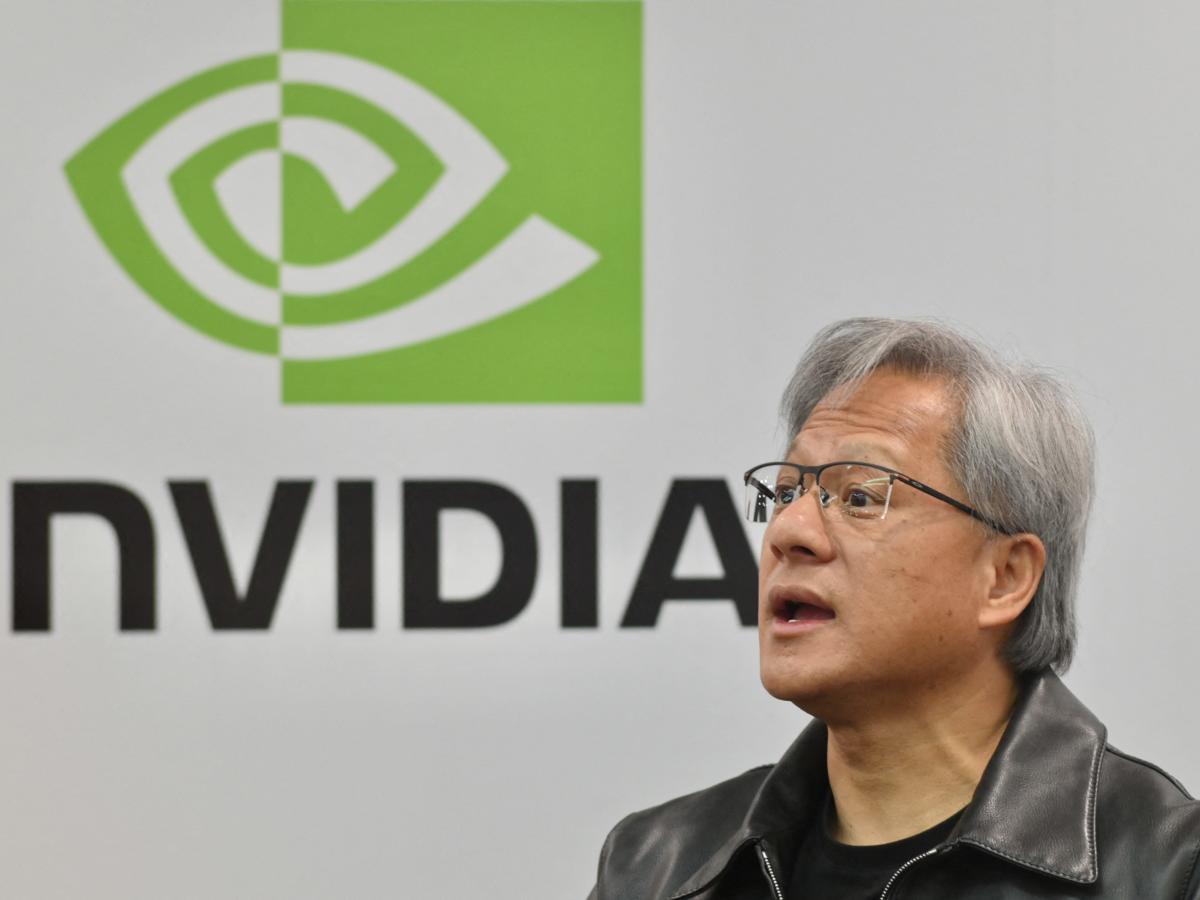

First off, Nvidia is a top choice, as is Broadcom. Bank of America sees major upside potential for both, with a price target of $1,500 and $1,680, respectively.

For Nvidia, some of this comes from an optimistic outlook about AI data center expansions, which are driving strong demand for the company’s hardware. Of current global IT spending, data center systems account for about 5%, or $260 billion, the bank said. But by 2028, this could rise to $360 billion.

Meanwhile, the growing importance of chips in the auto industry should boost stocks like NXP Semiconductors. This top pick has a price target of $320.

“Industrial/auto chip stocks are less crowded and offer diversification beyond AI, with easier comparisons from CY25E,” the bank said. “The end of the inventory correction could support solid double-digit sales growth in CY25E.”

Finally, the increasing complexity of semiconductor manufacturing should support the sector’s rising valuations, justifying the trading range of these stocks such as KLA Corporation and Synopsis.

Bank of America has a price target of $890 and $650.

“The top five global semicap equipment stocks are trading at a 46% premium or 26x CY25 price-to-earnings versus 18x historical average,” analysts wrote. “We expect the premium to continue on leverage (fundamental, sentiment) on AI-driven chip complexity, on global reshoring efforts and on their solid FCF margins above 25% even at the low of In recent years. [wafer fab equipment] bicycle.”

Read the original article on Business Insider