After a few years of disappointing stock performance, Walt Disney (NYSE: DIS) looks a little more magical these days. The stock is up 12% in the past year and the company has made progress in cutting costs and boosting growth. In fact, in its most recent earnings report, the entertainment giant reported profitability for its entertainment streaming businesses – Disney+ and Hulu – and forecast profitability for its entire streaming business in the fourth quarter of this fiscal year.

This all sounds great, and Disney is making an interesting buy, but another consumer stock is making an even better recovery and growth investment right now. This player, like Disney, attracts vacationers – and had a hard time when it had to suspend operations during the first days of the pandemic.

In more recent times, however, this company has demonstrated its ability to streamline its operations, become more efficient, and win customers at record levels. And over the past year, this stock is up more than 30%. Let’s take a closer look at this unstoppable growth player to buy instead of Disney.

Carnival’s early pandemic problems

I’m talking about the world’s largest cruise operator, Carnival (NYSE: CCL) (NYSE:CUK). As mentioned, the company hit hard times in the early days of the COVID-19 pandemic, with the cancellation of cruises leading to a net loss – and ballooning debt.

But Carnival took action by addressing efficiency and costs. Measures included eliminating old ships and replacing them with new, fuel-efficient ships; developing a new port positioned to support fuel-efficient routes; and focusing on ways to boost spending onboard cruisers. The company also made paying down debt a priority, and more importantly, Carnival focused on variable-rate loans, advancing more than $1 billion early last year. This makes Carnival less vulnerable in a higher interest rate environment.

In the first quarter of last year, cash flow from operating activities turned positive, allowing a focus on debt repayment. And continued positive cash flow from operations allows Carnival to continue on this debt reduction path.

In addition to the cost cuts and streamlinings, Carnival is also seeing huge demand, showing that people’s interest in cruising remains strong – and the pause at the start of the pandemic was only temporary. In the most recent quarter, Carnival’s booking volumes reached a record high, even with cruises priced higher than a year ago. And total customer deposits reached a record $7 billion in the first quarter.

Carnival’s record sales

Demand for Carnival cruises allowed the company to report first-quarter revenues of $5.4 billion and an improvement in operating results of $500 million compared to the same period a year earlier. So there’s plenty of evidence that Carnival is not only recovering from the difficult days of the first pandemic, but that the cruise giant is also entering a whole new era of growth.

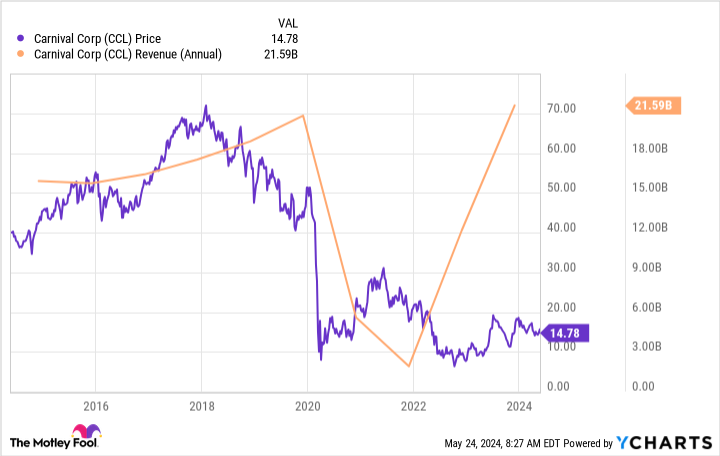

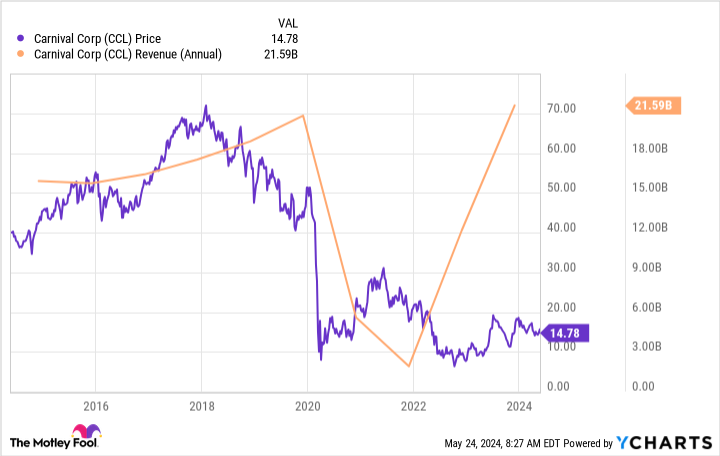

While Carnival’s shares have shown momentum recently, they are still well below pre-pandemic highs. And at the same time, revenues have returned to, if not exceeded, pre-pandemic levels.

All of this has led to Carnival’s shares trading at 0.84x sales, close to all-time lows by this measure. Disney shares are also trading at a reasonable level, but at about 2x sales they are more expensive than the cruise leader.

So while Disney is cheap and its future prospects look bright, investors looking for an unstoppable growth player should forget about the entertainment powerhouse for now and turn to Carnival instead.

The cruise line is cheap, has made significant progress on its road to recovery and has shown that demand for its cruises is strong, even at higher prices. And many of the efforts Carnival has made to drive the recovery – such as its emphasis on fuel efficiency – should support long-term earnings growth.

All of this means that now, with Carnival shares trading at a bargain, is the perfect time to join this growth story and potentially win if the company achieves its recovery goals – and can deliver explosive growth over time.

Do you need to invest $1,000 in Carnival Corp. now? to invest?

Consider the following before buying shares in Carnival Corp. buys:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Carnival Corp. wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Adria Cimino has no positions in the stocks mentioned. The Motley Fool holds and recommends positions in Walt Disney. The Motley Fool recommends Carnival Corp. On. The Motley Fool has a disclosure policy.

Forget Disney: Buy These Unstoppable Growth Stocks Instead was originally published by The Motley Fool