There is no denying it McDonald’s is still the king of the restaurant industry. Its 40,000 locations did $119.8 billion in business last year, generating $25.5 billion in revenue and $8.5 billion in net income for the company. No other name comes close to those numbers.

From an investor’s perspective, however, size isn’t everything. In fact, size can be a disadvantage, making it harder to achieve greater growth. In some cases, the biggest competitor to a new McDonald’s location may be another nearby McDonald’s restaurant that is already up and running.

If you are looking for a promising bet in the fast food restaurant sector, consider Cava Group (NYSE: CAVA) instead of.

What is Cava?

With only 323 restaurants in the first quarter, Cava is not exactly the household name that McDonald’s is. However, in places where Cava has been active for a while, consumers love the Mediterranean dishes. The pita breads and bowls are ideal for the fast-casual model and play into the demand of changing consumer preferences.

Although hamburgers have dominated fast food restaurants for decades, health risks are finally catching up. The enriched bread used to make most hamburger buns and heavily processed red meat are falling out of favor. Consumers are increasingly willing to pay even a small premium for fresh, natural ingredients like those found in Cava.

The real draw here, however, is the cuisine itself. It is relatively undiscovered by most American consumers who, once they try it, love it. The health benefits are merely an added bonus to its marketability.

In other words, this is the “something different” that consumers have been waiting for in the fast food restaurant industry.

Cava has the results to prove it

And Cava’s figures confirm this claim.

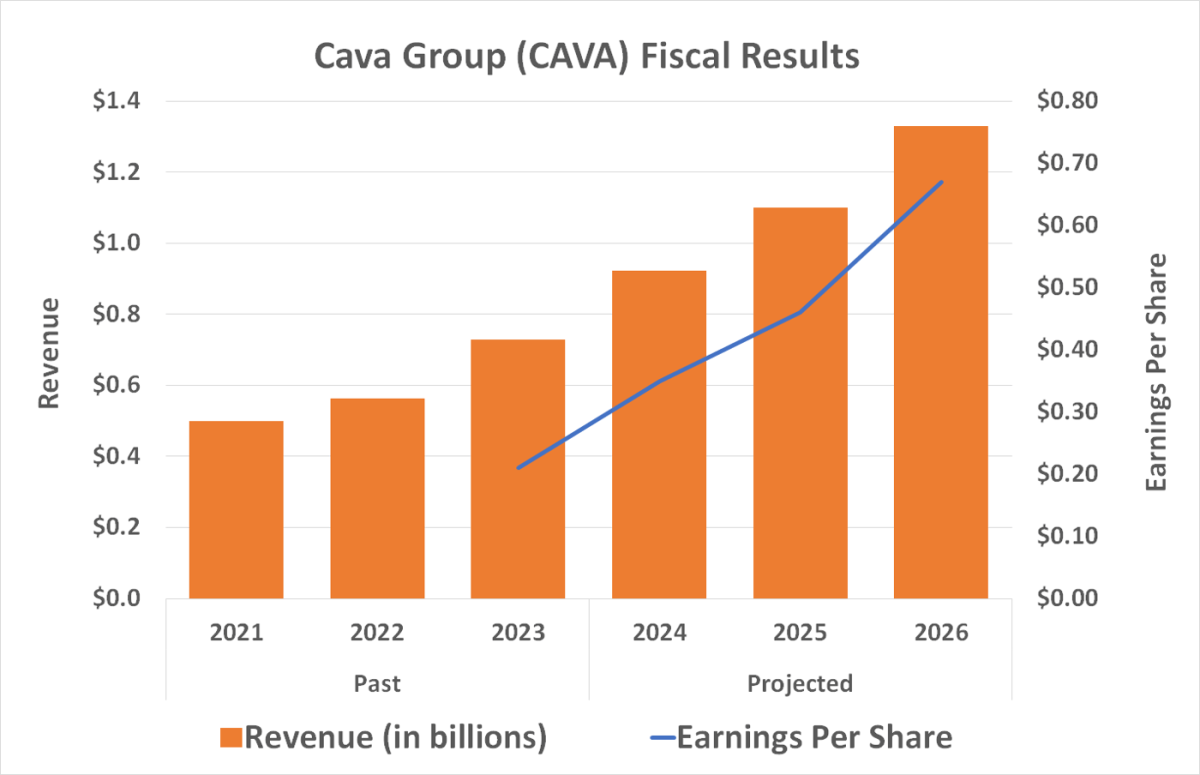

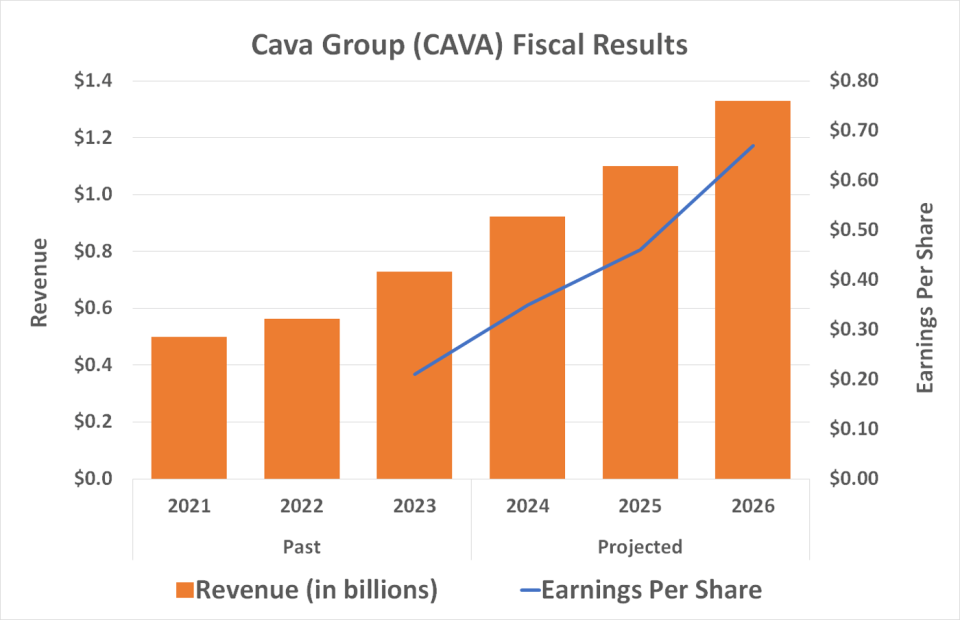

Take its first-quarter results, for example. In the three-month period ended April 21, Cava’s revenue grew 30.3% year over year to $256.3 million, while same-store sales rose 2.3%, compared with a very tough comparison of 28.3% in the same period last year.

Better yet, despite its young age and small size, Cava Group is increasingly profitable. First-quarter earnings before interest, taxes, depreciation and amortization (EBITDA) of $33.3 million doubled year over year, and net income of $14.0 million completely erased the $2.1 million loss from a year ago. Cava achieved this profitability while opening 14 new restaurants in the quarter.

Overall, the first-quarter numbers extend existing trends that are expected to continue at least into next year. In May, the company raised its full-year EBITDA outlook from a previous range of $86 million to $92 million to a revised range of $100 million to $105 million. Same-store sales growth forecasts were also raised. Analysts are also collectively predicting sales growth of at least 20% this year and next, with earnings per share expected to more than double over that two-year period. It all points to a tremendous tailwind.

The bottom line: Cava Group is essentially debt-free. As of April, the only long-term obligations to speak of were operating lease obligations, largely resulting from rents it has agreed to pay to landlords for its restaurant locations. However, as the numbers above show, Cava restaurants are profitable to begin with.

More importantly for interested investors, Cava benefits from financial flexibility, as it is not tied to bondholders expecting regular interest payments, regardless of whether making those payments is in the best interests of the organization at the time.

More reward than risk

So, is Cava a guaranteed winner? No, there is no such thing, especially in an industry as fiercely competitive as the restaurant industry. The stock is also very expensive relative to earnings. Young growth stocks also tend to be uncomfortably volatile, and Cava Group is no exception.

Nevertheless, the potential reward here is more than worth the premium for risk-tolerant investors. There is a huge amount of room for Cava to continue expanding its footprint in the coming years, and there are many reasons to believe it will be able to do so.

Should You Invest $1,000 In Cava Group Now?

Before buying Cava Group shares, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Cava Group wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $641,864!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 6, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool recommends Cava Group. The Motley Fool has a disclosure policy.

Forget McDonald’s: Buy This Unstoppable Restaurant Growth Stock Instead was originally published by The Motley Fool